Editor’s note: This story was updated to reflect that the company’s CEO says he is working to bring drivers home.

HVH transportation, a 344-unit trucking company, has abruptly shut down. It’s the latest in a string of trucking failures stemming from an economic environment that has put pressure on operating ratios.

The Denver, Colorado truckload carrier operated in all contiguous states west of the Appalachian mountains, with the exception of the deep South. According to Pitchbook, the trucking company had been operating since 1956 and was acquired by HCI Equity Partners, a private equity firm, in October 2012.

Initial reports in the wake of the abrupt shutdown indicated that the company left drivers stranded over the road, in a situation that was eerily similar to the sudden closure of Falcon Transport, another private equity backed trucking company that abruptly closed earlier this year.

Subsequent to the publication of this story, the company’s CEO, John Kenneally, said he is actively working to avoid stranding drivers and get them back home.

HVH, which has also gone by the name of Thacker Brothers Transportation, had 344 power units and employed 324 drivers. The company’s website and social media accounts were still operating as of Wednesday morning.

HCI Equity Partners has $957 million dollars in assets under management and has made investments in trucking and logistics buy-outs in the past, including investments in Road Runner (NYSE: RRTS) Naumann Hobbs Material Handling, GO2 Logistics, Milan Supply Chain, Southern Ag Carriers.

HCI exited its investment in Road Runner earlier this year, when the hybrid truckload/LTL carrier recapitalized the company with an investment from Elliott Management.

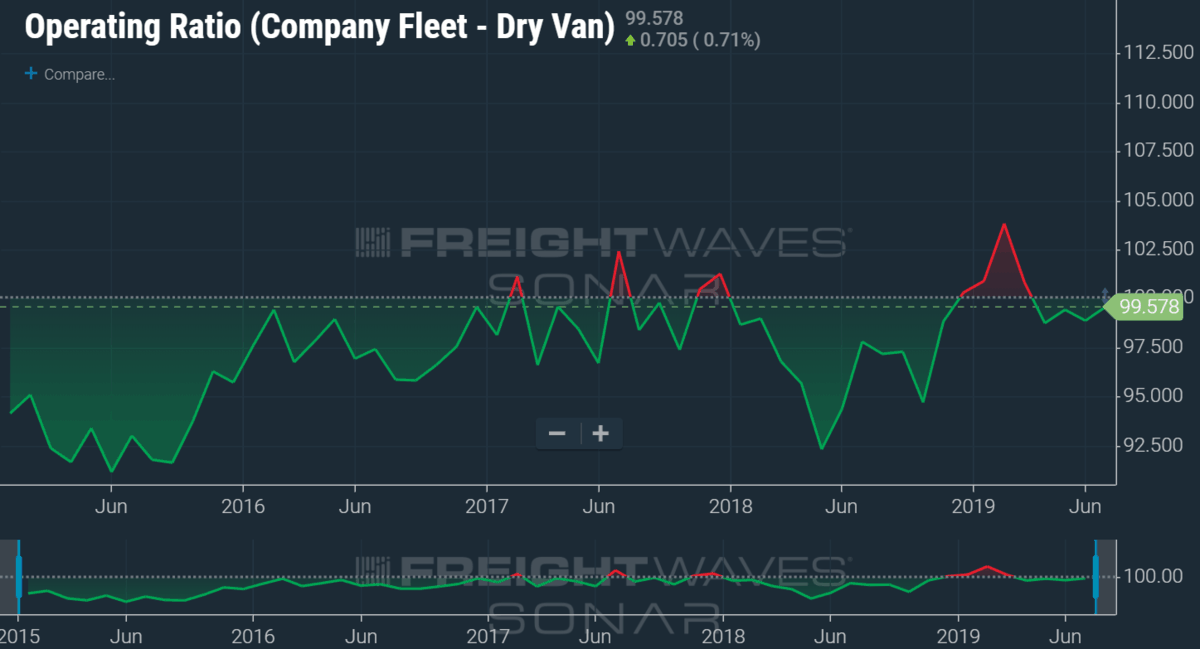

2019 has been the worst year of profitability in the trucking industry in over five years. Even the downturn of 2016 was not nearly as painful in terms of operating losses.

According to operating ratios across the industry, the average dry-van truckload carrier has teetered on losing money every month in 2019.

SONAR users can interact with this dashboard by clicking here.

Operating Ratios (OR) measure operating costs in relation to revenues. A high operating ratio is considered a bad thing (a 100 is an operating break-even, anything above one-hundred is a loss and anything below represents operating profit). OR will come before any debt servicing, distribution, or taxes.

This data is compiled based on financial reports from over 220 truckload fleet profiles, representing over 70,000 trucks, ranging from mid-sized (75 trucks to enterprise 7000 trucks). The operating KPI data is aggregated in partnership with the Truckload Carrier Association’s Truckload Indexes and available exclusively on SONAR.

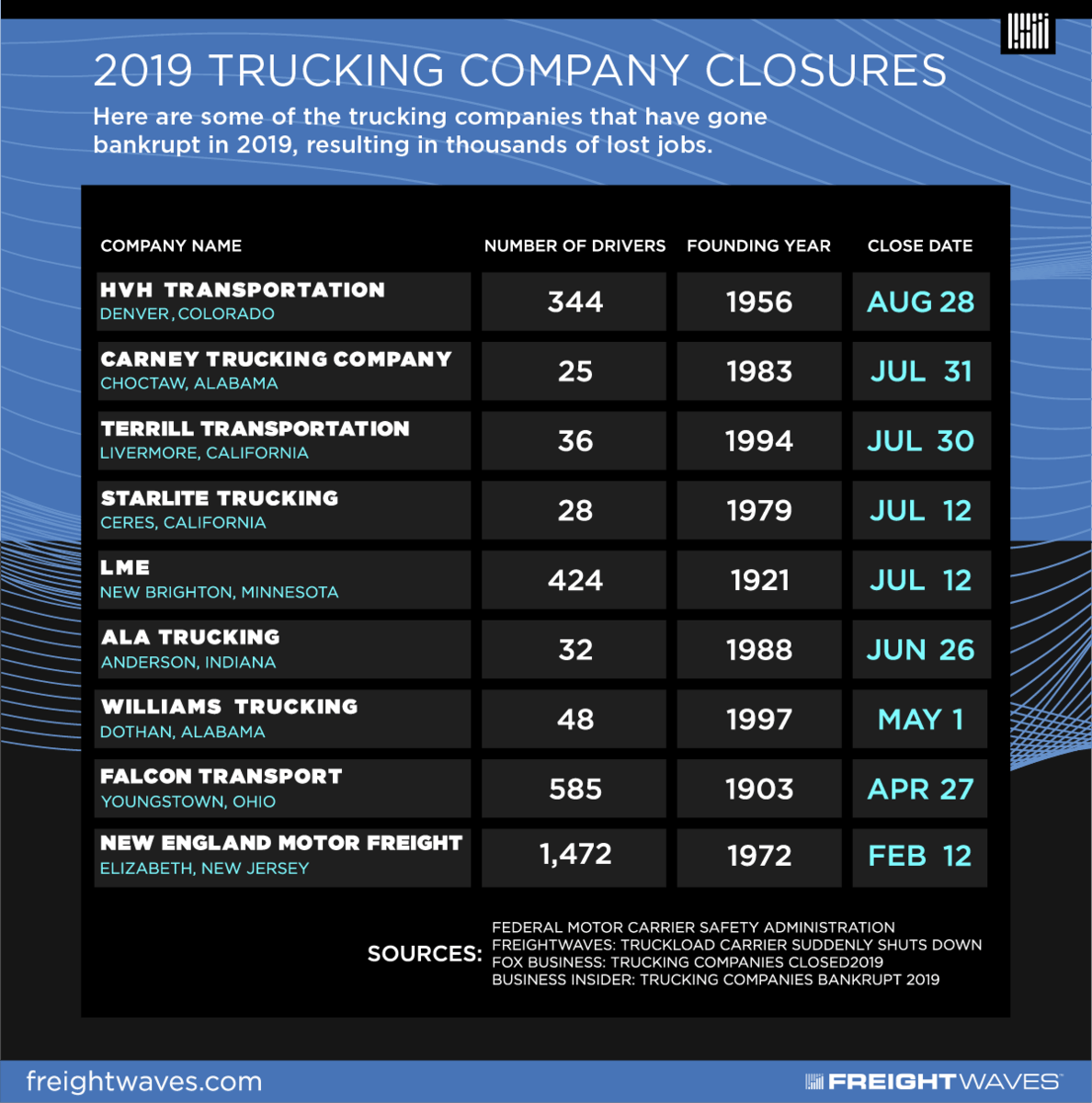

Eight mid-size and large carriers have shut their doors in 2019 including NEMF, Falcon, and LME.

Dima Malai

Market regulating itself. Brokers lost money last year and carriers who didn’t have enough insight to make good money and save are being thrown out of the game. Also, some of these companies re-emerge under different flags with new MCs ran by the same people who filed bankruptcies and failed to pay their fuel cards and employees. It’s a lot more to these stories that is not being told.

John Powelson

Jeez what horrible reporting!

Alex

You are 100 % correct

Thomas Hollins

Cheap freight n to much overhead equals failure. Not including INFLATION

Brian

To the HVH drivers. Please contact us. We have local positions open for COMPANY drivers, sorry O/O, we are at capacity for the moment. http://www.valleyequipmentleasing.com or https://safetyasaservice.com/garysjobboard/7194/search/carrier_search/2419/carrier_jobs . We have an immediate need for qualified drivers.

Unclefungus

I started driving in 1989. And owned my first truck

In 1995. I remember looking at the dat board in the truckstop

and the rates were the same then as they are now.

Fuel was 99 cents a gallon. Now I’m booking loads from my truck. The rates are the same but fuel is 2.89 (Texas)

To 4.69 ( California) The rate per hour at a dealership has gone from $65 an hour to $135. I heard recently that Kenworth jumped to $175. But I haven’t verified that because I can’t afford to go to the dealer anymore. My pay has gone from 16.5 cpm (Harold Ives 1989) to .50 cpm .

But my coffee has gone from .50 refill to 1.85 Pilot this morning. So needless to say the cost of operating a truck and the money you making make is caddy wompass.

Let’s throw in the huge influx of foreign workers here on the

Government dime and they are the

ones keeping the rates low. Because they will haul that $1 a mile freight. Let’s thrown in that wonderful invention the ELD.

And now you can’t work your drivers like red headed Step children anymore.

I say get rid of the ELD, pay drivers by the hour. 23.50 minimum. A congressman will have to sponsor a bill that charges the shippers and receivers that 23.50 an hour from the moment they hit the dock. Quit bringing in foreign workers on the Government dime. Regulate the truck driving schools. Setting strong standards for time behind the wheel as well as proper instruction on the operation of a semi and not just passing a test. And watch the market as well as the shippers and receivers react. I don’t know of any other job that sets 70/80 hours of work per week as a norm. You start paying drivers good the competent drivers will return, insurance rates can relax, accidents will go down, turnover will go down. And rates will reflect what it actually costs to get that load to market. So milk goes up. Everything thing else has. Let the consumer pay the actual cost of doing business in the trucking industry.

Jeffrie Harper

You hit the nail on the head.

Bigdee

All this is tied in to mandatory elds I don’t know why people can’t see that

Regular Trucker

With HVH, I think you’re right to point out that ELDs hurt them. HVH hauled dry van freight with a lot of that freight picking up in CO, which is typically one of the worst markets for outbound dry van freight. Prior to ELDs, I think there was “flexibility” that would allow HVH contractors to run a lot of miles – 3,200-plus per week so drivers made more and HVH made more while having its trailer cost / mile driven down.

David Roush

This is certainly a recurring theme. Carriers that increased driver pay, purchased new additional equipment, jammed their shippers with greedy rates and/or played the spot market as a response to shipper demand during the great rate party of 2018 are at risk now. Instead of spending their easy money those carriers should have invested in their foundation and balance sheets.

Not sure if this is the case with HVH, but my guess it is at least a contributing factor.

Bob halley

I’m surprised it didn’t happen sooner. Ever since they lost caterpillar it has been in a slide

mousekiller

A lot of different carriers HAD Caterpillar at one time or another. I worked for two of them. Carriers hauling for John Deer are facing the same situation.

Gary

Caterpillar wants Full Indemnity and your first born. lol