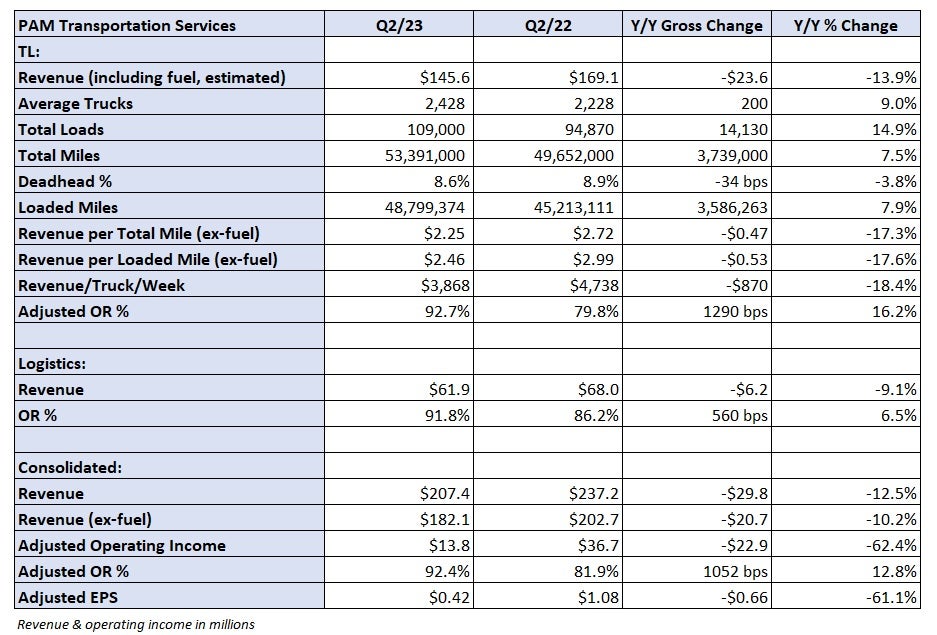

Pam Transportation Services reported late Wednesday a more than 60% year-over-year (y/y) reduction in operating income on revenue that was down just 13%.

The Tontitown, Arkansas-based truckload carrier saw revenue in its TL unit drop 14% y/y to $146 million even though average trucks in service (up 9%), total loads (up 15%) and loaded miles (up 8%) increased. The decline was tied to an 18% decline in revenue per loaded mile (excluding fuel surcharges), which dragged down utilization, or revenue per truck per week, by a similar percentage.

The increase in trucks in service and loads during the period was tied to the acquisition of Metropolitan Trucking last June.

The TL segment posted a 92.7% operating ratio (operating expenses expressed as a percentage of revenue), nearly 1,300 basis points worse y/y.

On a consolidated basis, salaries, wages and benefits increased 500 bps y/y as a percentage of revenue and the “other” expense line, which in the past has included “outside professional services expenses,” was up 180 bps. Operating expenses for the carrier were higher as a percentage of revenue on every expense line except insurance and claims, which was down 60 bps.

No commentary on the quarter was provided in the news release and the company does not hold a public call to discuss results.

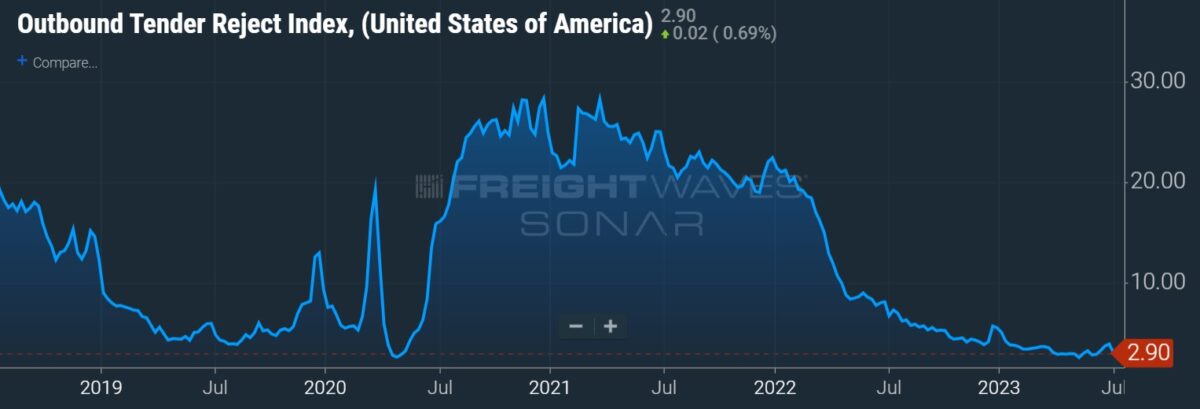

The falloff in results is emblematic of an industry still searching for the bottom of the cycle. Many carriers have been able to ride out the downturn better than in past freight recessions, partially due to numerous stimulus payments as well as a period of over earning during the pandemic. Abundant capacity and lower volumes have suppressed rates.

Pam’s (NASDAQ: PTSI) logistics unit reported a 9% y/y decline in revenue with a 91.8% operating ratio, 560 bps worse y/y. The company doesn’t provide gross profit margins for the unit or any operating metrics like load counts or revenue per load.

Earnings per share of 42 cents for the second quarter were down 66 cents y/y. Compared to the 2022 second quarter, lower gains on sale were a 3 cent headwind and a higher tax rate was a 2 cent headwind. However, both of those items were more than offset by a 13 cent tailwind from a change in the market value of the company’s equity securities.

Pam generated $69 million in operating cash flow in the quarter. Liquidity increased $5 million from the first quarter to $199 million and debt was reduced $21 million to $230 million.

Shares of PTSI were down 2.3% at 11:16 a.m. Thursday compared to the S&P 500, which was down 0.3%.

More FreightWaves articles by Todd Maiden

- Yellow blames Teamsters for liquidity crunch, union barks back

- XPO announces CFO change

- Teamsters issue strike notice at Yellow