Quarterly earnings for Marten Transport (NASDAQ: MRTN) were those of a truckload carrier facing a far weaker market in the third quarter than a year ago, which itself was starting to retreat from the strong market of 2021-22.

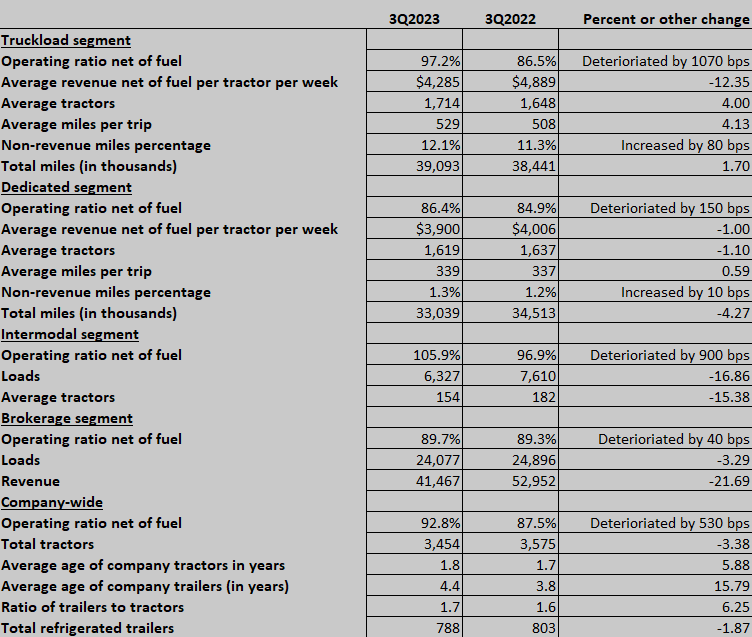

The company’s truckload segment, the largest by revenue, saw its operating ratio net of fuel slide to 97.2% from 86.5% in the corresponding quarter of 2022. Average revenue net of fuel per tractor per week dropped 13.4% to $4,285, though total miles rose to 39 million miles from 38.4 million miles.

Marten’s intermodal segment saw its performance plummet. Its OR net of fuel came in at 105.9%, down from 96.9%, a deterioration of 900 basis points. Unlike truckload, where total miles driven actually improved from a year ago, intermodal saw a significant loss of volume, declining to 6,327 loads from 7,610 loads a year ago.

The bottom line for intermodal was an operating loss of $1 million, down from a profit a year ago of $778,000.

Dedicated’s OR net of fuel also showed a weaker performance, reported at 86.4%, down from 84.9%.

While brokerages through the freight sector are struggling, Marten’s managed to turn in a relatively stable OR even as its total revenue declined. OR weakened only to 89.7% from 89.3% a year ago, on a revenue drop of 21.7% to $41.5 million from $53 million. Loads dropped about 3.3% to 24,077 from 24,896.

Revenue segment by segment beyond brokerage was truckload, $114.2 million, down 11.7%; Dedicated, $101.7, down 7.6%; and intermodal, $22 million, down 31%.

Beyond intermodal, the other segments did turn in operating profits, but they were down significantly. Truckload fell to $2.7 million, a drop of 81.1%; Dedicated fell to $11.3 million, a decline of 13%; and brokerage came in at $4.32 million, a decline of 24.5%.

For the company as a whole, the OR net of fuel was 92.8%, weakening from 87.5% a year ago.

Marten does not conduct an earnings call with analysts. The prepared statement by Executive Chairman Randolph Marten in the company’s earnings release was a recap of the state of the freight market.

“Our earnings this quarter were significantly pressured by the industry-wide weak demand, cumulative impact of reduced freight rates with the resulting freight network disruption, and inflationary operating costs within the current freight market recession,” Marten said.

But in a rarity for public truckload companies, Marten also talked about the price of diesel. Fuel surcharges are generally effective enough that it rarely is brought up by companies in their earnings statements or on calls with analysts, not seen as a headwind or a tailwind.

But Marten said the combination of “record heat and rising fuel prices each month of the third quarter led to an increase in our mile-adjusted net fuel expense of $3.9 million, or 4 cents per diluted share, from this year’s second quarter to third quarter.”

That 4 cents is a relatively sizable amount given that Marten’s earnings per common share were 17 cents, down from 32 cents a year ago.

However, a year earlier in the third quarter, retail diesel as measured by the average of the weekly DOE/EIA price was $5.152 per gallon. This year it was $4.242/g.

Retail diesel as measured by the weekly Department of Energy/Energy Information Administration average retail price rose from $3.767/g on July 3, the first posting of the third quarter, to $4.586/g on Sept. 25, the final posting of the three months.

Salaries, wages and benefits as a percentage of revenue rose to 33.1% in the quarter from 30.7% a year ago. Purchased transportation fell to 17.7% of revenues from 19.8% a year ago.

Marten’s stock in the past year has mostly treaded water, up 3.78% in the last 52 weeks, per Barchart. It closed Wednesday at $19.22 and was little changed in post-earnings trading.

More articles by John Kingston

Marten sees minor pullback from Q1, sharper drop from a year ago

Marten drove more in 1st quarter than last year but made less money

Marten revenue up but net income growth lowest in over 2 years

Tad a Richards

The source of the problem with Marten begins at the top. And rolls down hill rapidly. Too many unqualified individuals with management titles. Poor communication. Low or no weekend support. I was terminated for pulling a u turn caused by the Qualcomm navigation sending me down a dead-end road. I averaged over 177,000 miles per year with 100 percent on time pickup and deliveries. No tickets no accidents and they terminated me citing unsafe driving. My driver manager lost his number 0ne driver as safety sent me out on the streets of Laredo I gave up all my tools bedding,frigde,freezer,microwave,toaster,hotplate,coffee pot etc. 2 taxis,a hotel and airfare to Arizona .The wrongful termination cost me over

$3,000.00 to get home.

Thanks Marten.