Xeneta CEO Patrik Berglund said in late November that if spot rates had not stabilized and started to rise again by the first and second quarters of this year, “carriers have played this market really badly.”

By that definition, ocean carriers have played this market really badly.

Spot indexes are not plummeting like they were in the second half of 2022, but they’re still inching downward week after week. The market bottom is proving elusive as transport capacity continues to exceed demand.

The spot market is signaling where annual contract rates are heading in 2023.

Contract revenues are more important to carriers’ bottom lines than spot revenues and carriers are entering this year’s trans-Pacific contract negotiation season with an extremely weak hand amid a backdrop of still-falling spot rates.

Freightos Baltic Daily Index

Different spot indexes post different rate assessments, but the directional trends are generally the same.

The Freightos Baltic Daily Index (FBX) assessed spot rates in the China-West Coast lane at $1,040 per forty-foot equivalent unit on Friday, down 94% year on year (y/y) and down 30% versus March 2019, pre-COVID.

FBX put Friday’s China-East Coast rate at $2,286 per FEU (minus-87% y/y, minus-17% versus pre-COVID).

Meanwhile, the trans-Atlantic market continues to far outperform the trans-Pacific. FBX’s westbound Europe-East Coast assessment was at $4,418 per FEU on Friday, down only 36% y/y and up 89% versus March 2019.

The year-to-date (YTD) changes show the pace of rate declines in the trans-Pacific has decelerated versus last year, but rates are still headed lower.

The FBX China-West Coast index rate is down 25% YTD, China-East Coast 21% and Europe-East Coast 20%.

Drewry World Container Index

The Drewry World Container Index (WCI) assessed Shanghai-Los Angeles spot rates for the week ending Thursday at $1,948 per FEU.

That’s down 2% YTD, 82% y/y and — in contrast to what the FBX says — up 23% since March 2019, pre-pandemic.

The WCI assessed Shanghai-New York spot rates at $2,772 per FEU, down 29% YTD, 79% y/y and 1% versus March 2019.

In the still-strong Rotterdam, Netherlands-to-New York market, the WCI assessed spot rates at $5,573 per FEU, down 20% YTD and 14% y/y, but up 179% versus March 2019.

Drewry said it expects “small week-on-week reductions in rates in the next few weeks.”

Other indexes

Other data sources tell the same story: The ocean container freight market, while more stable than in the second half of 2022, has yet to truly find a floor.

The Shanghai Containerized Freight Index, which gauges spot levels on all mainline routes from that Chinese port, fell to 931 points in the week ending Friday. That’s down 12% YTD and 66% y/y but still up 16% from March 2019.

Xeneta’s short-term index, the XSI-C, was at $1,259 per FEU for the Far East-U.S. West Coast lane as of Wednesday, down 4% week on week and 10% month on month.

The Platts index for North Asia-North America was unchanged in the week ending Friday. Sources told Platts “volumes are too weak to make a dent in rates” and “margins are terrible.” The weak spot market has convinced “many shippers to delay contract negotiations,” Platts reported.

Still too much capacity

Lower rates and weaker vessel utilization confirm there is too much capacity in relation to cargo demand.

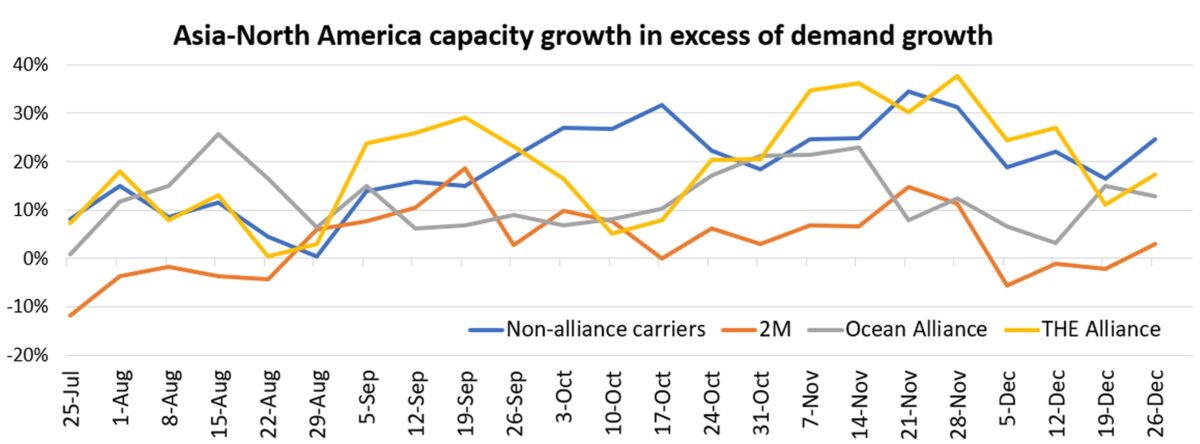

Sea-Intelligence analyzed the extent of the imbalance in the Asia-North America trade lane. In a report published Sunday, it measured the percentage difference between capacity growth and demand growth throughout the second half of 2022, a period when spot rates fell sharply.

Sea-Intelligence looked at the balance for each of the three big alliances — 2M, Ocean Alliance and THE Alliance — as well as for non-alliance carriers.

It found that members of THE Alliance (Cosco, CMA CGM, Evergreen), non-alliance carriers and 2M member Maersk “contributed the most to structural capacity in the trans-Pacific trade.”

“These carriers are more responsible for overcapacity in the market than the other carriers,” said Sea-Intelligence CEO Alan Murphy.

Looking at the average of all carriers, excess capacity topped demand by the highest degree in November — at over 20% more than demand — and the gap was still in the low to midteens in December.

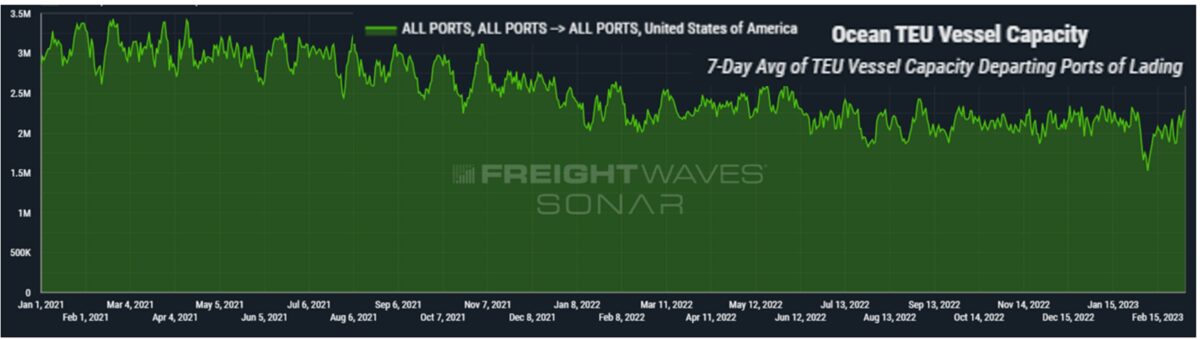

Another indicator of excess capacity: FreightWaves SONAR’s Container Atlas tracks the seven-day trailing average of container-ship capacity bound for the U.S., based on departure dates.

This data shows inbound capacity to the U.S. is down by around a third from peak levels in 2021. However, despite falling spot rates, Container Atlas data shows no significant decrease in inbound capacity over the past five months, excluding the temporary dip for Lunar New Year.

Click for more articles by Greg Miller

Related articles:

- Container trade’s next turn: Price wars, cheap contracts, new ships

- Maersk: Container shipping contract rates will sink to spot levels

- Good times still rollin’ for shipping lines in trans-Atlantic trade

- Lag effect: Why liner profits stay high much longer than spot rates

- Container shipping’s ‘big unwind’: Spot rates near pre-COVID levels

- Plunging spot rates drag down container shipping contract rates