Think electric trucks are just a thing in California? Think again. The Golden State unsurprisingly leads in zero-emission truck (ZET) adoption. But other states move more battery-powered trucks in certain segments.

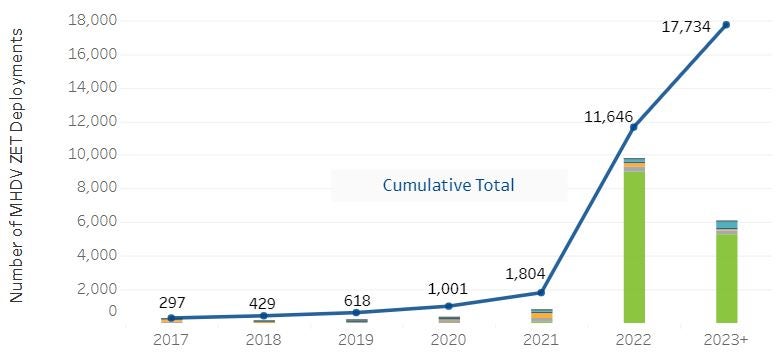

A new white paper from the nonprofit clean transportation advocacy group Calstart shows a developing hockey stick of electric truck adoption, though overall ZETs make up far less than 1% of trucks on the road.

California continues to lead ZET deployments, with approximately 3,075 such trucks deployed through June. That’s just under one-fifth of total U.S. deployments. Following California, Texas, New York, Florida and Illinois top the list for ZET deployments.

versions of California’s Advanced Clean Trucks rule. (Source: Calstart)

Electric cargo vans lead the way

A “meteoric rise” in Class 2b cargo vans drives the increase. Approximately 14,400 zero-tailpipe-emission cargo vans operate in the U.S. Calstart said 11,835 of those hit the road in the first half of 2023. Texas edged out California to lead in electric cargo vans, with Florida in third place.

“The reason why you see the cargo van market exploding is because BrightDrop came in with a great price point. Then Ford came in with their product. So that area is expanding very, very rapidly,” Paul Gioupis, CEO of electric infrastructure developer Zeem Solutions, told FreightWaves.

The growth in zero-emission cargo vans traces to higher production volumes — especially from legacy automakers — and more marketing campaigns. Cargo vans require smaller batteries, meet the relatively short duty cycles for repeatable pickup and delivery routes and cost much less upfront than larger ZETs. Return-to-base overnight charging is another advantage.

Following cargo vans in ZET deployments are yard tractors that move trailers in distribution yards (1,134), Class 8 heavy-duty trucks (867), medium-duty step vans (843), medium-duty trucks (442) and refuse trucks (48).

Carrots and sticks drive EV adoption

California’s carrot-and-stick approach of incentives and regulations drives EV adoption. The state’s Advanced Clean Trucks (ACT) rule mandates that OEMs make rising numbers of electric trucks. An Advanced Clean Fleets rule, delayed by a legal challenge, requires fleets to buy the trucks. Both rules aim to eliminate diesel trucks in the state by 2045.

The 10 states that have adopted regulations similar to the ACT rule account for 38% of all ZET deployments but just 25% of all truck registrations, according to Calstart research.

California’s generous voucher program for ZETs combined with the federal Commercial Clean Vehicle Credit that provides up to $7,500 toward the purchase price of a zero-emission cargo van, makes them cost-competitive with combustion-powered cargo vans.

Among Class 8 heavy-duty trucks, adoption is slow given the 5 million diesel-powered trucks on the road.

“Battery electric trucks certainly have a space and we’re starting to commit heavier into the assets to support that,” said John Rich, Paccar Inc. chief technology officer. “We started in small volumes to learn and let our customers learn, take feedback and start building the next generation of trucks.”

The emissions factor

Reducing pollution from smog-creating nitrogen oxides and planet-warming greenhouse gases from carbon dioxide energizes the push for clean trucks. A lot of pollution occurs around major ports in Los Angeles and Long Beach, California. Nearby low-income neighborhoods report elevated health dangers from idling diesel trucks awaiting port entry.

The transportation sector generates roughly 28% of the nation’s GHG emissions, according to the Environmental Protection Agency. Medium- and heavy-duty trucks represent only 10% of vehicles on the road. But they account for almost 30% of transportation-related GHG emissions; 45% of NOx, and more than half of fine particulate matter emissions for all vehicles.

Related articles:

California doubles electric truck rebates for small fleets

CARB sets up unit to help fleets navigate California’s Clean Fleets rule

Loaded and rolling: ATRI reports on California’s electric truck challenges