Borderlands is a weekly rundown of developments in the world of United States-Mexico cross-border trucking and trade. This week: Researchers find ways to minimize wait-times at border crossings; truck cargo volumes down at Otay Mesa; container volume slows down at Port Houston; and KAL Freight expands into Texas.

At the U.S.-Mexico border, time is money

Getting goods across the border fast and efficiently is the goal of anyone moving international freight.

Experts from the Texas A&M Transportation Institute (TTI) have been researching ways shippers and carriers can maximize profits and truckers can minimize wait-times at the United States-Mexico border.

Juan Carlos Villa, regional manager for Latin America at TTI, said each port of entry along the U.S.-Mexico border is unique and requires different strategies to get the best results for freight transport.

“We have been investigating different ideas. For example, the border crossings in El Paso-Juarez are more maquila-oriented [factories producing goods],” said Juan Villa. “We proposed, and U.S. Customs and Border Protection (CBP) proposed as well, expanding hours of operation in El Paso. And that has produced some good results, but it has to be a long-term plan that will be able to facilitate the crossing.”

Other border crossings, such as the Pharr-Reynosa International Bridge in Pharr, Texas, is heavily reliant on produce shipments from Mexico.

“We have seen increasing traffic at the Pharr Bridge, and that’s because more produce is coming through Pharr than any other location,” Villa said. “Over in Laredo, wait times have been increasing on some days, some months, depending on what is happening.”

TTI, which is based in College Station, Texas, is one of the largest transportation research agencies in the U.S.

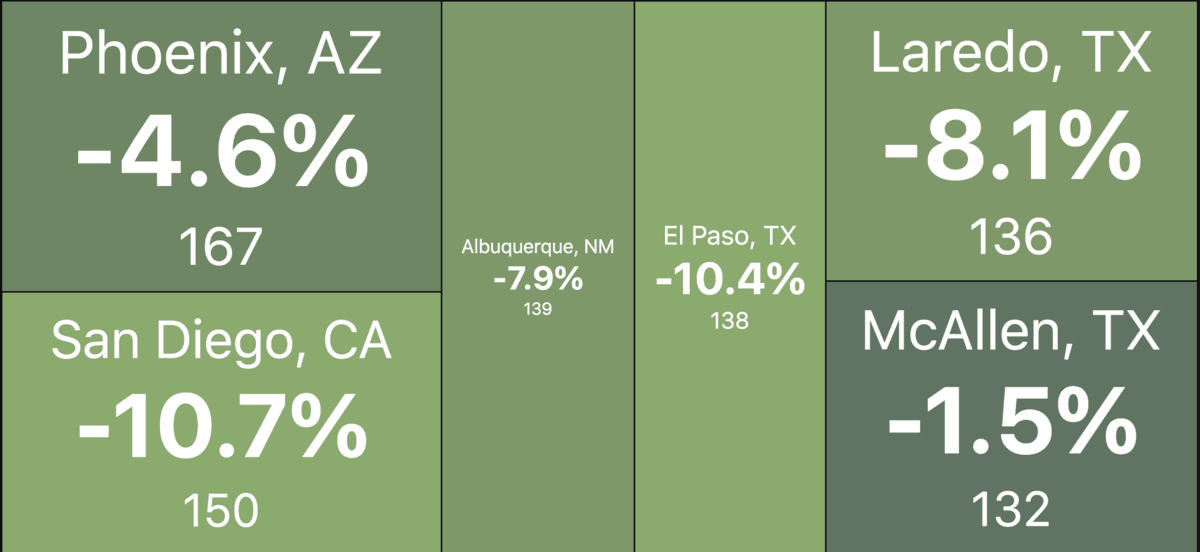

At TTI, Villa and other researchers have been analyzing border wait times by measuring northbound truck crossings at all major ports of entry along the U.S.-Mexico border.

Around 85% of goods transported between the U.S. and Mexico are transported by trucks. There are 29 commercial land crossings between the U.S. and Mexico, including ports in Arizona, California, New Mexico and Texas.

Villa said based on TTI’s research they have not seen a significant trend in increasing border wait time averages across all U.S.-Mexico ports of entry. But they have seen that events such as weather (tornados, severe storms) and the immigration crisis can cause major spikes in border wait times.

“What we have seen is that crossings that utilize the Unified Cargo Processing (UCP) program, that’s been really helpful, especially for the Free and Secure Trade (FAST) shipments,” Villa said.

U.S. and Mexican agencies initiated the UCP program in 2018, which streamlines the vehicle inspections conducted by Aduanas Mexico and the U.S. Customs and Border Protection agency.

The FAST program allows for expedited crossings by commercial vehicles hauling low-risk shipments entering the U.S. from Canada and Mexico. FAST gives dedicated lane access and passage preference to those carriers that have completed background checks and met eligibility requirements.

“Wait times at borders have gone down a lot, because UCP and FAST are working very well. But not all the crossings have the UCP. That’s something we’re working with CBP to try to implement throughout the border,” Villa said.

The UCP program is currently used at ports of entry in El Paso and Laredo, Texas; Nogales, Arizona; and Otay Mesa, California.

Villa said another way to expedite freight transport is for the U.S. and Mexico to consider truck-only lanes.

“We are actually researching truck-only lanes for the Texas Department of Transportation,” Villa said. “I don’t see it in Mexico, because the infrastructure in Mexico is not conducive to have truck-only lanes. But in the U.S. there is some potential for that.”

Truck cargo volumes down at Otay Mesa port of entry

Commercial cargo volumes dropped 20% during the last two weeks of March at the Otay Mesa port of entry, California’s largest international commercial land port.

Officials with the Otay Mesa Chamber of Commerce said Mexico’s March 30 declaration of a national emergency has hindered cross-border truck crossings.

“Volumes are already down by around 20% at Otay Mesa; these numbers will continue to decrease this week,” Otay Mesa Chamber officials said on its website.

Mexico’s government declared a health emergency on March 30, after the number of coronavirus cases in the country exceeded 1,000. The government suspended all non-essential activities in the public and private sector until April 30.

The Otay Mesa port of entry is in the southern section of San Diego, just north of the U.S.–Mexico border near Tijuana, Mexico. In 2019, trade at Otay Mesa totaled $49 billion, according to U.S. Census data analyzed by WorldCity.

Otay Mesa averages around 3,000 trucks a day northbound from Mexico, according to Otay Mesa officials.

A total of 263 coronavirus cases and 17 deaths were reported Friday in Baja California, the Mexican state just south of California.

Container volume slows down at Port Houston during March

Container activity at Port Houston, the largest container port on the Gulf of Mexico, began slowing in late March due the coronavirus outbreak, according to port officials.

Port Houston handled a total of 248,280 twenty-foot equivalent units (TEUs) in March, a drop of 11% compared to March 2019, when 280,721 TEUs were recorded.

Port Houston saw a total of seven blank sailings during March, with additional vessel omissions anticipated as carriers manage capacity globally in response to shifts in market demand.

For the full year, Port Houston handled 773,087 TEUs through March, compared to 694,167 TEUs for the same period last year, an increase of 11% for the first quarter.

Port Houston’s Barbours Cut Container Terminal and Bayport Container Terminal temporarily closed March 18 after an employee tested positive for the coronavirus. Both facilities reopened 23 hours later.

The Bayport and Barbours Cut container terminals are important to the local, state and national economies as well as the supply chain, Roger Guenther, executive director of the Port of Houston Authority, said in a statement.

“We also must support the economy with the necessary infrastructure to rebound when this global pandemic is brought under control,” Guenther said.

KAL Freight expands into the Dallas-Fort Worth metroplex

KAL Freight Inc. has signed a lease for a 49,883 square-foot industrial property in Arlington, Texas, outside of Dallas.

The entire property occupies more than 26 acres within the Great Southwest Industrial District, a distribution and manufacturing hub totaling more than 100 million square feet. The warehouse is midway between Fort Worth and Dallas, near Interstate 30 and Highway 360.

KAL Freight is a logistics and trucking company based in Ontario, California, according to the Federal Motor Carrier Safety Administration. The company has more than 500 trucks, 550 drivers and 1,200 trailers.