Walmart Inc. reported Thursday fiscal 2024 second-quarter revenue growth of 5.7%, paced by a 6.4% gain in U.S. same-store sales, and an overall operating income increase of 6.7% year on year.

Walmart (NYSE: WMT) also raised its third-quarter and full-year guidance. For the quarter, the company raised systemwide sales figures by 3%, operating income by 1% and adjusted earnings per share to $1.45 to $1.50 per share. For the full year, it expects sales to increase by 4% to 4.5%, operating income to increase by 7% to 7.5% and adjusted EPS to between $6.36 and $6.46.

The company saw gains across all its lines. Even general merchandise activity, which was down year-over-year, is “holding up better than I would have guessed,” said Doug McMillon, Walmart president and CEO, in a post-earnings analysts call.

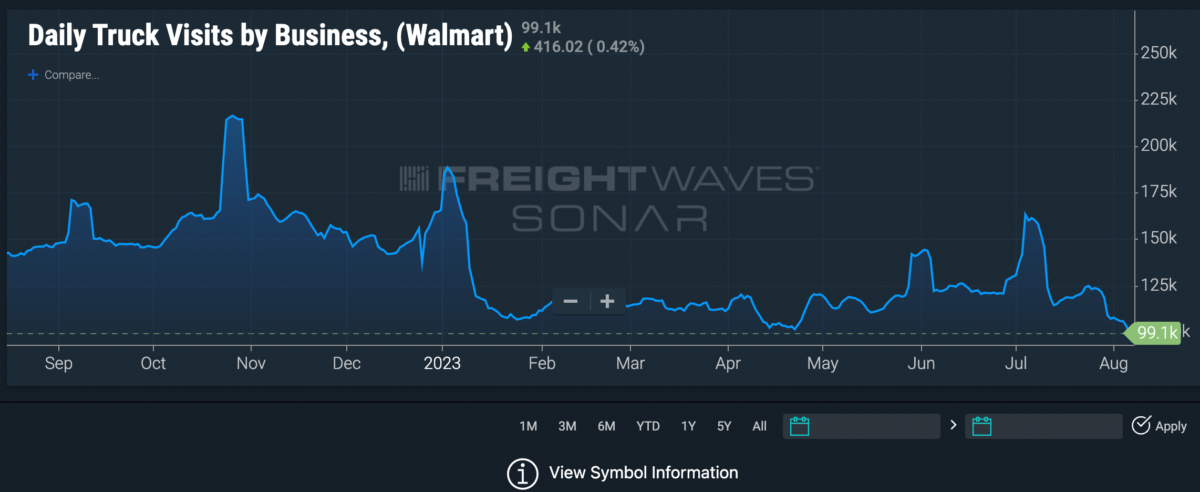

The gains came despite a decline in truck trips made to Walmart, according to data from the FreightWaves SONAR market intelligence tool. A similar decline in activity was experienced at Walmart rival Target Corp. (NYSE: TGT).

Meanwhile, Target, which reported results Wednesday, saw a 5.4% drop in sales and posted a weak outlook for the rest of the year.