The Port of Los Angeles’ January import numbers highlight that the inventory glut of 2022 and early 2023 is largely in the rearview mirror. The port experienced the second-best January on record, surpassed only by January 2022, which was fueled by pandemic-related spending.

The port handled 855,652 total TEUs during January, eclipsing last year’s mark by 18%. The growth compared to pre-COVID levels is minimal, with the port handling only 0.4% more TEUs during the month than it did in January 2019.

While the Port of Los Angeles experienced the second-highest-volume January from a total TEU perspective, loaded imports had the best January on record. The Port of Los Angeles handled 441,763 TEUs during the month, up 19% year over year. The previous strongest January was in 2021, when the port handled 437,609 loaded TEUs.

In a media briefing Wednesday afternoon, Gene Seroka, executive director of the Port of Los Angeles, highlighted two factors that contributed to the growth in imports: replenishing inventories at a faster clip ahead of the Lunar New Year holiday, which began Saturday, and consumer spending.

The inventory replenishment rationale is much more of a driver as retail sales figures released by the U.S. Census Bureau on Thursday morning dropped by 0.8% month over month. Sales were 0.6% higher than they were last year, but the retail sales metrics aren’t adjusted for inflation. The decline isn’t as severe as when isolating consumer goods by removing spending on motor vehicles and parts as well as spending at gas stations. By that metric, sales were down 0.5% m/m but still 2.2% higher y/y.

The Logistics Managers’ Index in February highlighted the growth in inventory levels after months of contraction.

The pull-ahead for the Lunar New Year will help boost import volumes at the Port of Los Angeles in February as well. The February import figures will likely show larger growth y/y than January due to the timing of the Lunar New Year, and March will see the impacts of the Lunar New Year, which could still show growth y/y.

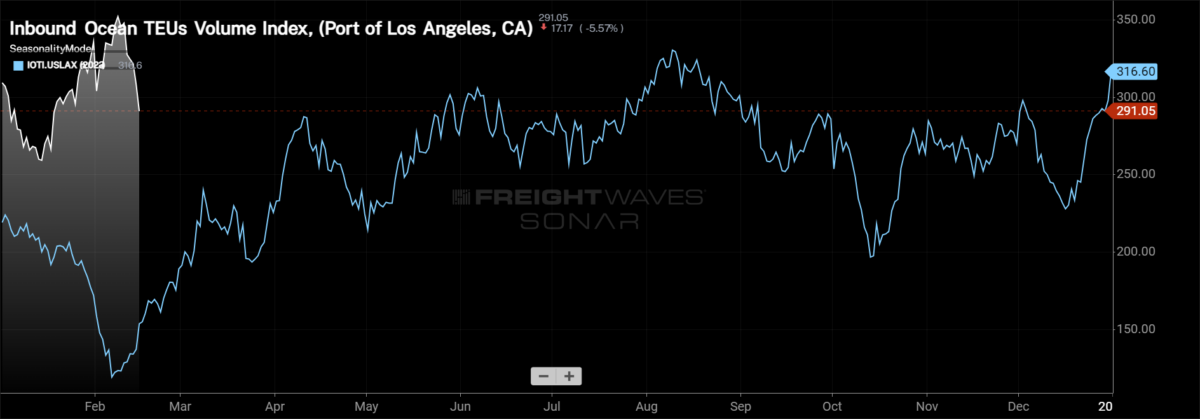

The Inbound Ocean TEUs Volume Index for the port shows the y/y growth in TEUs as they are leaving various ports around the globe despite the Lunar New Year holiday being firmly underway. The question that remains is, what will the rebound from the holiday look like?

Another tailwind for the port is the situation in the Panama Canal. There were more scheduled slots through the drought-stricken canal in January, but it didn’t result in more transits. These impacts will likely be a tailwind for the port throughout the dry season in Panama, which extends into May.

The strongest growth at the Port of Los Angeles came in the form of loaded exports. The port handled 126,554 loaded export TEUs, the highest number of outbound loaded containers since November 2020. Loaded exports were up 23% y/y in January.

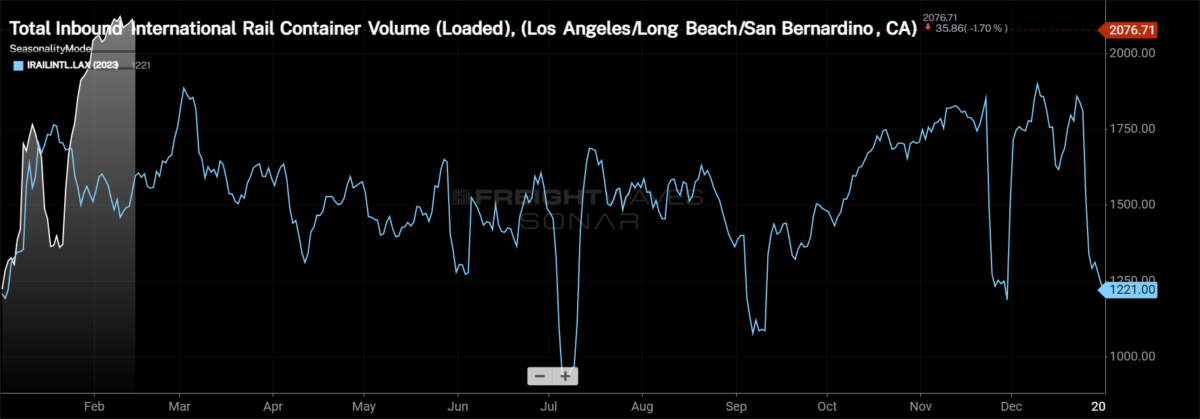

Loaded international intermodal container volumes for the Los Angeles market, which has both the Port of Los Angeles and the Port of Long Beach within its boundaries, held up y/y for much of January but was also strong in the back half of December, which helped boost loaded exports in January.

The growth in inbound loaded international intermodal container volumes into the Los Angeles market in February will likely help boost loaded export volumes in the coming months.

The Port of Los Angeles has capitalized on factors impacting global trade, and the impending labor negotiations between the International Longshoremen’s Association union and the East Coast ports could help generate a longer tailwind for the port at the heart of the U.S.’s freight economy.