Management from less-than-truckload carrier Old Dominion Freight Line noted “continued softness in the domestic economy” on a Wednesday call with analysts. However, it said the company has been preparing for an eventual recovery and that shipment counts in March typically provide a tell on what the full year will produce.

The carrier’s fourth-quarter report showed head count was up a little more than 2% from the third quarter to nearly 23,000. This was the first increase in six quarters as it is focused on backfilling dockworkers. Following Yellow’s exit, Old Dominion’s daily shipment count increased about 6%, requiring it to put CDL-holding platform workers behind the wheel. The company has also ramped recruiting efforts at its driving schools as it prepares for a recovery.

Old Dominion currently has about 30% excess terminal capacity, which is a little more than it normally carries. It opened just two new service centers last year after opening nearly 10 per year during the upcycle. The company has several more that could be opened quickly if volumes dictate, but it is eyeing four to five additions this year.

Old Dominion (NASDAQ: ODFL) typically takes market share when the cycle turns positive. It has outperformed growth rates of peers by 600 to 1,000 basis points during most market recoveries. The disparity was wider in 2021 as it grew shipments by 20% when the average growth rate for the competition was 4%.

“As demand improves for our customers’ products, we’re in place and we will be able to bring on that freight to the truck line and get back into doing what we do best, which is growth,” said CFO Adam Satterfield on the call.

He said the transition to growth could happen quickly as muted truckload demand is forcing some TL carriers to encroach on LTL freight. Some TL carriers are combining shipments from different customers into a single trailer, which requires multiple stops. When TL demand and rates improve, TL carriers will stop aggregating smaller shipments and will again opt for more efficient one-stop deliveries.

Q4 by the numbers

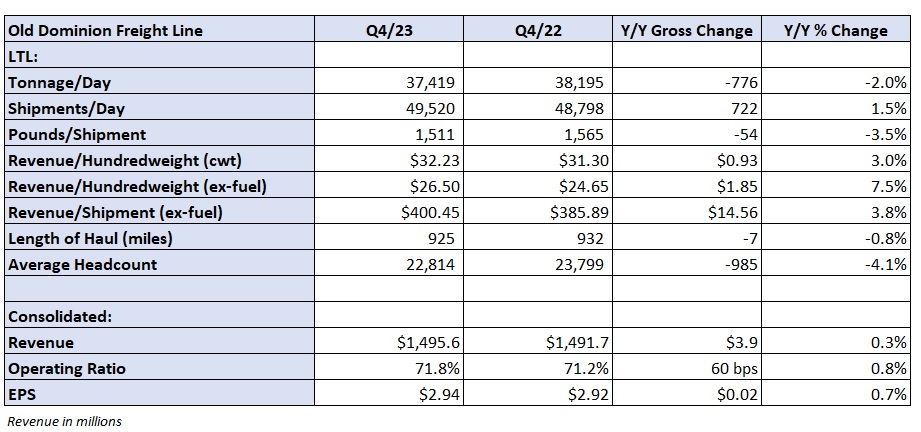

Old Dominion reported fourth-quarter earnings per share of $2.94, which was 2 cents higher year over year (y/y) and 9 cents ahead of the consensus estimate. The number included $15.1 million in gains from the sale of property and equipment, which was a 10-cent benefit. That was partially offset by an 8-cent headwind from higher insurance expenses, which were tied to an annual review of accident claims.

A lower tax rate was a 3-cent tailwind compared to the year-ago period.

Revenue was up just slightly y/y to $1.5 billion as daily tonnage fell 2% and revenue per hundredweight, or yield, was up 3% (7.5% higher excluding fuel surcharges). The metric was positively impacted by a 3.5% decline in weight per shipment.

Management said Old Dominion’s overall share of the LTL market increased in the quarter as daily shipments of 49,520 were 1.5% higher y/y but down slightly from the third quarter.

Revenue per day is expected to be down 3.1% y/y in January as tonnage per day is off 5.1% and yield (excluding fuel surcharges) is 6.4% higher.

A fourth-quarter headline operating ratio of 71.8% was 60 bps worse y/y and 120 bps worse than the third quarter. Netting out the gain on sale and the insurance true-up, OR was roughly 72%, 140 bps worse than the third quarter but still better than management’s guidance of 160 to 200 bps of sequential deterioration.

For the full year, the company recorded a 72% OR, just 140 bps worse y/y, even though tonnage was down 9%. The number included a 100-bp y/y headwind from incremental depreciation and amortization expenses given the growth-oriented investments made during the year.

The carrier normally sees 100 bps of OR degradation from the fourth to the first quarters. It’s forecasting 170 to 220 bps of deterioration this year given the net benefit to the fourth-quarter OR and a still-sluggish demand environment.

The company reiterated a long-term goal of pricing freight 100 to 150 bps above costs.

Old Dominion generated $1.6 billion in operating cash flow during 2023. It repurchased $454 million in stock and paid out $175 million in dividends. The company announced Wednesday it raised its quarterly dividend by 30% to 52 cents per share.

It outlined $750 million in capital expenditures for 2024, which is in line with the $757 million spent in 2023. The new capex program calls for $350 million to be allocated to real estate projects and $325 million for tractors and trailers.

Shares of ODFL were off 0.3% Wednesday at 12:07 p.m. EST compared to the S&P 500, which was down 0.8%.

More FreightWaves articles by Todd Maiden

- Roadrunner adds more lanes; coverage now includes Toronto, Montreal

- Third-party insurance business sinks Knight-Swift’s Q4

- Late-December swoon has analysts cutting Q4 estimates again