Forward Air’s fourth-quarter earnings call didn’t provide the financial targets analysts were seeking following its controversial merger with Omni Logistics. The main takeaway was the company’s disclosure that the combined entity was cash flow-positive during February without any significant help from cost or revenue synergies.

Forward (NASDAQ: FWRD) closed the acquisition of Omni on Jan. 25, more than three months behind schedule. Legal challenges from investors and Forward’s efforts to exit the deal led to the holdup. Allegations of bad faith and unscrupulous document handling ended with the departure of the CEOs from both companies.

A $2.1 billion closing price required Forward to issue $1.8 billion in debt to take on Omni’s outstanding balances and restructure its existing debt. At closing, Forward’s net debt to adjusted earnings before interest, taxes, depreciation and amortization was estimated to be 5.2 times. The adjusted EBITDA number included the expectation of $75 million in cost synergies.

Forward expects to lower debt leverage to 4.5 times by the end of 2025 and to less than two times longer term. It will look to divest other noncore units to deleverage the balance sheet, and it has suspended a 24-cent quarterly cash dividend. In December, it sold its final-mile segment to Hub Group (NASDAQ: HUBG) for $260 million.

Interest expense and principal repayment are expected to total $181 million annually. The company generated more cash than needed to service its debt during February without the benefit of integration synergies. The cash flow number was adjusted to exclude deal-related and other one-offs, which were described as “minimal.”

“The fact that we [were] cash flow-positive for the month of February, given the environment that we’re in, should be reflective, I think, of just more positive news to come in terms of being able to generate that cash,” said Chief Financial Officer Rebecca Garbrick on a Thursday call with analysts. “We know that the combined entity has synergies, cost synergies that are there for us to be realized.”

Forward said it has more than $200 million in cash on hand currently and additional availability under a $340 million revolving credit facility.

The company will provide details on a go-forward plan at a later date as it is still awaiting Omni’s audited financial results. A delay in receiving timely financials from Omni was a reason Forward tried to break the deal, previous court filings showed.

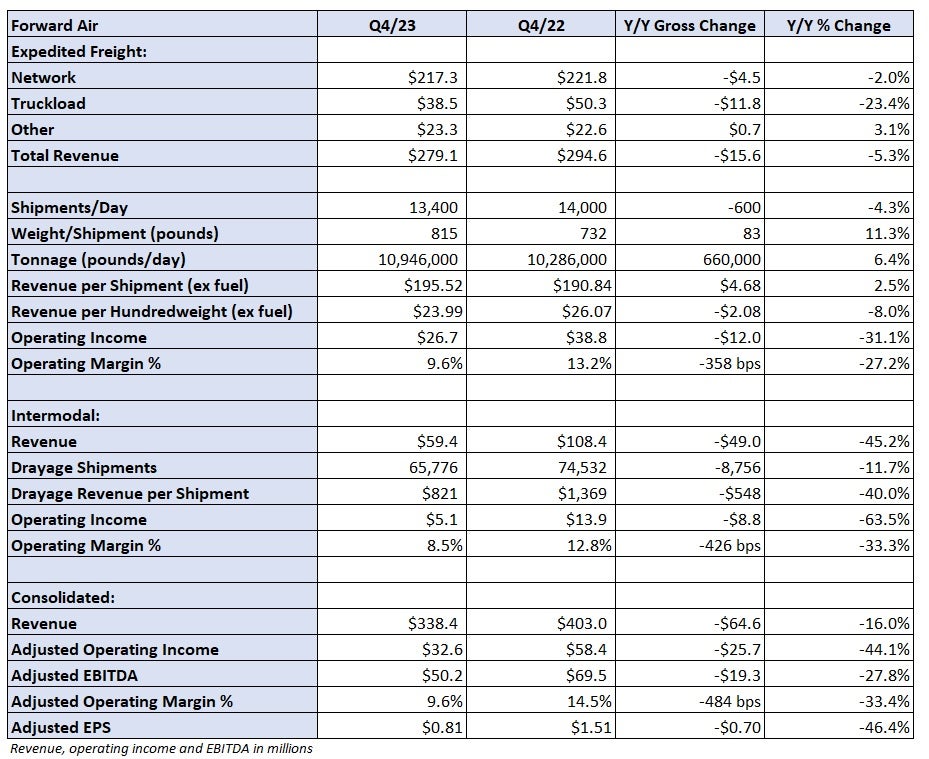

The company reported adjusted earnings per share of 81 cents from continuing operations during the fourth quarter, which was 70 cents lower year over year (y/y) and 17 cents below the consensus estimate. However, the number excluded 20 to 22 cents per share in earnings from its final-mile segment, which is now recorded as a discontinued operation. It’s unclear if analysts accounted for the exclusion in their forecasts.

The 81-cent result was 1 cent higher than management’s revised guidance range of 78 to 80 cents, which excluded final-mile operations.

A headline net loss of $14.7 million from continuing operations included one-off deal-related costs and excluded final-mile results.

Consolidated revenue of $338 million was 16% lower y/y.

Revenue from its expedited segment, which includes less-than-truckload operations, fell 5% to $279 million. Tonnage in the expedited segment increased 6% y/y as shipments fell 4% and weight per shipment was up 11%. Revenue per hundredweight, or yield, was down 8% y/y excluding fuel surcharges.

Tonnage was 9.2% higher y/y in January as weight per shipment increased 9.8%. The combination implies daily shipment counts were off slightly. Revenue per ton mile increased 1.9% y/y excluding fuel surcharges. Tonnage was up 8% y/y in the first two weeks of February. The increase excluded the integration of Omni’s linehaul operation.

Forward said it will not be providing quarterly guidance during the transition.

The company will now operate in three segments: wholesale, shipper asset and Omni services.

The wholesale channel includes the company’s legacy forwarding business (freight forwarders, airlines and 3PLs). Shipper asset includes direct shippers needing an asset-based provider. Omni services provides end-to-end supply chain services.

Interim CEO Michael Hance said there has been little customer attrition, which was a concern as Omni competes directly with Forward’s freight forwarding customers.

Wholesale volumes were off 8.9% in the six months before and after the deal was announced, “But we believe almost all of that decline is driven by a softer freight market rather than customer attrition,” Hance said.

He said volumes with half of its legacy wholesale customers were up during the past six months and it has added $17 million in new premium LTL business since closing the transaction.

“We’re going to manage the rules of engagement in our channels really well, to make sure that we give our legacy customers confidence that we can be the provider that we’ve always been to them without fear of any kind of encroachment into their space, unnecessarily,” Hance said.

Hance is also the company’s chief legal officer and secretary. A search committee was formed to find a new CEO, following former Forward CEO Tom Schmitt’s departure earlier this month.

Shares of FWRD were down 6.2% at 11:56 a.m. EST on Thursday compared to the S&P 500, which was up 0.1%.