Freight shipments and spend were again under water in October, according to data from Cass Information Systems.

The shipments component of the Cass Freight Index fell 2.4% year over year during the month and was off 1.9% from September (down just 0.1% seasonally adjusted). October marked the second straight sequential decline for the dataset.

“Although goods demand growth is driving broad freight volume growth, as can be seen in intermodal, imports, and freight GDP, it is still not reaching the for-hire market,” a Monday report said.

The report also said growth at private fleets continues to weigh on for-hire truckload demand.

The shipments index is forecast to decline approximately 3% y/y in November and is expected to be down 4% y/y for full-year 2024, assuming “normal seasonality.”

| October 2024 | y/y | 2-year | m/m | m/m (SA) |

| Shipments | -2.4% | -11.7% | -1.9% | -0.1% |

| Expenditures | -5.9% | -27.8% | -1.5% | -1.7% |

| TL Linehaul Index | -2.2% | -10.3% | 0.7% | NM |

The freight expenditures index, which captures total freight spend, fell 5.9% y/y in October and was down 1.5% sequentially (down 1.7% seasonally adjusted). That was the smallest y/y decline for the cost index since January 2023. The index was pressured by lower fuel costs, which were off 20% y/y.

The expenditures index was down 16% y/y in the first half of the year and is expected to decline 11% to 12% for the full year.

When netting the decline in shipments from the decline in expenditures, actual rates, or “inferred freight rates,” were likely 3.6% lower y/y during the month. Again, lower fuel prices accounted for the bulk of the decline, with the report noting that “rates have started to inch higher more broadly.”

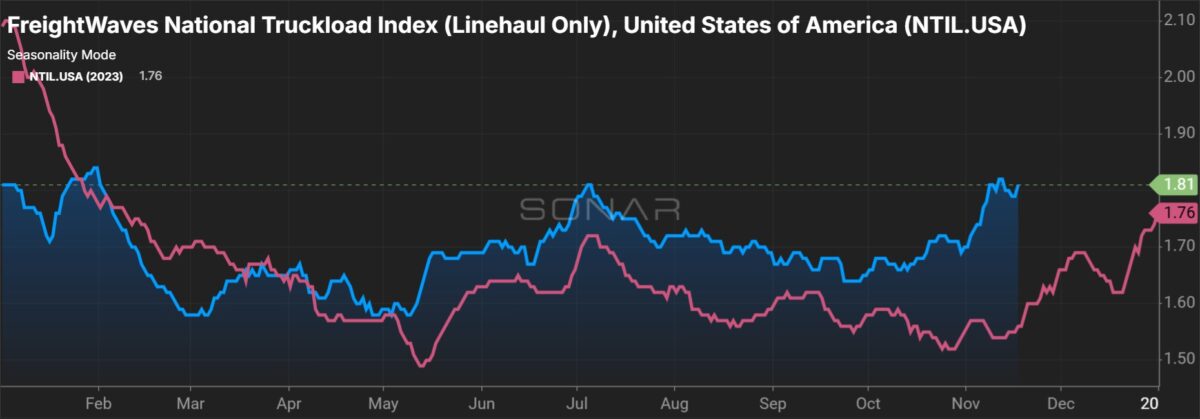

The Truckload Linehaul Index, which excludes fuel and accessorial surcharges, increased 0.7% from September but was 2.2% lower y/y. The index has hovered in a tight range over the past five months, with August being the “cycle-low.”

The dataset includes changes to both spot and contract freight.

“Spot rates have started to increase, and even conversations about contract rates are starting to turn positive with bid activity picking up seasonally,” the report said. Similar remarks were shared by Knight-Swift Transportation (NYSE: KNX) when it reported third-quarter results last month.

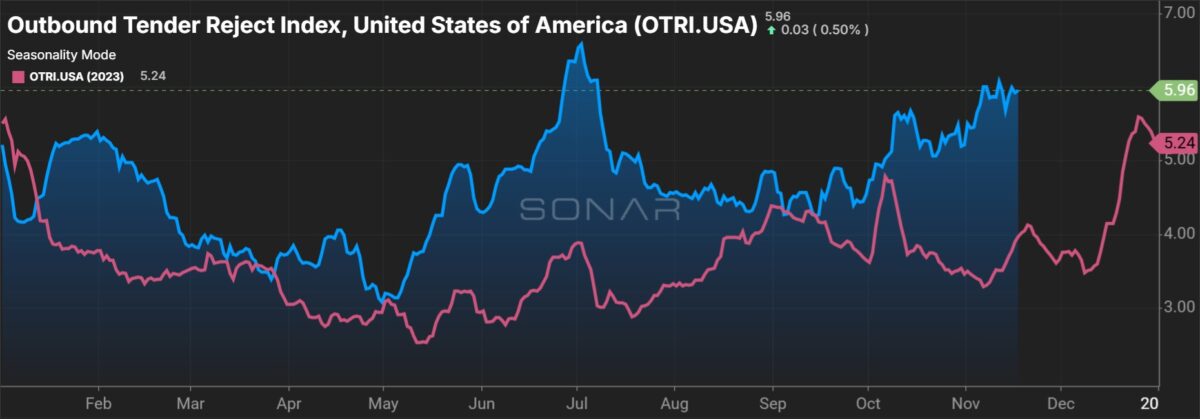

The report said the truckload market is “pretty balanced,” highlighting that private fleet growth has slowed. It also pointed to a 5.9% y/y reduction in fleet size among public carriers during the recent quarter.

“Even private fleets may be realizing how much cost they’re leaving on the table,” the report said, pointing to at least a $1-per-mile cost differential in for-hire contract rates versus private fleet costs. It said that’s more than double the average.

“After a long downturn in freight rates, the difference between the 5.9% contraction in capacity and the 2.8% drop in shipments may help explain why TL rates have started to rise, if only by a little,” the report concluded.

Data used in the indexes is derived from freight bills paid by Cass (NASDAQ: CASS), a provider of payment management solutions. Cass processes $38 billion in freight payables annually on behalf of customers.