Program targets lower-income Americans, who spend billions each year in Walmart stores

The online battle between Amazon and Walmart took another turn yesterday when Amazon announced it would begin offering discounted Prime memberships to those in the U.S. on U.S. government assistance. Earlier this year, Amazon was approved for the federal Supplemental Nutrition Assistance Program (SNAP) program, which allows customers to purchase goods using food stamps and other federal aid dollars.

Yesterday’s announcement could potentially shift millions of dollars of freight currently moving to Walmart distribution centers and stores – where one in five customers pay with food stamps – to Amazon’s transportation network, which includes a growing number of Amazon trucks, planes and ships, as well as UPS, FedEx, USPS and more regional and local delivery partners.

Prime subscriptions cost $10.99 a month ($99 a year) and include free and discounted shipping, fast shipping options, ebooks and streaming movies and TV shows among a host of other benefits. The new program will offer Prime subscriptions for $5.99 a month for those receiving government aid, giving them the same benefits as full-priced Prime memberships.

According to Morningstar, approximately 20% of the population receives SNAP assistance and Walmart secured about $13 billion in sales last year from the program – about 18% of the money spent in the program.

Related:

Amazon, e-commerce usher in a new world order for trucking

How retail trends are reshaping freight movement

In 2015, the U.S. government provided about $75 billion in SNAP benefits. Walmart and Amazon have both been approved as participants in a government pilot this year that for the first time allows SNAP recipients to make online purchases with their aid, although only residents of Alabama, Iowa, Maryland, New Jersey, New York, Oregon, and Washington are eligible to participate in the government pilot program at this time.

According to Mother Nature Network, 74% of people living below the poverty line have access to the Internet, but only 30% have access to a car. With a discounted Prime membership, which is roughly 5% of an average individual monthly SNAP benefit for fiscal year 2017, opening the door to more online ordering and free home delivery, the potential customer base is much bigger, even with a limited number of states participating.

If Amazon is able to grab a large slice of this business, the impact on Walmart’s private transportation fleet could be huge. Walmart has 173 distribution centers in the U.S. According to MWPVL International, 81% of goods sold in Walmart stores are shipped through its distribution centers.

“The primary reason for Amazon to the do this is to build density,” Thomas Albrecht, president of Sword & Sea Transport Advisors, tells FreightWaves. “More food adds density to their non-food deliveries which lowers the cost per delivery stop. And do I think they will be successful in winning shoppers from other retailers? Absolutely. The only question is how large their market share will be, but I think some people might underestimate the popularity and usage of smartphones even in lower-income America.”

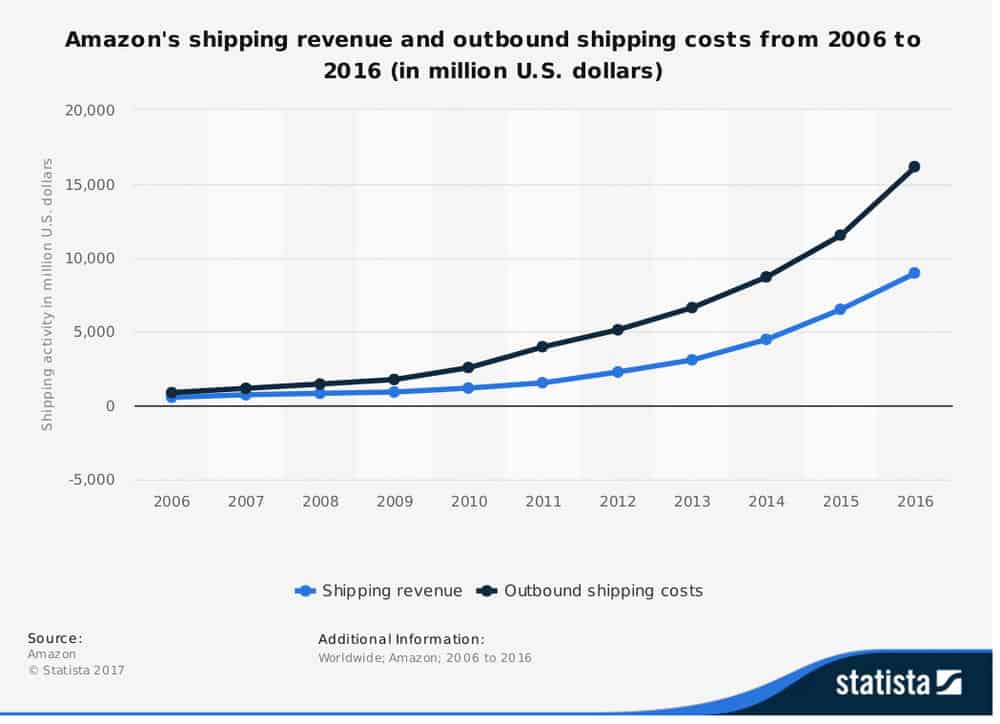

Amazon lost $7.2 billion on shipping last year, according to Geekwire, largely due to its 2-day free shipping with Prime. The company spent $16.2 billion on shipping costs, but generated just $9 billion in shipping revenue.

Earlier this year, Walmart launched free 2-day shipping on online orders to compete with Amazon’s Prime service. That plan seems to have worked as online sales jumped 63% in the first quarter. But Amazon’s online dominance remains. According to an analysis by Slice Intelligence, Amazon’s share of the online retail market has grown from 25% in 2012 to 43% in 2016.

Because lower income shoppers are less likely to have credit cards, the barrier to online shopping has been higher even with Internet access. To help combat that, Amazon introduced Amazon Cash earlier this year, which allows customers to put cash into their Amazon accounts through more than 10,000 physical locations in the U.S.

With the two behemoths battling for e-commerce supremacy, the battle for SNAP business is expected to intensify. To date, Amazon has been able to maintain an edge and that edge could grow greater if those below the poverty line see the $5.99 price point as a gateway to other savings, such as ditching more expensive cable thanks to Amazon Prime’s streaming movies and TV business.

With reporting from Brad Hill