GAO tells FMCSA to make carrier complaint data public

A report published Tuesday by the U.S. Government Accountability Office (GAO) concluded that the Federal Motor Carrier Safety Administration (FMCSA) must make its complaint database more transparent and publicly available. The 60-page report adds, “Specifically, FMCSA does not make public any information on complaints against truck companies, bus companies, or electronic logging device providers. As a result, FMCSA may be missing the opportunity to improve transparency and collaboration with industry partners.”

FreightWaves’ John Gallagher writes that the audit ran from April 2022 through September 2023 and analyzed complaints from January 2016 through December 2021. Of the total complaints reviewed 37,700 were against truck companies, 29,400 were against moving companies plus moving brokers, and 200 were against bus companies.

One issue highlighted was lack of trucker outreach, as the FMCSA audience outreach went more toward the general public that planned on using household movers and less to commercial drivers. Gallagher notes, “In fact, representatives from five trucking associations interviewed by GAO — including the Owner-Operator Independent Drivers Association and the Truckload Carriers Association — were not aware of FMCSA’s outreach to promote its complaint website.”

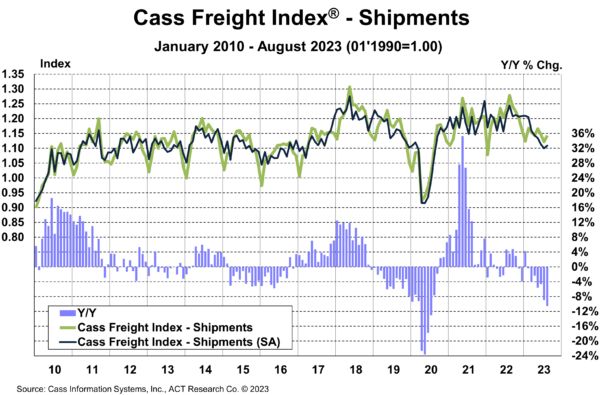

Cass August data: Slight monthly uptick, comps to 2022 accelerate downward

Freight audit and payment provider Cass Information Systems’ August transportation index data shows a continued decline in freight volumes compared to last year. The Cass shipments index rose 1.9% month over month (m/m) in August but fell 10.6% in August following a 8.9% decline in July on a year-over-year (y/y) basis. The expenditures index rose 1.1% m/m but was down 25% y/y in August as higher fuel surcharges impacted overall transportation spend.

One reason for the potential declines in for-hire freight volumes is the increase in private fleet growth. The report notes, “Private fleet growth is evident as Class 8 tractor retail sales are on pace to set a record this year, yet for-hire fleets are by and large demonstrating capital discipline.” The report speculates a large part of the decline in shipments comes from private fleets insourcing more freight, taking it out of the for-hire market.

One trend to watch is the slowing decline in the truckload linehaul index, which fell 0.5% in August but was down 11.5% y/y. Tim Denoyer with ACT Research noted, “This likely reflects a combination of stabilizing spot rates and smaller declines in contract rates. We’ve recently heard anecdotes of fleets addressing unacceptable rates, with some success remediating sharp rate declines. While not likely widespread, this suggests rates are nearing their lows.”

Market update: Preliminary August trailer orders remain soft

August preliminary net trailer order data released on Thursday by ACT Research suggests orders remain seasonally soft but demand remains. Seasonally adjusted preliminary net trailer orders came in at 14,700, down 6% sequentially, but high backlogs and minimally open order books for 2024 muddy expectations.

Jennifer NcNealy, director, CV Market Research & Publications at ACT, noted in the report, “Additionally, the data continue to provide mixed messages, with cancellations remaining elevated, driven primarily by the dry van and flatbed segments, even as backlogs remain at healthy levels. In July, the BL/BU ratio was north of six months in aggregate, with some specialty segments having no available build slots until the beginning of 2025.”

Dry van and flatbed cancellations should not come as a surprise as higher operating costs paired with lower rates eat into carriers’ margins and capex plans. One thing to watch will be if larger fleets continue to update their aging equipment at scale and the impact it may have on build orders and prices.

FreightWaves SONAR spotlight: End-of-summer outbound tender rejection rate rally may be stalling

Summary: The late-August rally in nationwide outbound tender rejection rates may be losing steam as rejection rates across all modes fell 40 basis points from 4.27% on Sept. 13 to 3.87%. Flatbed and reefer rejection rate declines over the past week contributed to the downward trend. Reefer rejection rates fell 78 basis points week over week (w/w) from 9.15% on Sept. 13 to 8.37%. During that same period, flatbed rejection rates fell 53 bps w/w from 8.9% to 6.79% as softness in home building and construction created additional headwinds. Dry van carriers heavily exposed to contracted load volumes continue to fight or solicit for additional truckload volumes. Nationwide van outbound tender rejection rates fell 25 bps w/w from 3.83% on Sept. 13 to 3.58%.

In spite of the challenging conditions for truckload carriers and brokers, shippers should expect to experience better service levels due to the ongoing excess truckload capacity glut. This environment drives competition, and carriers that prioritize tender compliance and service seek to remain an incumbent as other carriers and brokers vie for their volume. A broker or carrier’s position on the routing guide could mean feast or famine when tender compliance remains high.

The Routing Guide: Links from around the web

Low diesel fuel inventories, volatile pricing likely to boost carrier exits (Commercial Carrier Journal)

FreightWaves announces 2024 FreightTech 100 companies (FreightWaves)

Parts and labor costs begin to show improvement (Commercial Carrier Journal)

Sisler out as head of Coyote; CFO Pisipati rises to CEO post (FreightWaves)

We’ve got a truck parking crisis. Who should solve it? (FreightWaves)

Ransomware attack hits Orbcomm’s BT series of ELDs; paper logs are back (FreightWaves)