Freight market “return to normalcy” a promising sign for trucking

The American Trucking Associations recently held its annual Management Conference & Exhibition which saw trucking industry leaders and analysts converge in Nashville. One of the centerpieces of the event was a session by ATA Chief Economist Bob Costello who told attendees the return to normalcy will be a promising sign for a trucking industry beset by the ongoing freight recession.

Regarding truckload demand, Connor Wolf at Transport Topics reported Costello believes the drivers of truck freight are going to get better despite the macro economy slowing back to normal. But for freight volumes, Costello highlights the importance of the manufacturing sector. “One of the things a lot of people have underestimated is just how important the factory sector is to freight. And it’s one of the reasons why freight has been pretty slow. Because manufacturing activity, really the lack thereof, has hurt volumes this year. I think it’s going to get a little bit better.”

Costello adds one reason behind the sluggish freight recovery has been private fleet growth taking share from the for-hire space, something that he said hasn’t happened in a long time. “I do think longer term, the more they grow those private fleets and all of a sudden, they’re going to have some of the issues that you for-hire companies have.”

Costello brought up the term stagflation to describe the current situation truckload carriers are facing. Deborah Lockridge with Truckinginfo writes, “The trucking industry has been hit with a recession and higher cost inflation at the same time. This “stagflation” will likely push more fleets under in the months ahead. Again, somewhat counterintuitively, he said, when the market starts to look up, some fleets that have been getting grace from their lenders on truck payments may lose that.”

Regarding the loans on equipment prolonging capacity, Jason Cannon at CCJ writes, “Loan extensions granted by equipment lenders have kept capacity in the market, but if the market improves, used truck evaluations improve and freight improves, more fleets will go out of business, he said, because lenders will want to accelerate payments and claw back that deferred money quickly.”

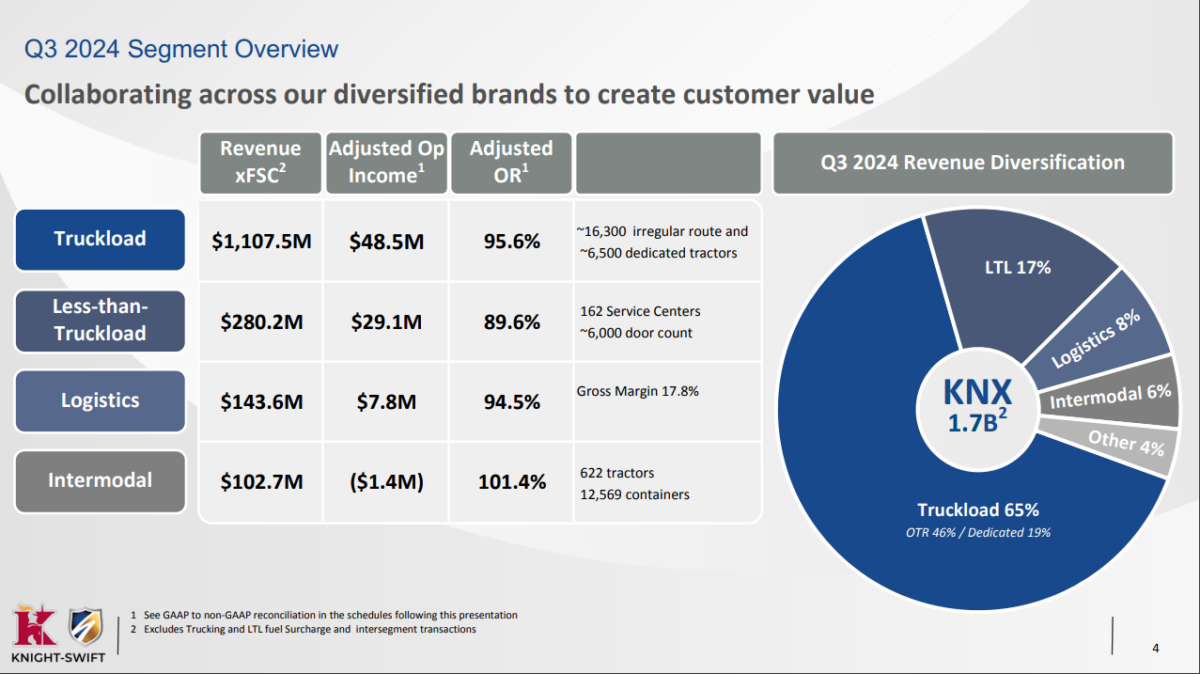

Knight-Swift Q3 earnings see normal seasonal demand trends

Knight-Swift recently announced its Q3 earnings which saw the return of seasonal demands to its truckload business while right-sizing its fleet though improving asset utilization. Brad Stewart, senior vice president of investor relations and treasurer at Knight-Swift, said on the earnings call that that the worst of the truckload cycle is now behind them based on sequential trends in their third quarter revenue. Stewart added, “Freight rates have largely stabilized and are showing modest improvement but remain at unsustainable levels.”

While revenue fell in the truckload segment, part of the reason was fewer tractors available as part of the rightsizing effort. FreightWaves Todd Maiden writes, Truckload revenue fell 6.1% y/y in the third quarter to $1.1 billion. The bulk of the decline stemmed from a 5.6% decline in average tractors in service. Utilization metrics like loaded miles per tractor (down 0.2% y/y) and revenue per tractor (down 0.6% y/y) were largely unchanged.”

Maiden notes that the truckload mileage metrics were impacted by Knight-Swift moving some U.S. Xpress equipment to cover higher priced regional lanes and lowering its exposure to the lower-priced long-haul lanes it was hauling.

Despite normalization, uncertainty remains. Maiden adds, “It tempered the update by saying what happens to demand after Thanksgiving is an unknown that will ultimately impact at least the beginning of next year’s bid season.”

Regarding the progress of integrating U.S. Xpress following its purchase in July 2023, Adam Miller, CEO of Knight-Swift said on the call, “…It’s certainly been more challenging than we originally anticipated.” Part of that pressure came from the dedicated business. Miller added, “They felt pressure there just like every other large carrier has went when over the road is really cheap dedicated sales pressure.”

Miller remains optimistic that the margin expansion they originally forecasted when purchasing U.S. Xpress will be recognized once the market improves. “I think when you have some wind at our back from a market stand much rapidly on the revenue side, I think that’s when you’ll start to see the margin expansion that we probably originally forecasted wind when we purchased U.S. Xpress.

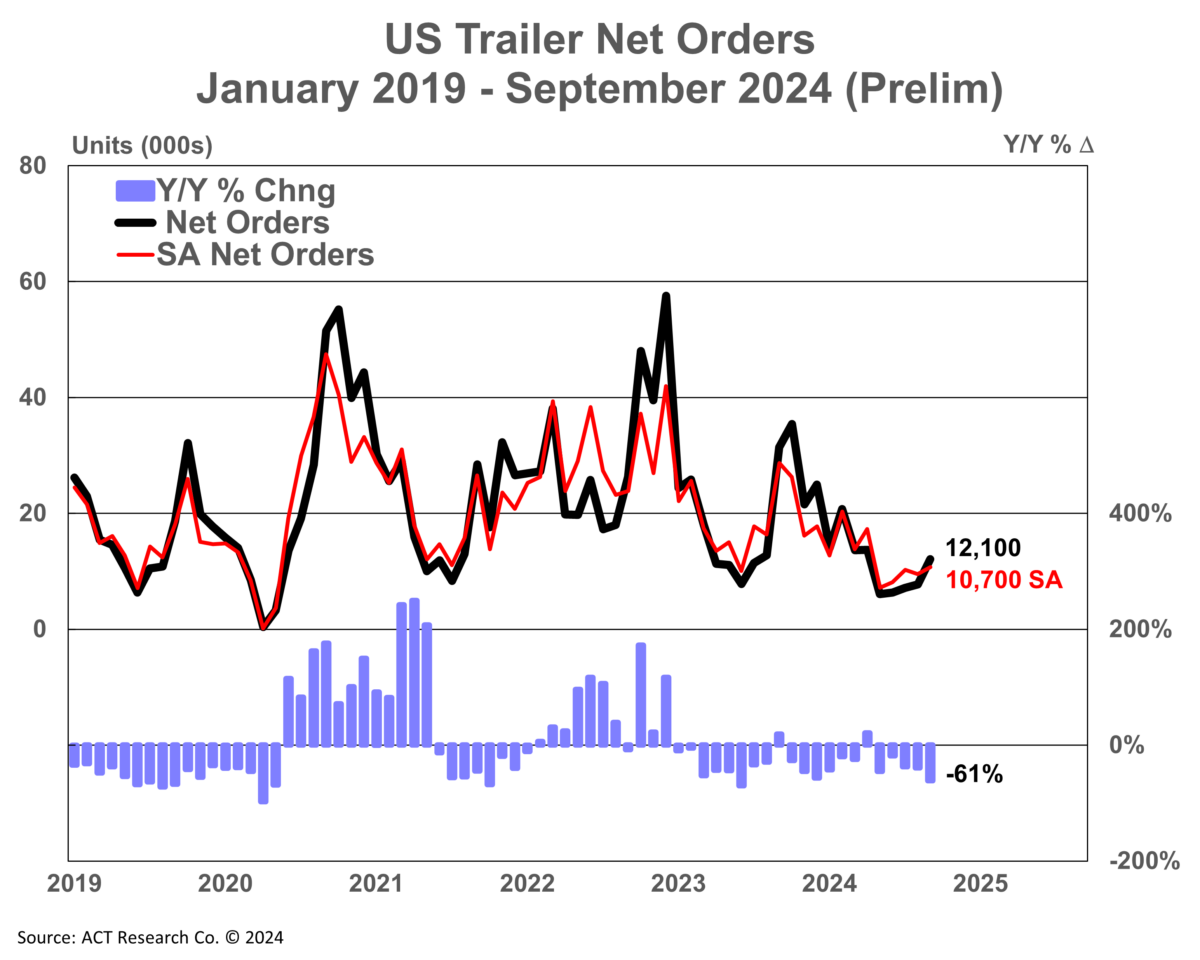

Market update: Preliminary Net Trailer Orders remain paused in September

Carriers continue to hit the pause button on new trailer orders in September according to recent data from ACT Research. Preliminary net trailer orders were up 4,400 units from August to bring September’s total to 12,100. While the monthly gain was impressive, compared to last September, trailer orders are down 61% y/y. Year-to-date U.S. trailer orders, adding September’s numbers, are at 101,600 units, down 34% compared to the same first nine months in 2023.

Jennifer McNealy, director of commercial vehicle market research and publications at ACT said in the report, “Since September is the traditional start to the order season, this month’s uptick was expected. It’s also no surprise that the data is significantly below the September 2023 intake, given the soft demand recorded throughout this year.”

McNealy cautioned that despite the order improvement from August to September, their data and expectations point to “weaker demand against the backdrop of elevated order velocity [over] the past few years.” Regarding carriers hitting the pause button, McNeally cited industry anecdotes that suggest the pause will remain through the remainder of 2024 with concern being expressed regarding 2025 orders.

McNealy concludes, “The timing and size of 2025 order bookings is the wildcard. Additional indicators supporting the lack of optimism include still-elevated cancellations and backlogs lower than we’ve seen in a decade. Despite positive momentum in the US economy, lingering weak carrier profitability suggests little support for trailer orders to bolster 2025 backlogs into the end of 2024.”

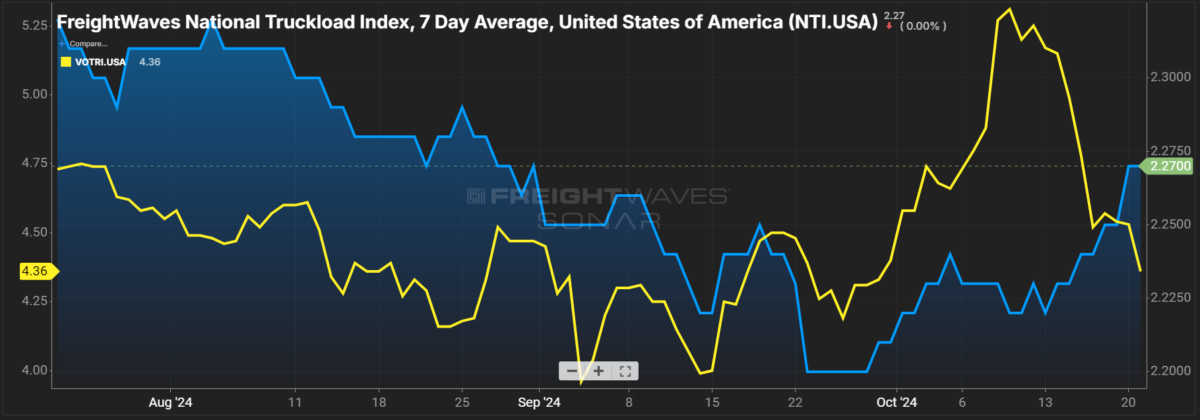

FreightWaves SONAR spotlight: Dry van spot bump, tender rejection slump

Summary: The past week saw a continuation of the reversal of fortunes in the dry van segment as outbound tender rejection rates sank while spot rates rose to their highest level since Aug. 31. The FreightWaves National Truckload Index 7-Day Average saw spot rates increase 4 cents per mile all-in from $2.23 on Oct. 14 to $2.24. The increase in the NTI sits against a backdrop of loosening conditions in the contract segment. Dry van outbound tender rejection rates fell 79 basis points w/w from 5.15% on Oct. 14 to 4.36%.

Looking at other modes, the reefer and flatbed segments continue to experience high outbound tender rejection rates. Reefer outbound tender rejection rates remain elevated but fell 157 bps w/w from 14.18% on Oct. 14 to 12.61%. Reefer spot rates saw the opposite, with RTI up 4 cents per mile all-in w/w from $2.49 to $2.53.

The flatbed segment also experienced a rapid rise in outbound tender rejection rates despite a slight decline in spot rates in the past week. FOTRI rose 460 bps w/w from 9.31% on Oct. 14 to 13.91%. So far, that contract pricing power success has not matriculated into spot market opportunities, with FTI falling 4 cents per mile all-in w/w from $2.64 to $2.60.

For a dry van segment seeking reasons for optimism, its next test will be if spot rates or outbound tender rejection rates rise ahead of Thanksgiving. For carriers struggling with rates paired with higher costs, a welcome development has been the ongoing declines in the Department of Energy weekly average retail price, which was reported at $3.55 per gallon. That is 99 cents lower than the $4.545 reported on Oct. 23, 2023, the closest DOE release point to reference.

The Routing Guide: Links from around the web

Tesla plans to ramp up electric Semi truck production in 2026 (FreightWaves)

OOIDA calls out Carrier411 enabling brokers ‘blackballing motor carriers on hearsay’ (OverDrive)

Marten’s earnings and almost all other key operating metrics down (FreightWaves)

Benchmark diesel price reverses course in biggest 1-week drop in 10 months (FreightWaves)

Truck parking expansion included in DOT’s latest round of infrastructure funding (Land Line)

Covenant Logistics Group Q3 earnings: First look (FreightWaves)