A bill that would mandate minimum pay levels for Uber and Lyft drivers in Minneapolis, including a per-mile rate that is not all that far less than what national averages show it takes to hire a truckload carrier, will head to the desk of the city’s mayor, where its fate so far is unknown.

In a 7-5 vote, with one abstention, the Minneapolis City Council Thursday voted to approve legislation that would require several benchmarks be met for Uber and Lyft drivers to be paid.

Among them is a requirement that a driver of “Transportation Network Companies,” as the city refers to them, be paid $1.40 per mile and 51 cents per minute, the latter translating to about $15 per hour. The alternative would be to be paid $5, but the actual compensation would be whichever is greater.

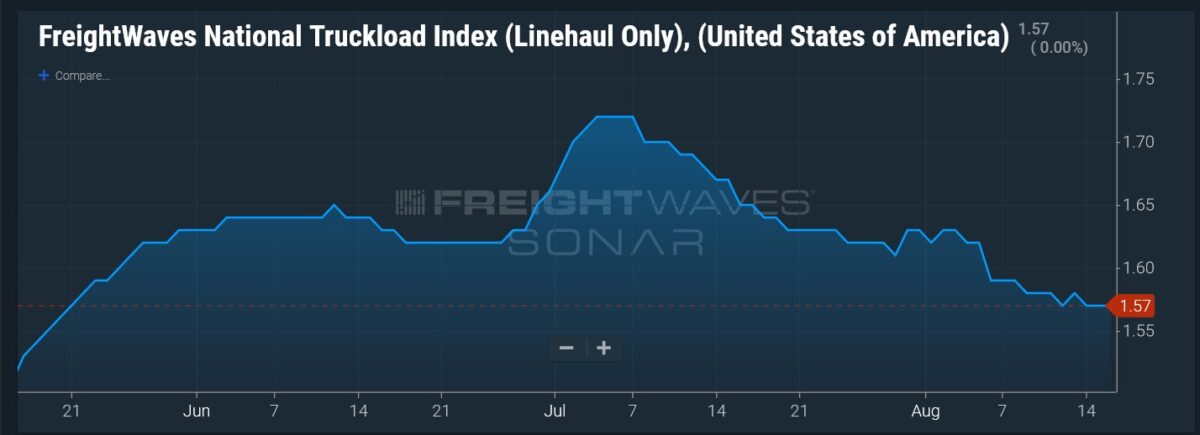

The $1.40-per-mile rate is still less than the lower per-mile truckload rate recorded in the National Truckload Index (linehaul only) rate in SONAR. It has trended between $1.50 and $1.70 per mile since about mid-February but has dropped below $1.50 per mile at least one day during that time.

In an email to FreightWaves, ATBS President Todd Amen, whose work with independent owner-operators and their taxes has given him insight into driver pay, laid out what those drivers are taking home from a $2-per-mile rate.

“Their net would be $.65 to $.80/mi or about 38% of the revenue after they pay expenses,” Amen wrote. “It gets a little more complex as good truckers can make significantly more money by running more.”

But once fixed costs are covered, “their profit becomes their contribution margin which can be over $1/mi or over 50%.”

Under the Minneapolis ordinance, minimum pay rates are to be paid only for the portion of the ride that is within the city limits. That would set up the prospect of a trip from suburban Minneapolis to the city itself running on two separate mileage rates.

Minnesota Public Radio (MPR) reported that Mayor Jacob Frey had sent a letter to the council that seemed to suggest skepticism of the proposed ordinance and its aggressive timeline for a Jan. 1, 2024, implementation.

According to MPR, Frey said in the letter that “we must allow more time for deliberation.” CNN reported that Frey has until Wednesday to make his decision.

There had been a statewide effort to impose similar minimum compensation levels throughout the North Star State. And while the legislation did pass the Minnesota Legislature, Democratic Gov. Tim Walz killed the effort in May with his first veto.

Jeremy Bird, Lyft’s chief policy officer, sent a letter to Minneapolis City Council President Andrea Jenkins Tuesday that was unambiguous in its opposition: “Should this proposal become law, Lyft will be forced to cease operations in the city of Minneapolis on its effective date of January 1, 2024.”

Uber (NYSE: UBER) has not put out a broad public statement. However, various news reports said Uber had sent a letter to its drivers earlier this week requesting that they reach out to their elected representatives and oppose the bill. “If this bill were to pass, we would unfortunately have no choice but to greatly reduce service, and possibly shut down operations entirely,” Uber wrote in its letter to drivers, according to the news reports.

Lyft’s (NASDAQ: LYFT) three-page letter said it was asking the city of Minneapolis to wait for the policy recommendations of Minnesota’s Committee on the Compensation, Wellbeing, and Fair Treatment of Transportation Network Company Drivers. The letter describes it as a task force with a broad membership including drivers and Minneapolis government officials. The task force is “engaging with a broad and inclusive stakeholder group and doing so on a much more sensible timeline.”

Frey’s letter also referred to the statewide task force, according to MPR.

The Lyft letter also laid out some statistics. Most Lyft drivers in Minnesota have an annual household income 17% below the state median, and 56% of Lyft rides in both Minneapolis and St. Paul “start or end in low-income areas,” in comparison to 39% in Seattle. But if the bill becomes law, Lyft rides in Minneapolis could be “more expensive than a cab in Manhattan,” according to the Lyft letter, which said a trip that now costs $20 would be double and operating expenses would double.

“Even if Lyft operated at a total loss on every single ride and waived all platform and services fees, this proposal would still substantially increase the price of every ride,” the company said in the letter.

Hubert Horan is an independent transportation analyst who has been critical of Uber’s and Lyft’s business model. He was not sympathetic to the companies’ arguments against the legislation.

In a lengthy email to FreightWaves, Horan said the “vast majority of these companies’ ability to reduce losses over the years has come from their ability to suppress driver compensation so investors can keep a larger share of each customer dollar.”

“They can get away with threats like this because of their incredibly predatory behavior ($33 billion in losses selling services below cost) that drove incumbent car service operators out of business and creating an impregnable duopoly. In almost any other business, new competitors with the ability to make money while meeting the minimum wage rules would immediately start service,” Horan wrote. “But everyone knows that Uber and Lyft would ruthlessly crush any serious efforts to introduce new competition.”

Horan said the two companies are “telling the citizens of Minneapolis that they have no right to take any actions that could limit the total, unfettered freedom of these two sets of shareholders.” And it’s not because of profitability, he added. Uber and Lyft “don’t want outsiders to realize just how awful the economics of these two companies are, and that passenger fares and service levels are now much worse than traditional taxi companies provided, and that driver compensation had hugely suffered. They provided billions in benefits for many early investors but absolutely everyone else is much worse off.”

More articles by John Kingston

Louisiana staged accident scam investigation springs back to life with 5 new indictments

How 1 city is curbing overweight trucks

Takeaways from State of Freight: A surprising volume increase in July