Less-than-truckload carrier Old Dominion Freight Line announced Monday a 4.9% general rate increase across multiple tariff codes effective Dec. 2. The GRI announcement follows similar price actions from other carriers in recent weeks, tamping down concerns that the industry is losing its ability to pass through rate increases two years into an industrial recession.

Carriers typically implement GRIs to general tariff codes annually. The stated percentage increase is an expected average of changes to base rates across various lanes and weight classes. The GRIs are taken to offset general cost increases across carrier networks and to fund capex projects.

“The general rate increase is based on the Company’s economic forecast and expectations for the operating environment,” said Old Dominion’s head of pricing services, Todd Polen, in a news release. “We must continue enhancing our high-quality service network and systems to meet and exceed our customers’ expectations and deliver on our promises.”

The timing and percentage of Old Dominion’s (NASDAQ: ODFL) 2024 GRI is in line with its 2023 rate increase.

ABF Freight, a subsidiary of ArcBest (NASDAQ: ARCB), implemented a 5.9% GRI on Sept. 9. The increase was the same percentage as last year but came approximately three weeks earlier. Importantly, the carrier said on its third-quarter call that it has seen “really good retention” across customers impacted by the hike.

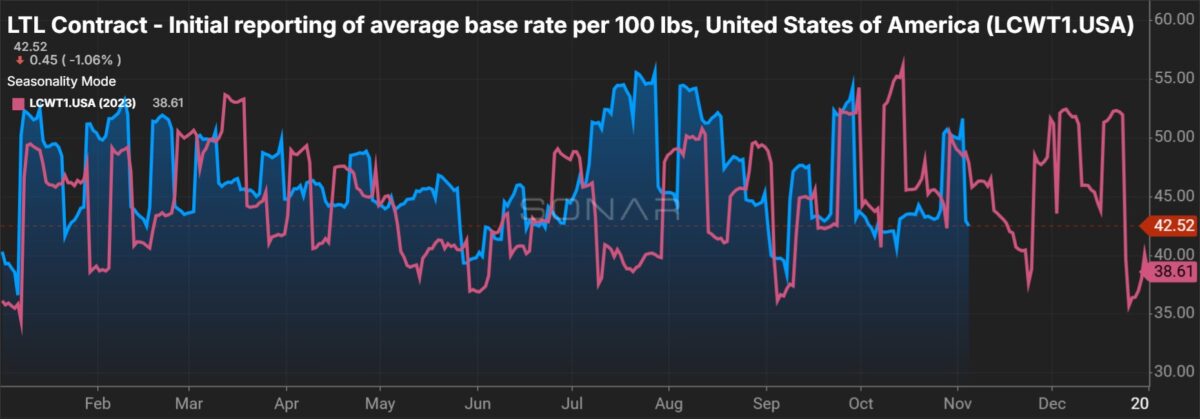

There have been occasions in prior downturns when carriers didn’t take an annual GRI or the rate increases implemented didn’t stick with customers. There has been growing concern among some analysts that the industry is losing pricing power two and a half years into a general freight recession and as bankrupt Yellow Corp.’s (OTC: YELLQ) terminals have been relaunched under new ownership.

Yield increases have slowed on a year-over-year comparison, but the industry is comping notable increases in prior periods. Contractual rate increases at the public carriers were up by mid- to high-single digits again during the third quarter.

Saia’s (NASDAQ: SAIA) 7.9% Oct. 21 GRI was 40 basis points higher and one and a half months earlier this year. FedEx Freight (NYSE: FDX) will implement a 5.9% increase on the first Monday of the year – its normal timing.

Old Dominion’s GRI will also include “a nominal increase” to minimum charges on intrastate, interstate and cross-border lanes.