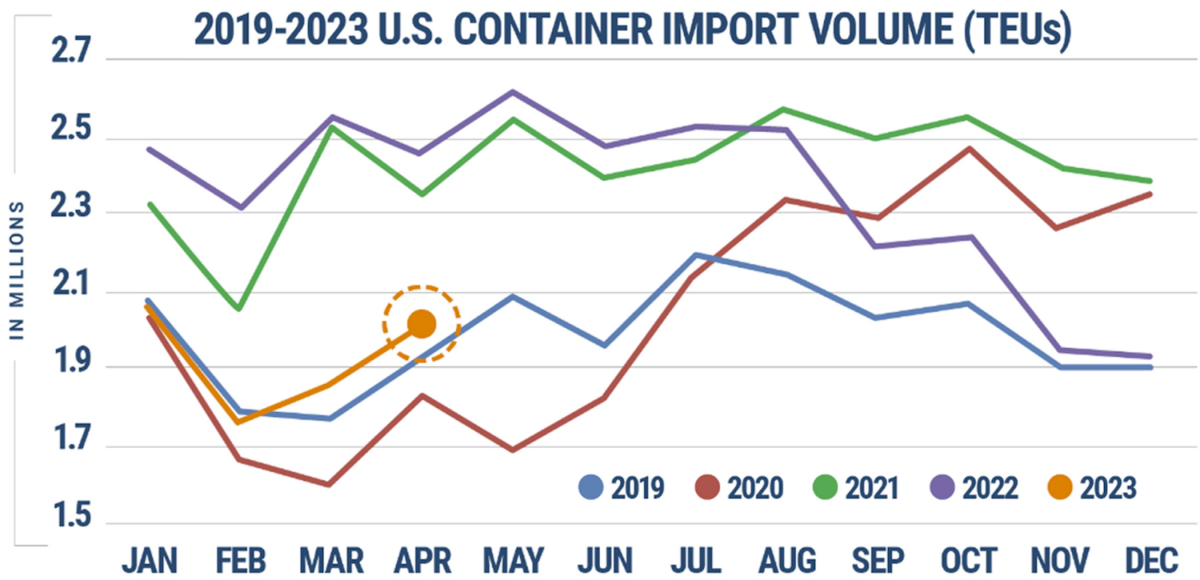

Amid all the doom and gloom on container shipping and the talk of an impending recession, U.S. imports are rising off their lows. Inventory-to-sales ratios are still much higher than pre-COVID, yet monthly imports are now either at or above 2019 levels, depending on which data source you use.

U.S. ports imported 2,020,197 twenty-foot equivalent units of containerized cargo in April, Descartes said on Monday.

That’s down 18% from a year ago, when American importers were frantically shipping in cargo. But it’s up 9% from March and 5% from April 2019, pre-COVID.

Volumes are showing “continued consistency with pre-pandemic volume seasonality,” said Chris Jones, executive vice president of industry and services at Descartes Systems Group.

Several ports saw large month-on-month import gains in April, according to Descartes data (which is based on customs filings and differs from official port counts).

Imports to the Port of New York/New Jersey surged by 54,466 TEUs or 19% in April versus March. Savannah, Georgia’s imports rose 24,923 TEUs or 15%. Los Angeles’ imports increased 22,514 TEUs or 7%, Long Beach was up 17,735 TEUs (6%) and Houston 12,237 TEUs (9%).

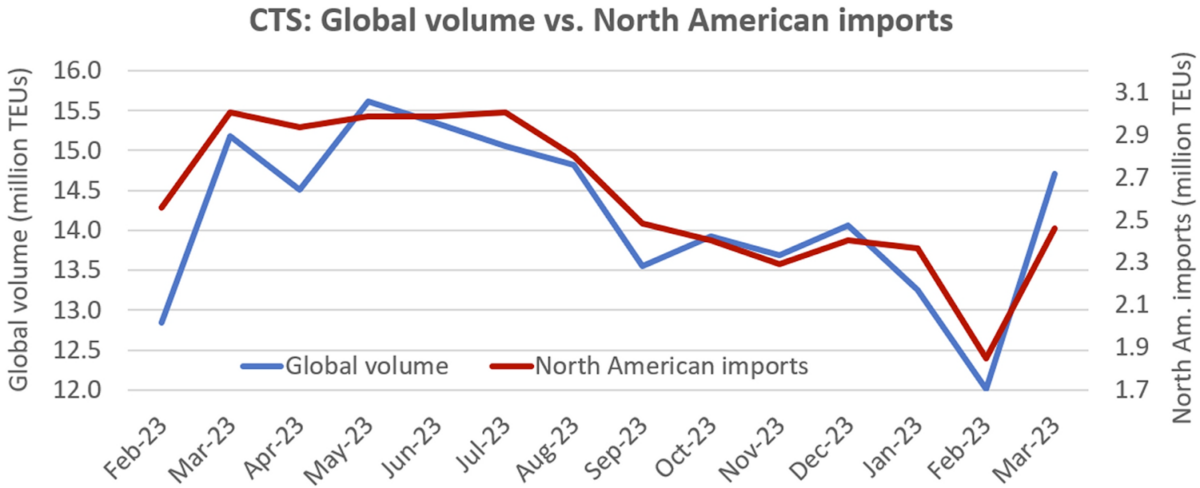

CTS global data confirms post-February rise

April marked the second straight month of U.S. import gains. Imports bottomed in February, when volumes were hit by Lunar New Year holiday closures in Asia.

Global volume data from ocean carriers published by Container Trades Statistics (CTS) shows the same upward trend as Descartes’ data. CTS released its March numbers on Monday, showing that global volumes jumped back toward August 2022 levels and North American imports (including Canada and Mexico) rebounded toward September levels.

China cargo flows to US rebound

Weaker flows from China have been a major negative for U.S. imports since September. This trade “significantly reversed the downward trend” in April, said Jones.

According to Descartes data, U.S. imports from China rose 156,563 TEUs in April versus March, up 27% month on month. Gains from China were far higher than from any other country; Vietnam was in a distant second, up 18,249 TEUs.

China’s share of U.S. imports bounced back up to 36.8% in April from just 31.6% in March. China’s share had been as high as 41.5% in February 2022.

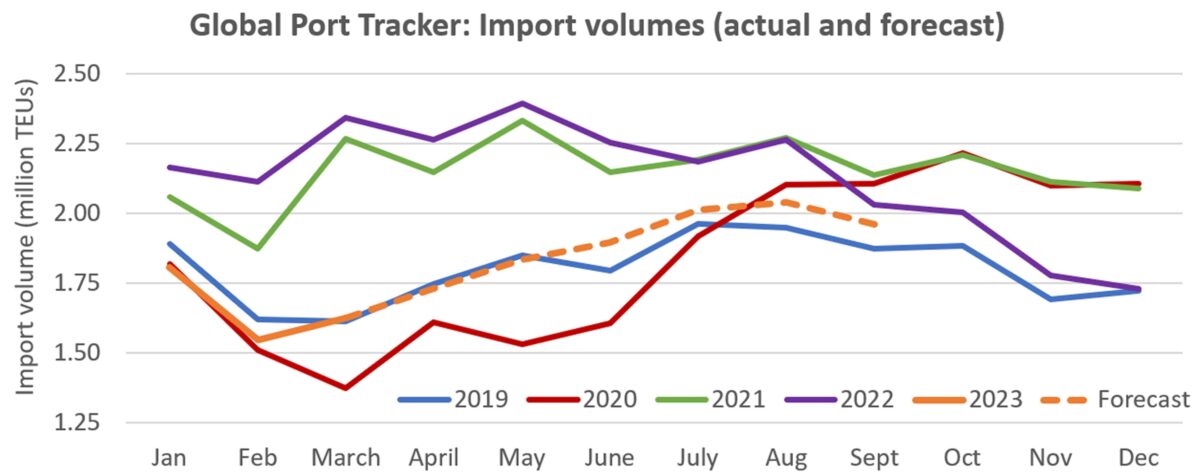

NRF downgrades peak-season outlook

The National Retail Federation (NRF) struck a more cautious note than Descartes. When releasing its latest import data on Monday, the NRF highlighted the declines versus the 2021-22 peak, the uncertainties ahead and a reduced outlook for peak season.

Global Port Tracker, published by the NRF and Hackett Associates, covers import flows to 12 leading U.S. ports. Final numbers are not in yet, but it estimates April volumes will be 1,732,948 TEUs for the ports it covers.

That’s down 23% from April 2022, when volumes were inflated by the one-off COVID-era demand boom. But it’s up 7% from March, 12% from February and essentially flat (down 0.7%) versus April 2019, pre-COVID.

Global Port Tracker cut its first-half volume forecast to 10.4 million TEUs on Monday from 10.8 million TEUs a month ago and now expects a 23% year-on-year first-half decline. It forecasts third-quarter imports of 6 million TEUs to the ports it covers, down 7% year on year.

“Our forecast now projects a larger decline in imports in the first half [versus 2022] than we forecast last month,” said Ben Hackett, founder of Hackett Associates. “Our view is that imports will remain below recent levels until inflation rates and inventory surpluses are reduced.”

Even so, Global Port Tracker is projecting that U.S. imports will remain roughly in line with 2019 levels through May and exceed pre-pandemic volumes in June-September. It forecasts that inbound volumes to the ports it covers will peak in August, at 2.04 million TEUs, then start to pull back.

Still no rebound in bookings

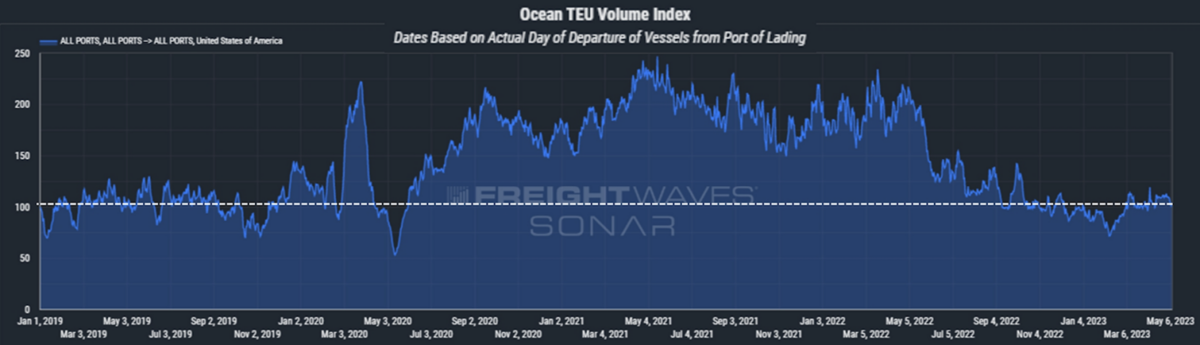

Imports are a lagging indicator of containerized cargo demand — in 2022, they were an extremely lagging indicator due to unprecedented port congestion and other delaying factors.

Maersk executives said on a conference call Wednesday that they expect imports to rise in the second half as inventories wind down. However, they admitted that they saw no evidence yet of the destocking phase ending. Internal data of Maersk’s fourth-party logistics arm shows no bookings recovery at this point.

Thus, the expectation for a second-half rebound is a best guess — and those guesses have proved wrong in the recent past.

As markets boomed in early 2021, multiple carriers predicted a normalization in the second half. It didn’t happen. In early 2022, as markets continued to boom, they predicted a normalization in the second half of that year. This time they were right — but they predicted a gradual decline. It turned out to be precipitous.

Maersk’s comments on the absence of a bookings rebound are in line with the proprietary bookings index of FreightWaves SONAR’s Container Atlas. This data shows the seven-day average of all bookings (not loadings) of a subset of global bookings bound for the U.S. by scheduled date of departure, indexed to Jan. 1, 2019.

The index was at 101 on Thursday. With the exception of a Lunar New Year-induced dip, the index has been hovering around 100 — i.e., the pre-COVID level — since the beginning of this year.

Click for more articles by Greg Miller

Related articles:

- Maersk: Downturn on predicted course, liners acting ‘rationally’

- 2nd-half freight rebound increasingly unlikely

- US imports bounce back in March despite dwindling China cargo

- Container shipping warning: Green shoots are ‘transitory illusion’

- As Asia-US shipping rates rise, so does skepticism on staying power

- Container shipping sees signs of a bottom (at least, for now)

- Mixed signals: Container shipping downturn not following the script

- ‘Colossal’ tidal wave of new container ships about to strike