The Canadian west coast ports strike is creating a trade situation we have not seen since COVID.

The ITS Logistics Port/Rail Ramp Freight Index shows nothing but a sea of red, and the fuel heating up this dumpster fire is the reconsignment of containers once bound for Canada, which will now be unloaded in the United States.

Read more: Over 20 ships wait off Canada ports as dockworker strike drags on

Destine Ozuygur, head of operations at maritime data and vessel tracking company eeSea, said the company has identified two additional vessels that are officially diverting from Vancouver. This brings the diversion count up to five.

Fourteen container vessels waiting off Vancouver and Prince Rupert are further clogging up the Canadian-U.S. trade pipeline with a total of 116,076 TEUs stranded, according to VesselsValue.

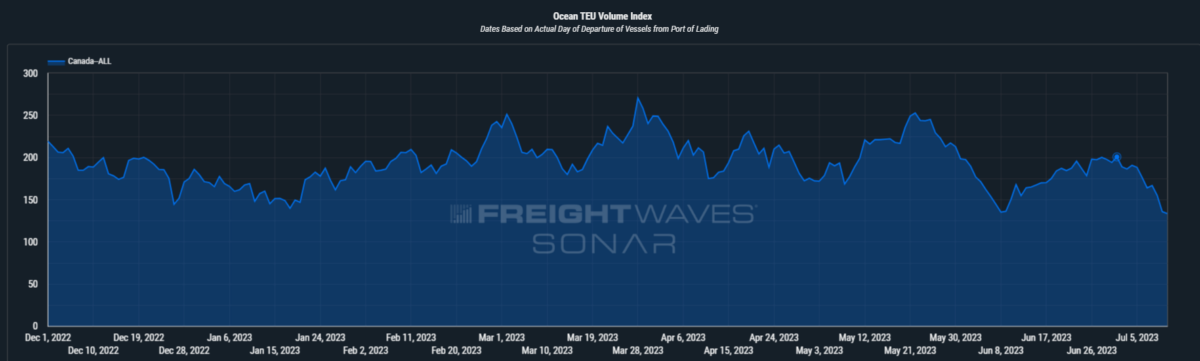

The port strike container conundrum can be easily tracked by SONAR. The drop in containers shows the lack of processing of vessels.

Paul Brashier, vice president of drayage and intermodal of ITS Logistics, said the strike at the ports of Vancouver and Prince Rupert will have a severe negative impact on the U.S. supply chain as well as Canada.

“Most of the [interior point intermodal (IPI)] freight that enters through these ports are destined to major U.S. rail hubs, including Chicago and Memphis,” he explained. “There is a high probability that a large portion of this freight will be reconsigned to U.S. West Coast ports if the vessels call on those ports prior to or after calling Vancouver or Prince Rupert.”

Brashier has been advising clients that they should immediately put contingency plans in place, not only to reroute freight into the U.S. but to also alter the mode of freight to domestic truckload in anticipation of rail congestion that will occur once the strike is resolved.

“Depending on the duration of the strike, it could take one to three months for rail operations to return to normal,” he said.

Brashier is not the only one with this dire warning.

Read more: Canada’s dockworkers strike impacts freight rail operations

The Railway Association of Canada has said that for every day this strike lasts, it will take three to five days for networks and supply chains to recover. A spokesperson told American Shipper the knock-on effects are a real aspect of why strikes are damaging to supply chains — and ultimately to families and businesses — before, during and after a strike.

In the report, ITS notes both U.S. east and west region rail ramp service will be impacted by container congestion at the IPI-to-U.S. rail ramps. Freight will overwhelm the rail lines and ramps once vessels are able to be unloaded and containers are transferred from the terminals to the ramps.

“For that reason and continued concern for ocean chassis availability at inland U.S. rail ramps, we have moved both East and West Coast rail regions to severe concern.”

What we are seeing now is the flow of trade trying to move around obstacles. The unintended consequence of this container chess match is that it’s creating another growing hairball in the trade pipeline.

Time to get out another bottle of Drano.