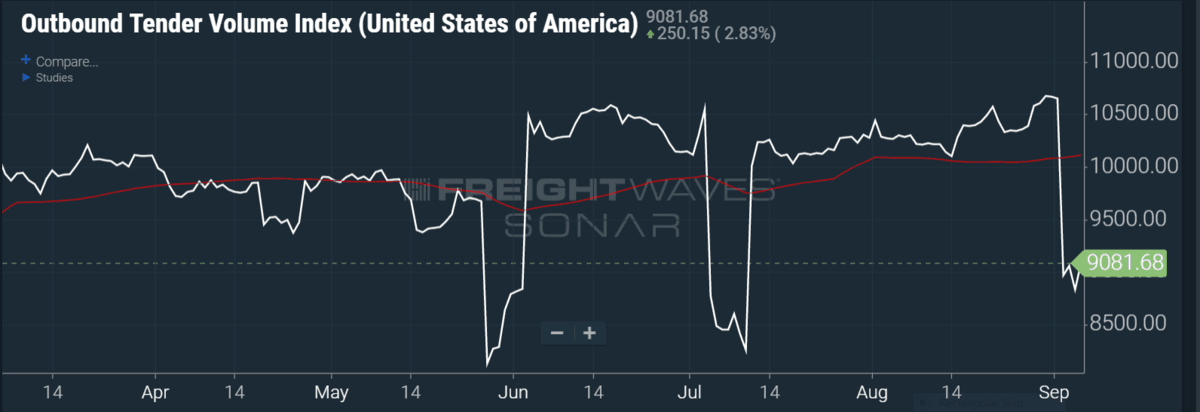

We saw a typical seasonal reduction in volumes this week due to the Labor Day holiday and a sharp sequential drop in OTVI.USA as it is calculated based on a seven-day moving average. Given this factor, only year-over-year comparisons are relevant and offer meaningful insights. National outbound tender volumes were up 3.60% this week versus tough 2018 comparables. Ten out of the 15 primary freight markets we track were up an average of 22% this week (and 11% overall), solidly outperforming the national average. Outbound volumes have remained above 2018 levels since the third week of July.

Capacity on the West Coast expands while Hurricane Dorian disrupts the Southeast

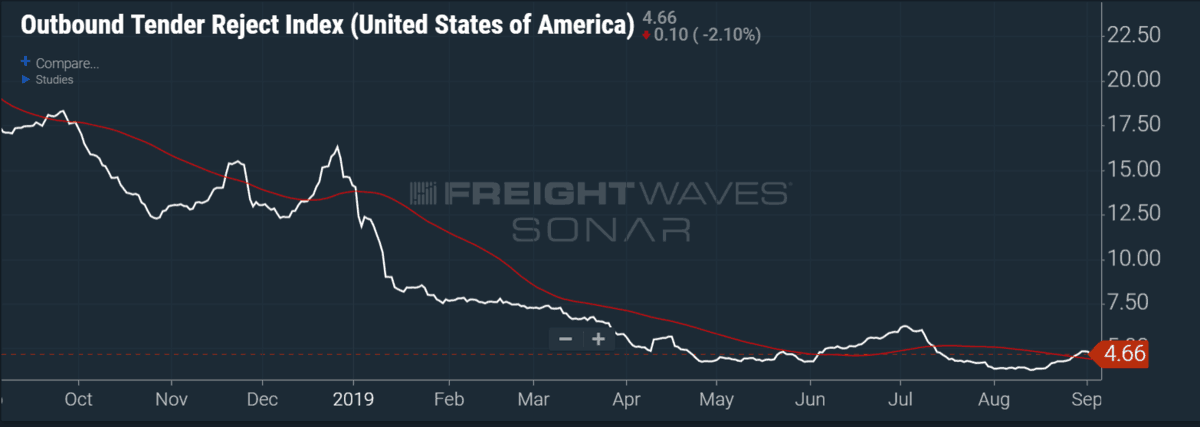

Capacity fluctuated throughout the country last week with Labor Day and Hurricane Dorian causing distortions in freight flows. National rejection rates were little changed over the past week and sit at 4.66%, but regional markets exhibited significant weekly volatility. Western regional capacity expanded with the Southwest region (OTRI.URSW), the West region (OTRI.URWT) and the Northwest region (OTRI.URNW), each falling more than 15% over the past week.

Hurricane Dorian disrupted normal freight movement in the Southeast over the past week as the Outbound Tender Rejection Index for the region (OTRI.URSE) is up to 4.96%, or 131 basis points.

OTRI.USA is up 21.09% on a monthly basis and up nearly 24% from the mid-August lows of 3.77%. Year-over-year comparables are still difficult due to the daunting 2018 numbers in which rejections never fell below double digits.

From a year-over-year perspective, port markets around the country are exhibiting strong throughputs, with East Coast ports Elizabeth, NJ, and Savannah, GA, up nearly 40% and 20%, respectively, and West Coast ports Los Angeles and Seattle up 35% and 20%.