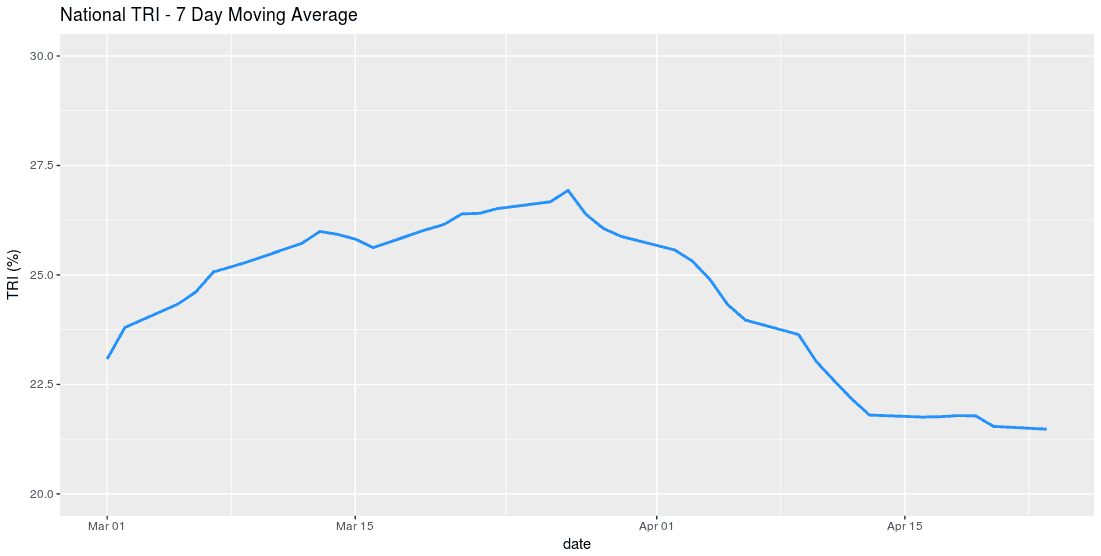

DAT is reporting a softening spot market for the second week in a row in terms of dry van rates. The FreightWaves tender rejection index (TRI) is showing this should continue for the next couple of weeks as no real sustainable increase in the rate of load rejection is occurring on a national level. To put a more positive spin on it, load tenders are being accepted with more frequency over the past month.

As freight contracts continue to be executed almost 4 weeks into the second quarter, shippers are not seeing as many of their loads rejected for better paying alternatives on the spot market. Carriers are giving the shippers a “breather” for the time being as spot rates deteriorate. DAT reports a $0.05 per mile decrease on the average spot rate for dry van compared to last week. The national outbound TRI (OTRI) has been declining for the past several weeks with the sharpest of drops ending around the 13th of April.

You can see the trend is still downward but at a lower rate. The longer the market remains stable with carriers remaining in their contracts the spot market should continue to soften. Many shippers had seen delayed implementation of new contract rates giving them time to prepare for the increases. You can see shippers pushed freight volumes at the end of the 1st quarter trying to move as much as they could prior to the end of quarter as well as attempting to take advantage of lower transportation costs.

Digging into a few major markets you can see similar trend lines, but they are not entirely correlated. A few of these markets are showing signs of increased activity or lowered capacity.

The outbound Los Angeles market is showing signs of life as the agriculture season has started, but it is still relatively low as compared to end of quarter numbers and to other markets. From the end of March to April 15th the percentage of loads rejected dropped from 13% to 8.5% or a 70% reduction in rejection rates.

In the south you can see the Atlanta market has experienced the steadiest swings of the three. The TRI caught fire in early March and rode a wave of increased activity into early April before retreating. The weather could be playing a role here as well with an unusually cold early spring having a moderating effect on retail centers as consumers remain indoors.

The outbound Chicago market has seen some of the more violent swings in terms of basis point delta. The OTRI for the Chicago market hit highs in early March with a 32% rejection rate and has dipped to a low of approximately 18% after Tax Day, almost a 44% reduction in rate of rejection. You can see there is a sharp uptick immediately following the period low. There are reports of many Midwestern shippers attempting to get ahead of the inevitable thaw as the winter has lasted into early spring in the Midwest and Northeast. The bump is probably not enough to show in the spot market, but it is a signal worth watching.

None of these markets are exhibiting enough movement over long enough periods of time to have spot market implications, at least for now. The individual markets are all quite varied but remain relatively calm leading us to expect continued stability in the freight markets over the next few weeks. Chicago and Los Angeles are showing a pulse, but nothing significant yet. Stay tuned to FreightWaves for any further developments in the TRI.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.