Monthly freight data compiled by Cass Information Systems showed year-over-year declines in shipments and expenditures narrowed in July.

The shipments component of the Cass Freight Index was down just 1.1% y/y during the month, the smallest y/y decline in 17 months, and supports the view that the worst of this cycle has passed. The subindex bounced back from an unseasonally weak June report. July shipments captured by the dataset increased 3% from June (3.1% higher after seasonal adjustments).

The Wednesday report said pressure on the for-hire truckload market is easing as demand for goods slowly improves and private fleets rein in capacity additions.

Compared to two years ago, shipments were off 9.9%.

July shipments came in ahead of guidance calling for a 4% y/y decline. The report said August shipments are expected to decline 3% y/y with the full year coming in 4% lower, which is 1 percentage point better than the June forecast.

| July 2024 | y/y | 2-year | m/m | m/m (SA) |

| Shipments | -1.1% | -9.9% | 3.0% | 3.1% |

| Expenditures | -6.2% | -29.1% | 0.7% | 1.5% |

| TL Linehaul Index | -3.2% | -15.5% | -1.0% | NM |

The expenditures subindex, which captures the total amount spent on freight, fell 6.2% y/y, the smallest y/y drop in 18 months. The dataset was up 1.5% seasonally adjusted from June. However, the July reading was off 29.1% on a two-year-stacked comparison, which was just 2.5 points better than the worst-ever rate of decline logged by the 34-year-old dataset last month.

The expenditures subindex records fluctuations in fuel, mix and accessorial charges, which can present a “bit more volatile” reading. The subindex is expected to decline 11% y/y this year after dropping 16% y/y in the first half. July’s outlook is slightly better than June’s update, which called for an 11% to 12% decline for the full year.

With shipments down just 1.1% y/y and expenditures off 6.2%, inferred freight rates (actual rates) likely declined 5.2% y/y (off 1.6% seasonally adjusted from June ). Inferred rates are expected to be down 7% y/y for full-year 2024.

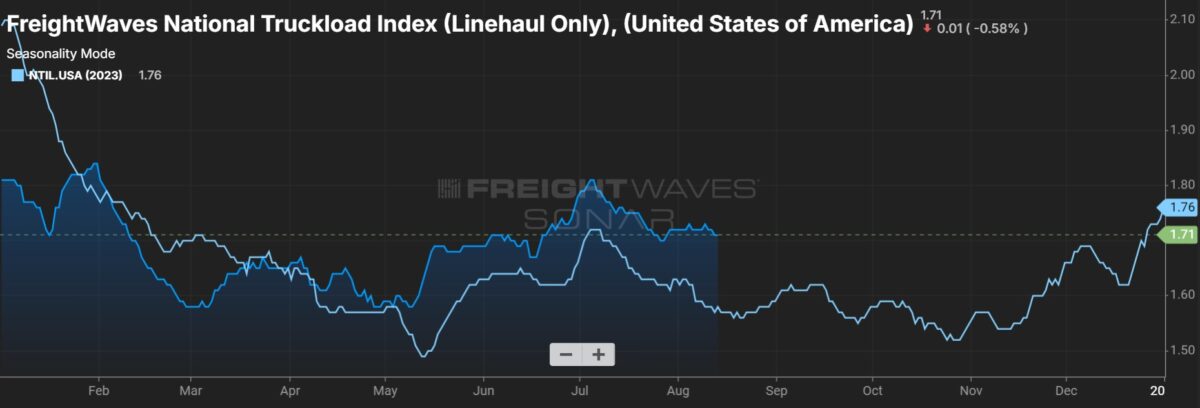

The Truckload Linehaul Index, which records core linehaul rates absent changes in fuel or accessorial surcharges, fell 3.2% y/y in July (down 1% from June) as a “soft market balance persists and overcapacity keeps bids highly competitive.”

The TL linehaul index includes both spot and contract freight.

This was the largest y/y decline in the index since April. The index has been off by a midteen percentage on a two-year comparison for five straight months. The report said private fleet additions and increased spot market activity are responsible for “dragging out the for-hire downturn for at least a year.” However, it noted the supply side appears to be “moderating.”

“With spot rates steady over the past year, downward pressure on the larger contract market is lessening, but recent slight increases in spot rates are not yet enough to turn contract rates higher,” the report said.

Data used in the indexes is derived from freight bills paid by Cass (NASDAQ: CASS), a provider of payment management solutions. Cass processes $38 billion in freight payables annually on behalf of customers.