All thawed out

Drones are everywhere. While some of the most exciting topics for the use of drones are Walmart deliveries in residential areas and 15-minute-or-less food delivery, the most accessible and approachable way to get drones involved in the supply chain is by adopting them in warehouse inventory management.

Gather AI has developed a drone solution that now encompasses the cold chain. The company says it has the first inventory management automation setup using drones for inventory monitoring automation. The cool part about this is that the operators of the drone don’t have to be on lifts or right next to the drone. They can be on the ground or even in a toastier part of a warehouse if they don’t enjoy the prospect of standing in a cold warehouse for 12-plus hours at a time.

Langham Logistics CEO Cathy Langham said in a news release: “We use business intelligence solutions like Gather AI to give our life sciences customers total inventory visibility, control, and compliance. After engaging Gather AI in 2022, we went from a 97% accuracy rate to over 99% accuracy. With the expansion into cold storage and freezer locations, we expect the same accuracy gains and up to 10X faster cycle counts.”

Temperature checks

The rise of direct-to-consumer and e-commerce shipping isn’t showing any sign of slowing down as the market continues to grow. Grip, a logistics tech and fulfillment leader for e-commerce companies that ship perishable goods, has announced the opening of its fifth fulfillment center in Michigan. This expansion positions Grip to service 70% of the U.S. population within 24 hours.

Juan Meisel, CEO and co-founder of Grip, said in a news release, “Expanding to Michigan is a significant milestone for Grip as we continue to support DTC brands with unmatched speed, cost savings, reliability and technology. Our goal is to empower brands to scale with confidence, knowing their operations and logistics are optimized at every step.”

The perishable goods transportation market size is forecast to increase by $9.23 billion, at a compound annual growth rate of 8.8% between 2023 and 2028. Perishable e-commerce has a larger emphasis on reliability and efficiency than traditional e-commerce models as temperature-sensitive goods can’t be easily replaced if something happens, and the risk of damaged or unusable goods is higher.

Food and drug

Southern hospitality at its finest invites you to come in and have a bite. Nestle USA is taking that sentiment literally, announcing plans to invest $150 million to increase production at its food processing plant in Gaffney, South Carolina. Food processing doesn’t always involve the cold chain, especially when talking about one of the largest consumer packaged goods shippers in the U.S.

This investment is primarily targeted to increase production of single-serve frozen meals in the form of a new production line. The company is also looking to enhance some automation and technology. Reaping the rewards of this enhanced facility are fan favorites of the frozen food aisle with Stouffer’s, Lean Cuisine, Vital Pursuit, Sweet Earth bowls, and Hot Pockets sandwiches, as well as DiGiorno, Jack’s and Tombstone pizza.

Nicole Caldwell, manager of the Gaffney factory, said in a news release, “This investment further solidifies our dedication to the Gaffney community, where Nestlé has been an integral part for nearly 45 years. It also reflects our continued commitment to enhance our US manufacturing footprint and in-house capabilities.”

Cold chain lanes

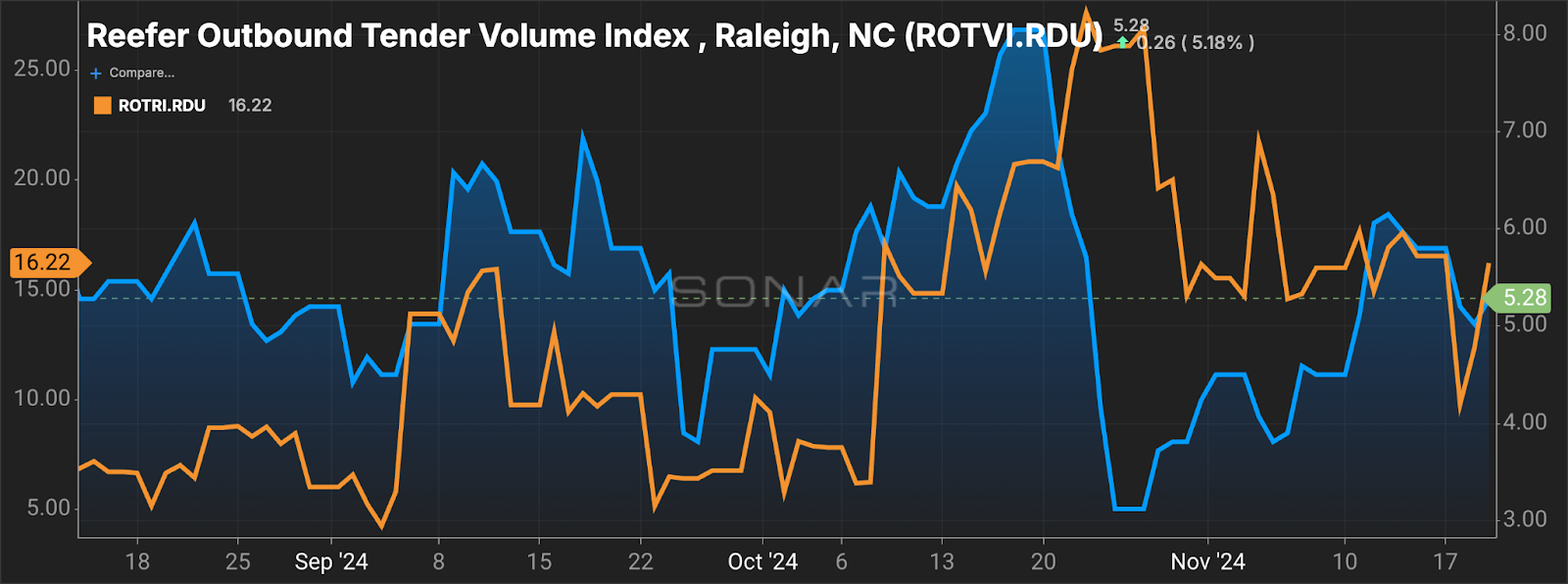

This week’s market under a microscope is Raleigh, North Carolina. Raleigh’s reefer market is facing a mild capacity crunch as outbound reefer rejections are on the rise. Reefer rejections are technically down week over week but made a strong recovery compared to the sharp drop earlier this week. As one of the largest food holidays of the year approaches, rejection rates aren’t likely to change trajectory anytime soon.

Carriers will prioritize higher-paying lanes and shippers face tighter capacity, especially in regions with strong seasonal demand. Rejection rates are expected to creep up as late-year demand strengthens. Shippers should secure capacity to mitigate risks.

Is SONAR for you? Check it out with a demo!

Shelf life

McCain, Lamb Weston among frozen-food firms facing price-fixing lawsuits

Performance Health Selects ketteQ’s AI-powered solutions to optimize life sciences supply chain

Grocery chains vie for seats at Thanksgiving tables with deals

ALDI US is up to 745 transcritical CO 2 stores

Wanna chat in the cooler? Shoot me an email with comments, questions or story ideas at moconnell@freightwaves.com.

See you on the internet.

Mary

If this newsletter was forwarded to you, you must be pretty chill. Join the coolest community in freight and subscribe for more at freightwaves.com/subscribe.