The Future of Freight Festival in Chattanooga, Tennessee, is the event of the fall. Subscribers to Check Call have a special discount code for F3 registration. This is going to be one of the best deals on F3 tickets. Use the code CheckCallF324 or go to this link, and the discount will be applied. There is no better party than a Chattanooga party. This is not one to miss.

Tis the season of quarterly earnings, and there was no Christmas in July this time around. Second-quarter earnings have been taking over headlines for the past week, and they aren’t exactly what everyone is hoping for.

Starting off with the behemoth Amazon. The e-commerce mega annual event Prime Day will be reflected in third-quarter earnings, which typically make up 1%-2% of the company’s global sales. This year it was expected to bring in $14 billion. Performance before the event was not received well by Wall Street. FreightWaves’ John Kingston writes, “In North America, net sales exclusive of [Amazon Web Services] rose to $90 billion from $82.5 billion. News reports said CFO Brian Olsavsky, in a conference call with reporters after the release of the earnings, said Amazon ‘did come in a little short on revenue growth in North America vs. our internal estimates.’” Some of that was due to consumers continuing the trend of trading down to cheaper alternatives so overall sales were down.

Moving to the less-than-truckload sector, customary superstar ArcBest came up with a miss. At ArcBest reported adjusted earnings per share of $1.98 for the second quarter. The result was 8 cents below the consensus estimate but 44 cents higher year over year. ABF Freight, LTL operations reported revenue of $713 million, a 2% year-over-year decline.

It seems to be course correction time for ArcBest: The company has ended the use of its dynamic pricing model. The goal was to reprice underutilized lanes at lower rates to keep the network full of freight. ABF has since been purging that lower-yielding transactional freight for shipments from higher-margin core accounts. The change has resulted in pronounced tonnage declines, which have mostly been offset by large yield increases.

Hub Group’s Q2 earnings are also on the decline as the freight market is cited again for the struggle. “We just feel that the market, both the macro and the free market, is very hard to predict,” Kevin Beth, Hub Group’s CFO, said during a call with analysts Thursday. Hub Group’s second-quarter revenue declined 5% year over year to $986 million, below the $1.09 billion consensus Wall Street estimate.

Despite the unfortunate outcomes of Q2, there is a light at the end of the tunnel as sentiment around transportation capacity grew ever so slightly in July, despite some underutilization still running throughout the market. The market correction looks to be the hot trend of Q3. Outbound tender lead times and outbound tender volumes in major markets like Houston, Atlanta and Ontario, California, will continue to be the leading indicator of changes to the market.

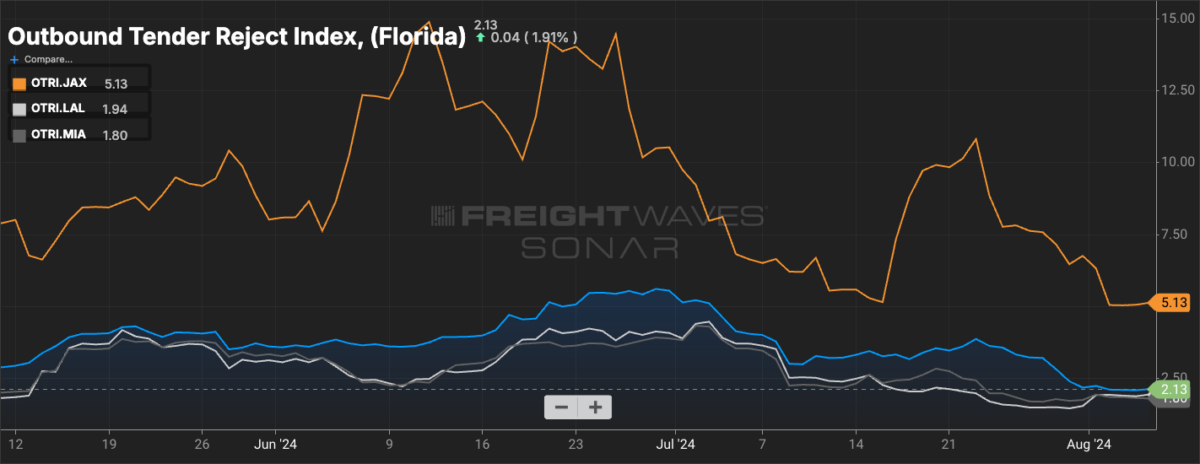

Market Check. All eyes are still on Florida as Hurricane Debby tears through the state. The hurricane hit the Big Bend coast of Florida on Monday as a Category 1 storm. As it traveled toward the East Coast, it was downgraded to a tropical storm. HIstoric rainfall is expected, dumping up to 18 inches of rain on parts of Florida and North Carolina. This could become the new normal for the Southeast over the next two and a half months as hurricane season is only ramping up, with the worst to come in October.

Outbound tender rejections have stayed relatively flat for central to South Florida, only dropping in the northern part of the state in Jacksonville. Category 1 hurricanes don’t typically have evacuation orders that result in a spike of the Outbound Tender Reject Index. However the flash flooding hitting the Southeast and the ports will continue to be problematic. It would not be a bad time to reemphasize to drivers that driving through floodwaters is not a viable option.

Who’s with whom?

This week we’re taking a slightly different route with this section of the newsletter. We’re moving to the video game side of logistics. Logistics and video games aren’t new: We have Euro Truck Simulator 2, American Truck Simulator, Factorio and more. The newest addition to the lineup is none other than Forklift Simulator.

It is set to release Aug. 29 on PC, Xbox Series X|S and PlayStation 5. The simulator does require players to go through the process to get a forklift license in the game and then work their way up to bigger jobs with more precise skills. In addition to the different modes of play, Forklift Simulator features three reproduced fork trucks and one electric pallet jack, each with real-life physics.

The gameplay is supposed to include tasks such as load inspection and assembling pallets. If only verifying that the trailer belonged to the correct carrier for the load were included. While the game might be for a niche audience, I for one can’t wait to see the countless TikToks and videos of brokerage offices playing it or the inevitable office staff versus warehouse.

The more you know

TA (previously TA Services) reveals updated brand

Borderlands Mexico: Surging cross-border flows a boon for operators like DHL

McLeod Software enhances broker and carrier relationships and communication with TMS update

FedEx and UPS must adapt to changing parcel landscape

Tow truck operators blame lack of insurance in price-gouging debate