There was a surprising sense of positivity about the air cargo industry’s prospects in 2020 as stakeholders converged on Hungary this week.

Budapest was the meeting place for The International Air Cargo Association’s (TIACA) 2019 Executive Summit, the first since Steven Polmans, director of cargo and logistics at Brussels Airport Company, took over as chairman from his predecessor Sebastiaan Scholte earlier this year.

As previously reported in FreightWaves, uncertainty has been a major drag on the air freight industry during a mostly disappointing 2019. Yet in Budapest there was a surprising sense of optimism in the air.

Optimism flows on the Danube

TIACA committees pledged the organization would be revitalized by a renewed focus on consultancy, workshops and training in support of members. And one survey saw 67% of delegates predict a ‘moderate acceleration’ in global trade in 2020.

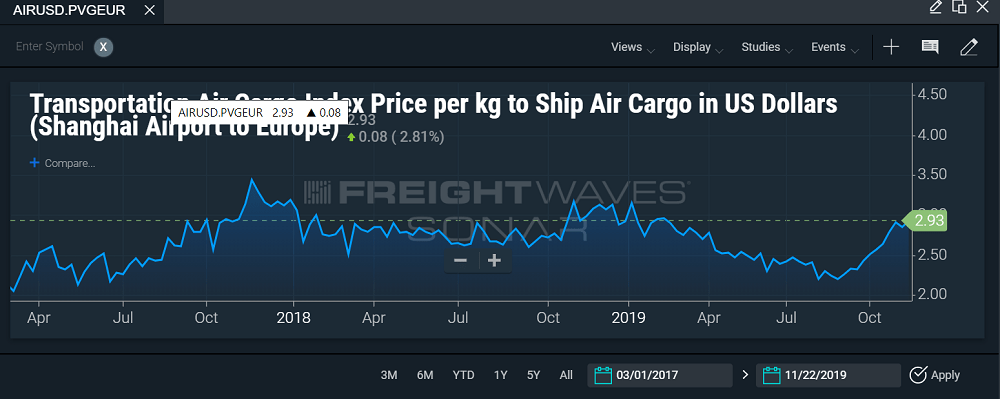

As reported in FreightWaves, analysis of air freight rates in 2019 illustrates that this year’s fourth quarter peak season is so far looking shorter and less robust than those of 2017 and 2018 (see SONAR chart below).

However, George Anjaparidze, CEO and Founder of Switzerland-based consultancy Veritas Global, was surprisingly upbeat both for this year’s peak season and for the market in 2020 when he expects a short-term rebound for air cargo.

Setting the scene, he said that cargo volumes so far in 2019 were currently down around 4% globally compared to a year ago, with lower export orders and increased policy uncertainty acting as dual headwinds on demand.

IMF policy boon for air freight

Yet he believes the decision by the International Monetary Fund (IMF) to severely cut its economic growth forecasts earlier this year will eventually give trade a boost because the IMF’s warnings prompted central banks to loosen monetary policies.

“Some of the central banks went as far as saying they don’t envision tightening monetary policy for the next few years,” he said. “So what that means is that there will be cheap money sloshing around, or at least that’s how the markets took that signal.”

He continued, “So I expect that this will reflect quite positively in the short term for air cargo.

“We will still probably end the year with negative growth, but I expect the fourth quarter of this year to be stronger than last.”

Dual threat: Trades wars and Brexit

Anjaparidze noted that policy uncertainty over issues such as the U.S.-China trade war and the U.K.’s exit from the European Union – now expected at the end of January – had stabilized recently while export orders had picked up. “So, it’s good news,” he added.

Glyn Hughes, Global Head of Cargo at the International Air Transport Association (IATA), said the air cargo industry would need to rely on its agility to capture opportunities that arise in a turbulent global economy.

He said these were “unprecedented times” with policy uncertainties such as the trade war and Brexit “soap opera” set against the positives of record low levels of unemployment and rampant equity markets.

“You’ve got some very mixed scenarios,” he added. “You have consumers who are flooding through e-commerce platforms, which is one of those opportunities that is tremendous. Specialised cargoes is another opportunity which is tremendous going forward.

Equilibrium needed, says IATA

“But something needs to rebalance this policy uncertainty [to bring] trade equilibrium.”

Hughes said that over the last 25 years, air cargo fortunes has been linked to gross domestic product growth, with volumes generally growing at a multiple of 2 to global gross domestic product growth, although growth currently, and possibly in the future, was closer to a multiple of 1.2.

“Going forward when you look at gross domestic product growth for the next 10, 15, 20 years it’s very positive and I think that’s where we are more upbeat in the longer term and over the course of the next 50 years,” said Hughes.

“The downturn in this year will equate to a minor blip on the long-term chart.”

Upside drivers in 2020

In terms of upside possibilities for air freight next year, Anjaparidze believes that if trade tensions lessen and there are no geopolitical shocks, an “improved policy environment” will prompt companies and governments to “start spending the piles of cash that they are sitting on which will make the economy grow.”

He added, “So optimistically if all these things would have come together, we will see freight ton kilometers (FTK) growth rates of nearly double digits in 2020.

“But that is the optimistic strong growth scenario.”

A second scenario in which economic growth picked up moderately would, he said, translate into a commensurate increase in trade. This would result in FTK growth rates “of somewhere between 3 and 5%” for air cargo.

“Crucially, under this scenario trade tensions do not get worse,” he added. “They don’t necessarily get better, but there are no major increases in the trade tension environment and there are no new disruptions on the geopolitical side.”

Worst case scenario – the Trump effect

However, he warned that an “orderly” Brexit was not a certainty and noted that while easing trade tensions between China and the U.S. offered room for optimism, U.S. elections could complicate matters next year.

“Trump will want to show that his policy of being hard on China has rebalanced the trading relationship while at the same time not causing harm to the U.S. economy,” said Anjaparidze.

Outlining the worst-case scenario for air cargo in 2020, Anjaparidze said this could see some global economic growth but this would not translate into trade growth. In this scenario air cargo demand, measured in FTKs, would contract.

“This could happen because of rising protectionist measures and an escalation in trade tension,” he warned.

“It’s not that far-fetched to think if the Trump administration can’t reach a resolution with China, there would be some pressure to position yourself as someone who stands for the American worker.

“[Trump] may well look to other economies that are running large trade deficits with the U.S. and target those – like the EU for instance – and so intensify pressure on those countries, while at the same time perhaps positioning [his administration] as hard on foreign policy and exerting maximum pressure on countries that are perceived to be negative toward the U.S. like Iran. So that could feed geopolitical tensions.

“So under this scenario there would be a pretty bleak outlook for air cargo.”

More articles by Mike