Startups planning commercial vehicle charging operations are pursuing an idea that was big 30 years ago when corporate fuel islands dispensed gasoline and diesel instead of electricity.

Twice this week we were reminded that, like Solomon wrote in the biblical book of Eccelsiastes: “What has been will be again, what has been done will be done again; there is nothing new under the sun.”

The late baseball Hall of Famer Yogi Berra put it another way with his famous quote: “It’s like deja vu all over again.”

Dedicated charging depots – not so novel an idea

Consider the rush to create public charging depots for electric trucks. Of course, they are important to keeping these trucks charged and moving. But is the idea really new?

Not so much, according to Rich Mohr, the vice president of fleet at electric services company ChargePoint Inc.

“All the asset-charging companies have variations of buying property, supplying vehicles and supplying charging,” Mohr told me. “We did this years ago. Every business park across America had designated fuel islands. We put fuel islands in business parks with our partners all over the place.

“They buy the property, they use your Comdata, your WEX [business fuel] card. It’s just different because now it’s kilowatts instead of gallons. So if someone wants to buy a bunch of property and put it in fuel islands, I think it’s great for the commercial business. The more, the better.”

Speaking of fuel cards, they are improving. Freight automation company Transflo and Comdata Inc. have jointly developed Transflo Wallet, a mobile-app-based cardless fuel payment alternative.

More powerful single fuel cell comes later for Toyota

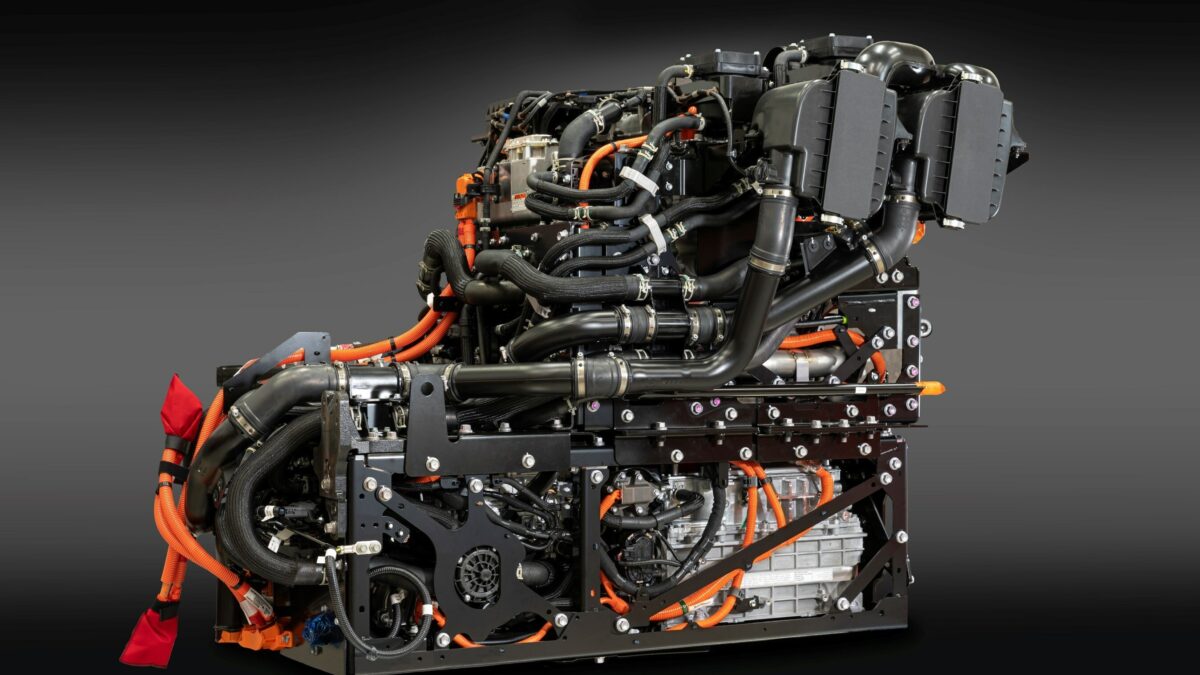

Then there’s Toyota Motor North America’s announcement of its second-generation heavy-duty fuel cell that it will begin producing in Kentucky this year.

Touted as smaller in size, lighter and more efficient, the backbone of the fuel cell kit is still twin stacks from Toyota’s Mirai passenger car.

“We’ve looked at it and those are obviously things for the future that are potential when volumes increase,” Chris Rovik, executive program manager in TMNA’s advanced product planning office, told me. “The one thing we wanted to show [was] scalability.

“Having flexibility to develop a single stack allows us to be more efficient from a development standpoint. But that doesn’t mean that for a third generation, we wouldn’t have a stack with more power.”

By contrast, Hyzon Motors, the startup spun out of Singapore’s Horizon Fuel Cell Technologies, will display and demonstrate its 200kW single fuel cell for heavy-duty trucks at the ACT Expo.

When simulation is not enough

Self-driving trucking startup Waabi’s message to the autonomous industry is that simulation and artificial intelligence can speed commercialization. The Waabi Driver is intended as a full-stack autonomy solution for heavy-duty truck OEMs to integrate during manufacturing.

Focusing on simulation is how Aurora Innovation, a Waabi competitor and investor, approaches autonomous trucking. Waabi founder Raquel Urtasun ran the Toronto outpost of Uber’s Autonomous Technology Group before ATG was sold to Aurora in an equity deal valued at $4 billion in December 2020.

Waabi came out of stealth mode in 2021 with an $83 million capital raise, including participation from Uber and Aurora.

A company talking point is that its Waabi Driver is an end-to-end trainable system that automatically learns from data, speeding up development dramatically and enabling it to learn the complex decision-making needed for operating on the road safely.

Now, Waabi is launching a Million Mile Driver Advisory Board to add human experience to its AI approach. The goal is to foster transparency and collaboration with a selection of North American truck drivers who have racked up more than 1 million miles of accident-free driving.

Collecting and applying safety driver expertise is a best practice. Embark Trucks, Plus and others use driver insights to incorporate into their robot driving systems.

A rebranding and refocus for Atlis Motor Vehicles

Startup Atlis Motor Vehicles is suspending work on electric work trucks to focus on the batteries that power them.

The company has rebranded itself as Nxu (pronounced new) and is pressing forward with developing its megawatt charging system. It says it will resume efforts on work vehicles later.

Atlis was founded in 2018 with an initial focus on developing electric vehicle technology for heavy- and light-duty work trucks used in agriculture, service, utility and construction industries. It turns out that was harder — and more expensive — than Atlis thought.

But its efforts in battery technology prompted a transformation. It will ship its first battery packs to an off-highway equipment customer this summer. Nxu claims its proprietary cells allow for faster battery-charging times. It has demonstrated 700kW charging — as well as greater range and extended life span compared to legacy batteries.

After going public in October following a crowdsourcing approach, Atlis shares are trading just above 50 cents. Its initial $35 million capital raise is close to the company’s $32 million market cap, suggesting that most investors have hung around. The Atlis name remains as a parent to the Nxu subsidiary.

Quote of the week

“Aurora is a really good partner and we’re pleased with the progress they’re making with their autonomous driver. We’ll just have to wait and see when it will be time for us to go into a revenue-producing autonomy model that doesn’t have a driver and that could be a while.” — Preston Feight, Paccar CEO, on the company’s first-quarter analyst call

Two days later Aurora announced 2027 as the year when its hardware-as-a-service business relationship with Continental AG would begin producing Aurora Driver autonomous trucking kits for sale to manufacturers.

Briefly noted:

The North American Council for Freight Efficiency has got its players for the Run on Less – Electric Depot fact-finding mission on electric truck scaling. Seven of the eight participating fleets are based in California. That is unsurprising since 60% of Class 2b-8 battery-electric trucks operate there.

Colorado has become the eighth state to follow California’s lead in adopting the Advanced Clean Trucks rule, which requires manufacturers of medium- and heavy-duty vehicles to sell an increasing percentage of zero-emission models in the coming years.

Food distributor Sysco is building an electric vehicle hub at its Riverside, California, facility that eventually will be capable of powering 40 EV trucks and 40 hybrid-electric refrigerated trailers. Sysco signed a letter of intent in May 2022 to purchase up to 800 Freightliner Class 8 eCascadias by 2026.

The Texas Commission on Environmental Quality has awarded $8.2 million in state incentives to help companies operating in Texas purchase 51 electric trucks.

Hexagon Purus and Panasonic Energy have signed a multiyear supply agreement for lithium-ion battery cells in North America. Hexagon is paying Panasonic $43 million to secure capacity at Panasonic’s plant in Kansas.

Frito-Lay has received reflected glory in electrification by becoming the first customer for the Tesla Semi. It also picked Schneider as its first third-party electric truck shipper in Freightliner eCascadias. Now the PepsiCo subsidiary plans more than 700 battery-powered delivery vehicles in its fleet by the end of the year.

That’s it for this week. Thanks for reading. Click here to get Truck Tech via email on Fridays. And tune into Truck Tech on FreightWavesTV on Wednesdays at 4 p.m. EDT.

Next week is a one-hour special episode from the ACT Expo. Joining me live in Anaheim will be Erik Neandross, CEO of Gladstein, Neandross & Associates. GNA is the consultancy behind the event that expects a 50% increase to about 12,000 attendees. About 8,000 attended the May 2022 event in Long Beach.

Also scheduled on the show are Daniel Barrel of Ree Automotive; Matt Horton from Voltera; and Ken Ramirez, executive vice president of Hyundai Commercial Vehicles, which is expected to make significant news on the fuel cell front.