Management from Old Dominion Freight Line noted demand has ticked up in recent days but didn’t attribute the increase to troubles at Yellow Corp.

Over the last few days, shipments per day have increased from 47,000 to 50,000, however, management said it’s typical to see volumes step higher at the end of July. The carrier may not be the first choice for shippers if Yellow Corp. (NASDAQ: YELL) were to shut down as the two reside at the opposite ends of the service-pricing spectrum.

“We’re very disciplined on price and we’re not going to do anything to trash our service by taking on too much freight,” said Marty Freeman, Old Dominion president and CEO, on a Wednesday call with analysts. “We expect if something were to happen that we would remain disciplined.”

Management did say the company could get business from other carriers that may suffer service issues if they take on volume from Yellow too quickly.

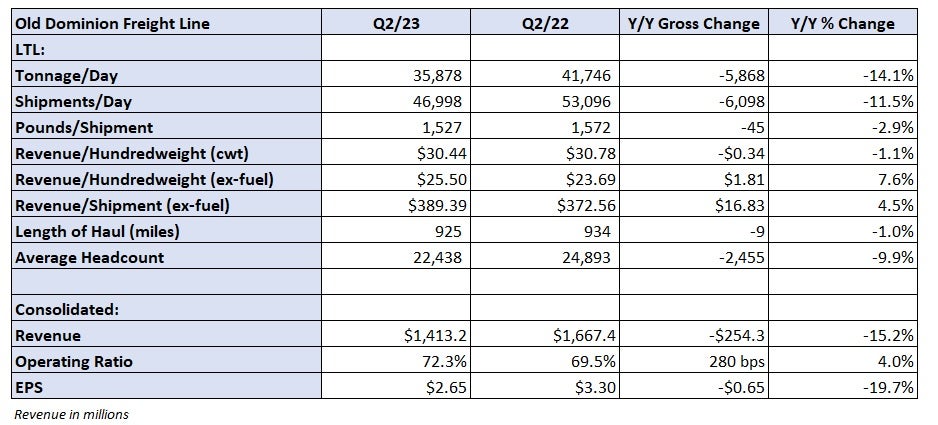

Old Dominion (NASDAQ: ODFL) reported second-quarter earnings per share of $2.65 Wednesday before the market opened. The number was in line with the consensus estimate but 65 cents lower year over year (y/y).

The less-than-truckload carrier saw consolidated revenue fall 15% y/y to $1.41 billion, the combination of a 14% drop in tonnage per day and a 1% decline in revenue per hundredweight, or yield. Excluding fuel surcharges, yield was 8% higher in the quarter. Retail diesel fuel prices were down 29% y/y on average in the period.

LTL revenue excluding the impact of fuel was down 8% y/y. Management expects fuel to be less of a revenue headwind in the back half of the year as prices started declining this time last year.

Revenue declined 2% from the first quarter. The normal seasonal progression is an increase of 10%. Tonnage was down 2% sequentially versus a normal increase of 7%. Management said shipments had largely been consistent since December until the recent uptick over the last few days. If the trend holds, revenue is expected to decline between 14% and 14.5% y/y in July with tonnage down 11.5% to 12%.

Yield excluding fuel surcharges is up between 6.5% and 7% so far in the month.

Even with volume weakness and cost inflation, the company recorded a 72.3% operating ratio, which was just 280 basis points worse y/y.

Salaries, wages and benefits (as a percentage of total revenue) increased 320 bps even as head count declined 10% y/y and 2% sequentially. Depreciation and amortization expense was 160 bps higher y/y. Lighter loads also appeared to weigh on margins. Average weight per shipment was down 3% y/y in the quarter.

Despite the modest sequential dip in revenue, operating income was up 2% from the first quarter, reflecting prudent cost management. The company saw better efficiency in the period as platform shipments per hour increased 6.6% and pick-and-delivery shipments per hour were up 0.5%.

Looking to the third quarter, the company expects OR to deteriorate between 50 and 100 bps as depreciation and amortization, general supplies and miscellaneous expenses are expected to increase. Overall, management said its cost per shipment numbers are moderating.

With the softer demand environment, the company has 30% excess capacity in its network currently, which is about 5 percentage points higher than normal. Old Dominion prefers to “stay ahead of the curve” regarding investments due to the lag time it takes to add capacity when the market shifts.

“We do not always know when an inflection point in the demand environment is going to occur but we believe we are well positioned to respond to any acceleration in volumes when it happens,” Freeman said.

The carrier has put forth a plan to handle additional business should Yellow close. However, its base case forecast assumes the market is “at the end of a long, slow cycle” and volumes will start to improve by the end of the year as broader customer conversations have recently become more constructive. The comments are also likely reflective of easier tonnage comps from a year ago when the freight market rolled over in the second half.

Old Dominion generated $288 million in cash flow from operations in the quarter and $703 million in the first half of 2023. It reiterated capital expenditures guidance of $700 million, which includes $260 million in real estate investments, $365 million for tractors and trailers and $75 million for information technology projects.

In addition to capex, the company announced it will use cash flows to buy back another $3 billion in company stock in addition to the $377 million remaining on its current share repurchase program.

Shares of Old Dominion and other LTL carriers were up more than 5% at 1:30 p.m. EDT on Wednesday compared to the S&P 500, which was down 0.2%. Shares of YELL were 9.7% higher at the time.