Motive expands AI-powered visibility tools at Vision 24

NASHVILLE, Tenn. — Motive, a telematics, technology and fleet management platform, announced new AI-powered products and telematics hardware at the inaugural Vision 24 Motive Innovation Summit on Wednesday. The recurring theme for these announcements was safety and visibility, with special attention given to breakthroughs in Motive’s AI Omnivision, a general-purpose computer vision platform that uses AI to identify unsafe driving behaviors and conditions within and outside the cab. Using training models and footage collected from in-cab and side/rear cameras, the technology can now identify safety issues including unsafe lane changes, distracted or drowsy driving, forward collision warnings, and lane control violations such as running a red light or stop sign.

The added telematics capabilities were extended into a first responder feature, where the AI-enabled dashcam would recognize a collision and dispatch emergency services. The challenge for truck drivers involves delayed response times when it can take first responders 10-19 minutes to arrive on scene. Another challenge is finding the exact location to dispatch emergency services, especially in hard-to-reach geographic areas. Data provided by Motive showed that 54% of fatal crashes involving large trucks occurred in rural areas, putting an emphasis on speed. Motive partnered with various emergency services TMS platforms to send driver information and truck data to expedite dispatching and notify back-office staff.

From customer testimonials and interviews, the biggest improvement from installing and implementing the cameras was greater overall safety and fewer accidents. A Motive internal customer survey found 91% of those surveyed reported a reduction in at-fault accidents. One large carrier was able to negotiate for lower insurance rates by demonstrating how many vehicles are actually in operation and using the dashcams to protect against false claims. One challenge fleets noted is change management and getting drivers used to front-facing and driver-facing cameras and building a proactive safety culture.

FMCSA report highlights dismal numbers for under-21 driver apprentice program

The under-21 driver pilot program appears to be stalling and losing altitude. FreightWaves’ John Gallagher writes, “The Federal Motor Carrier Safety Administration says only 113 motor carriers have applied for its under-21 truck driver apprenticeship program since the agency began accepting applications in July 2022, a dismal sign for an initiative that had been expected to recruit up to 1,000 carriers and 3,000 drivers.” The pilot program is slated to end in July 2025 and sought to address shortages of truck drivers and encourage drivers 18-21 years old to participate.

For carriers that submitted applications, the approval rate was also underwhelming. A fiscal year report for 2022 submitted to Congress by the FMCSA noted, according to Gallagher, that “as of February 2024, FMCSA has rejected 34% — or 38 of the 113 applications received. The agency has fully approved only 30%, or 34 of the applications.” This was an improvement from last year’s numbers. Sen. Cindy Hyde-Smith R-Miss. told a Senate Subcommittee meeting in March 2023 that only four apprentices were participating.

“At the time of the presentation from FMCSA, only 21 carriers had been approved for participation and four apprentices were in the program. One, two, three, four, and we could take up to 3,000.” said Hyde-Smith. For the Owner Operator Independent Drivers Association, this lack of participation is a sign to prioritize driver retention. Jay Grimes, OOIDA’s director of federal affairs, said, “This turnover makes it challenging to retain drivers and develop a well-trained workforce. The lack of participation in the Safe Driver Apprenticeship Program to this point is another signal that the industry must prioritize driver retention. This includes addressing inadequate pay, poor working conditions, minimal training requirements and truck parking, among other concerns.”

Market update: LMI March inventory data a tale of two halves

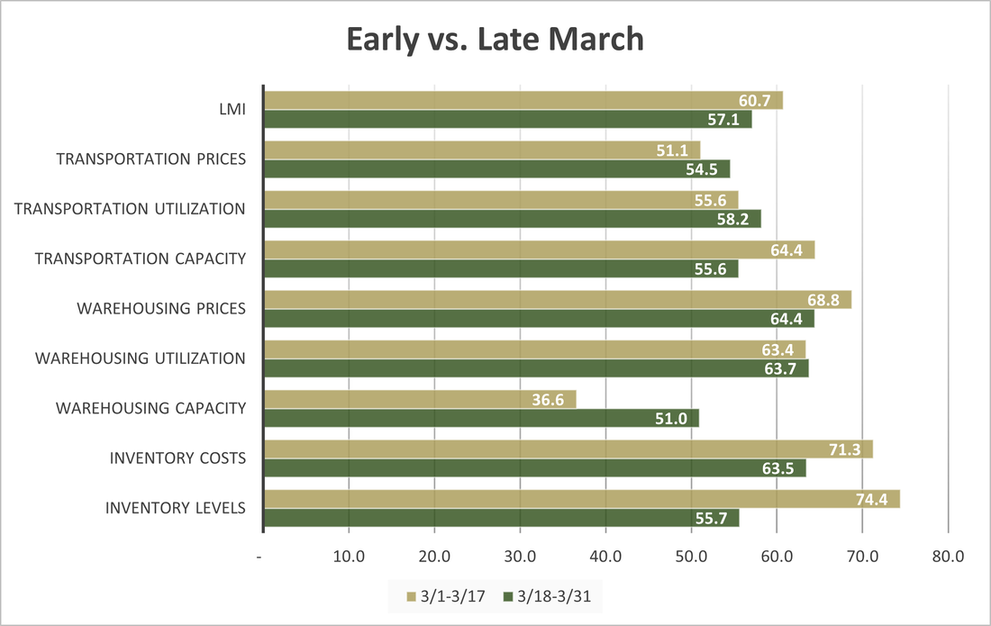

Recent data for March released by the Logistics Managers’ Index showed overall improvement from February’s reading of 56.5 to 58.3 in March. This is the fastest rate of expansion since September 2022 when the overall index was at 61.2. The LMI is a diffusion index with a reading above 50 indicating an expansion, while anything below 50 signals a contraction.

For inventory levels, it was a tale of two halves. FreightWaves senior analyst Tony Mulvey writes, “The biggest driver of the difference in the first and second halves was inventory levels. Levels in the first half of the month were rapidly expanding (74.4) compared to the back half of the month (55.7). Much of the early growth in inventory levels can be attributed to the Lunar New Year-linked timing of goods hitting warehouses, roughly six weeks following the start of the holiday. Additionally, the slower growth in the back half of March can be attributed to inventory moving around the Easter holiday weekend. Bank of America’s latest card spending data shows the impacts of the Easter holiday weekend. Total card spending for the week ending March 30 was up 4.7% year over year.”

The changes in inventory levels had a ripple effect in other categories. The report notes, “This growth has had cascading effects on tightening Warehousing Capacity (-8.2) which is back into contraction territory for the first time since January 2023. These changes suggest that firms are building up inventories in anticipation of continued consumer spending and suggests that the economy will continue to grow in the near-term.”

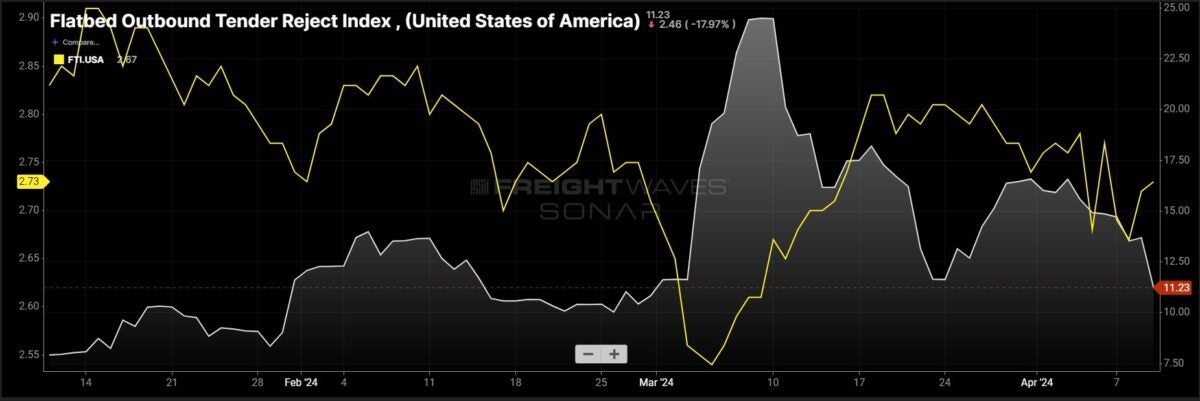

FreightWaves SONAR spotlight: Flatbed spot and outbound tender rejection rates fall

Summary: Q1 flatbed outbound tender rejection rates and spot market rates continue to fall. The Flatbed Outbound Tender Reject Index (FOTRI) fell 534 basis points week over week from 16.57% on April 3 to 11.23%. The loosening of flatbed capacity on the contract market also saw declines in flatbed spot market rates. The Flatbed Truckload Index (FTI) all-in spot market rate fell 3 cents per mile from $2.76 on April 3 to $2.73.

Flatbed wasn’t the only specialized equipment category to see declines. Reefer outbound tender rejection rates and spot market rates posted week-over-week declines as well. Reefer spot market rates fell 16 cents per mile all-in from $2.56 on April 3 to $2.40 per mile. Reefer contracted outbound tender rejection rates also declined, albeit at a lower rate, falling 94 bps w/w from 5.24% on April 3 to 4.3%.

The first week of Q2 continues to show softness in the truckload space as excess capacity remains abundant in both the dry van and reefer segments. Further loosening in the flatbed market is worth watching as construction activity and manufacturing indexes show increased activity in March. The most recent data from the Institute for Supply Management Manufacturing Purchasing Managers’ Index notes, “US ISM Manufacturing PMI is at a current level of 50.30, up from 47.80 last month and up from 46.30 one year ago. This is a change of 5.23% from last month and 8.64% from one year ago.”

The Routing Guide: Links from around the web

Platform Science secures $125M to grow OEM partnerships (FreightWaves)

Trucking industry stakeholders square off over CDL test flexibility (FreightWaves)

Kodiak establishes advisory council with Walmart, Werner, UPS (Trucking Dive)

Court upholds EPA’s ability to grant environmental waivers to California (FreightWaves)

Fuel costs show why transportation market is so challenging for providers (FreightWaves)

NACFE: Natural gas has promise, but not perfect alternative solution (Commercial Carrier Journal)