Correction: The story has been updated with correct figures for cargo revenue. The original story said cargo revenue increased 9% to $60 million, but that line item covers cargo and other revenue, such as from ancillary fees and terminal lounges.

Alaska Air Group [NYSE: ALK] has caught an updraft after initial turbulence digesting its 2016 acquisition of Virgin America, reporting third-quarter adjusted pre-tax profit margin of 18% – 3 percentage points higher than the same period a year ago.

The strong performance was driven by 8% growth in operating revenue to almost $2.4 billion, outpacing a 3% rise in expenses.

Alaska Air, which includes its mainline subsidiary and regional carrier Horizon Air, so far is the only domestic passenger airline to have growth in cargo revenue this year in a down year for airfreight overall. For the third quarter, cargo revenue increased 3% to $37 million. Alaska’s cargo business, however, is less than a fifth that of bigger competitors United Airlines, Delta Air Lines and American Airlines.

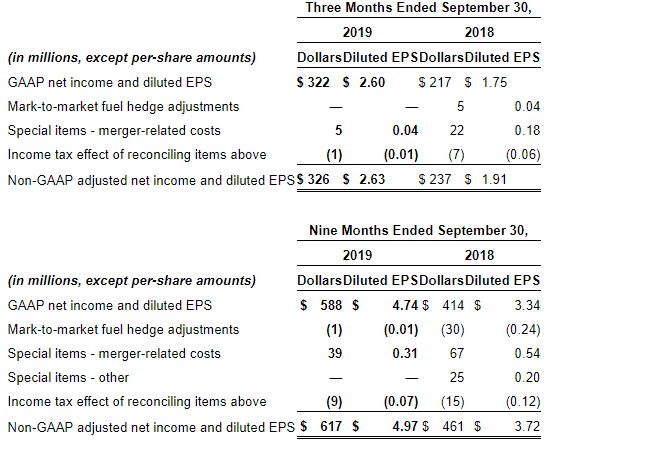

Group net income was $326 million, up 37.5%, excluding modest merger-related charges and fuel hedging expenses, with earnings per share of $2.63 beating consensus estimates of $2.52.

The Seattle-based airline generated $1.4 billion in operating cash flow for the nine-month period.

Mainline revenue per available seat mile grew 4.5% to 12.83 cents, and load factors crept up to 86.2%.