Zim, the world’s 10th-largest ocean carrier, announced a big earnings beat for the fourth quarter and paid out a higher-than-expected dividend. However, it faces a tough year ahead, with a chance of at least some quarters in the red.

The company’s shares (NYSE: ZIM) surged Monday on news of the earnings beat, jumping as much as 25% in morning trading. Shares gave back most of their gains by the end of the day, closing up 6.6%. Trading was heavy, at more than four times average volume.

Big earnings beat

The Israel-based shipping line reported net income of $417 million for Q4 2022, down 76% year on year and 64% versus the third quarter. Earnings per share came in at $3.44, well above the consensus forecast for $2.84. The company declared a Q4 2022 dividend of $6.40 per share. That brought full-year dividends to $16.94 per share, equating to $2.04 billion or 44% of net income.

Zim amassed a sizable cash cushion during the COVID-era boom that it can use as a buffer in the years ahead. The company now boasts zero net leverage and total liquidity of $4.6 billion.

2023 guidance: Quarterly losses ahead?

Zim announced Monday that it expects full-year 2023 adjusted earnings before interest, taxes, depreciation and amortization of between $1.8 billion and $2.2 billion. The midpoint of the range is down 73% from 2022 adjusted EBITDA but still over five times 2019 levels.

The company expects adjusted EBIT (which includes the earnings effect of depreciation and amortization) of between $100 million and $500 million for this year — and net income comes in lower than adjusted EBIT. In full-year 2019, Zim posted adjusted EBIT of $149 million and a net loss of $13 million.

Thus, the guidance suggests there could be at least some loss-making quarters in 2023.

Jefferies analyst Omar Nokta, who updated his outlook on Tuesday, expects net losses in both Q1 and Q2, offset by net gains in the second half, bringing Zim’s full-year net income to $89.9 million or 72 cents per share.

Rates slide 38% quarter on quarter

Zim’s earnings are heavily driven by its average freight rates.

CEO Eli Glickman said during Monday’s conference call: “Q1 2022 was our best quarter ever. Since then, our quarterly results have declined sequentially, with Q4 2022 results dramatically reflecting the negative impact of the declining freight rates.”

The quarter-on-quarter slide in net income coincided with a drop in average freight rates to $4,244 per forty-foot equivalent unit, down 38% from the third quarter and 42% year on year.

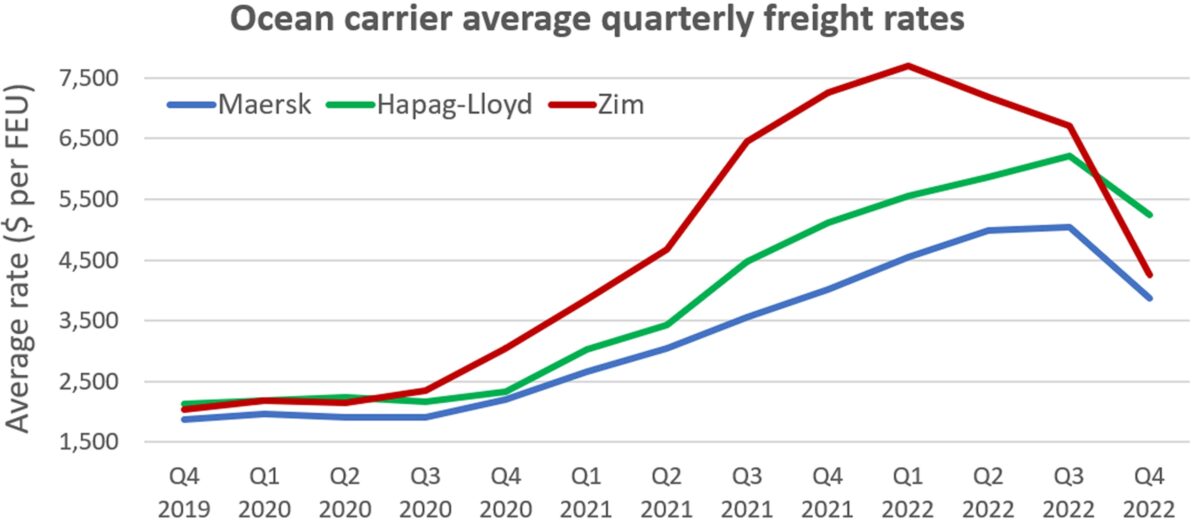

The company’s average freight rate has fallen sooner and faster than those of larger competitors such as Maersk and Hapag-Lloyd, whether because Zim has more spot exposure or because more of its annual contracts signed in 2022 were renegotiated lower before maturity.

Zim’s average freight rate (including both spot and contract) peaked at $7,696 per FEU in Q1 2022 — much higher than rates of its larger competitors — then fell 45% over the next three quarters. Average rates of Hapag-Lloyd and Maersk didn’t peak until Q3 2022.

Zim’s average rates fell below Hapag-Lloyd’s in the fourth quarter and were almost as low as Maersk’s. Even so, Zim’s average Q4 2022 rates were still more than double Q4 2019 levels, pre-COVID.

‘Floor’ set for annual contract rates

“The backdrop against which we are providing earnings guidance today is extremely challenging,” said CFO Xavier Destriau.

On a positive note, he added, “We believe [spot] freight rates are close to the bottom. Freight rates continue sliding, but at a slower pace than in the fall of 2022.”

He reiterated that Zim has 50% of its trans-Pacific capacity on annual contracts, with 50% on spot. The mix is 25% contract and 75% spot in Zim’s other trades. Its contracts are generally negotiated quarterly versus annually outside the trans-Pacific.

Annual trans-Pacific contracts for 2023 that begin in May are still being negotiated. Lower contract rates for this year should begin negatively affecting Zim’s average freight rates in the third quarter, to the extent they’re below 2022 contract rates (including renegotiated contracts).

Asked whether Zim will accept contract rates below spot levels for high-volume customers, Destriau said shippers are pushing for “significant rate reductions compared to last year and we understand that,” but “we have set a limit in terms of where we are not willing to go, in terms of a floor.”

He maintained that there is “a middle range that is a natural equilibrium” for contract rates.

“Otherwise … if we don’t get the rates we believe make sense for us to continue sailing, we will stop sailing. And if we stop sailing, it may have a drastic effect on the ability of customers to secure their supply chains.”

If shippers refuse to sign sufficient 2023 trans-Pacific contracts at acceptable rates, Destriau said Zim might revisit its 50/50 mix in the trans-Pacific “and expose ourselves more to the spot market.”

Warning signs for Q1 2023

Destriau said the company expects “improved results in the second half compared to the first half.” The first quarter is being hit by a combination of seasonal weakness and destocking.

“At some point the destocking effect will end and the retailers will have to come back and replenish their inventories. Hence … we think the market is close to reaching a bottom before demand starts to come back.”

Early indicators out of Asia point to a sharp sequential drop in the first quarter versus the fourth quarter. Taiwanese carriers report mid-quarter monthly operating revenues and have just posted February numbers.

The filings show that operating revenues of Evergreen, the world’s sixth-largest carrier, were down 45% in the first two months of Q1 2023 versus the first two months of Q4 2022. Operating revenues of Yang Ming, the ninth-largest carrier, were also down 45%. Those of Wan Hai, the 11th-largest carrier, were down 40%.

Zim’s dividend policy is to pay 30% of net income in the first three quarters, then a fourth-quarter payout that brings the full-year dividend to 30%-50% of full-year net income.

The catch-up Q4 2022 dividend appears to be the last hurrah for boom-era returns. From a stock pickers’ perspective, the “dividend catalyst [is] now past,” wrote Nokta.

Analysts asked on the conference call whether the positive guidance for the second half implied loss-making quarters in the first half, and whether Zim will stick to its dividend policy (i.e., no dividend in loss-making quarters).

Destriau responded that the company does not provide quarterly guidance and “on whether our guidance means we expect EBIT losses in the early part of 2023 — not necessarily. We didn’t say that.” He added, “There is no reason to think our dividend policy will change.”

‘Eagerly awaiting’ newbuilding deliveries

Zim also commented on its newbuilding program and its plans for its existing charters.

Last month, it took delivery of the ZIM Sammy Ofer, the first of 10 15,000-twenty-foot-equivalent-unit, LNG-powered newbuildings chartered from Seaspan and built by South Korea’s Samsung Heavy Industries.

“Out of the 10 15,000-TEU ships, nine were initially expected to be delivered in 2023,” said Destriau. The second and third are expected to be delivered in the next few weeks. “But we’ve been advised that there might be a delay for some of the vessels meant to be delivered in 2023.”

Slippage of newbuild delivery dates should help offset some of the capacity supply-demand imbalance caused by the orderbook, he said. “We think some of the shipyards have manpower and resource issues.”

Five of Zim’s chartered newbuildings have been delivered so far. Another 41 are scheduled to be delivered through the end of 2024. The newbuildings will be more cost-effective than existing chartered tonnage.

“Clearly, we intend to take delivery of each and every one,” said Destriau. “We are eagerly awaiting those vessels. There is no intention to cancel or delay any of those contracts.”

Charter redeliveries ‘very likely’

To offset deliveries of more cost-efficient newbuilds, Zim intends to let charters expire on a portion of its existing fleet and hand those ships back to tonnage providers.

Zim has 22 vessels up for charter renewal this year and another 36 in 2024. “For most of them, it is very likely they will be redelivered if market conditions remain difficult,” said Destriau.

Chartered ships will be redelivered at the end of existing contracts, not before, he added. “We do not intend to break any of our commitments to the tonnage providers.”

The chance of redelivery versus contract extension depends on the size category. Older Panamaxes will be let go and replaced by larger newbuildings in the trans-Pacific. But Zim needs smaller-size chartered ships for other markets it serves such as the intra-Asia market.

“The smaller feeder-sized vessels will be very much needed,” said Destriau. In those cases, Zim could negotiate with tonnage providers for contract extensions “at a lower rate, obviously.”

Click for more articles by Greg Miller

Related articles:

- Imports sink again as wholesale inventories remain bloated

- Container shipping market yet to bottom as spot rates keep slipping

- ‘Colossal’ tidal wave of new container ships about to strike

- Container lines still chartering ships despite drop in cargo demand

- Container trade’s next turn: Price wars, cheap contracts, new ships

- Maersk: Container shipping contract rates will sink to spot levels

- Hard landing? 2023 could be Hapag-Lloyd’s 3rd-best year ever