Good news for tanker rates: Port congestion is on the rise and even though floating storage is off its peak, there’s a long, long way to go before all those cargoes are unloaded. On the tanker-supply side of the equation, surging congestion in China is offsetting declines in floating storage.

The more the global tanker fleet suffers supply chain logjams and storage cargoes remain on board, the less ships are available for spot deals. That’s a plus for spot rates. The caveat is that demand for fresh voyages will fall as “stuck” tankers are finally unstuck.

The International Energy Agency (IEA) released new floating storage numbers on Friday, citing data from shipbroker EA Gibson showing an all-time high of 211.3 million barrels of short-term storage in May, falling by 34.9 million barrels in June.

At first blush, this implies a fast unwinding of floating storage. But there is intentional storage, where traders look to buy low and sell high, and there is unintentional storage, where tankers can’t unload due to congestion.

When it comes to supply-demand fundamentals, all that matters is that ships are tied up. It doesn’t matter why. And despite the evaporation of floating-storage economics, an inordinate number of tankers are getting tied up.

For further insight, FreightWaves obtained the latest data on floating storage and congestion from VesselsValue and Kpler.

Crude and products diverge

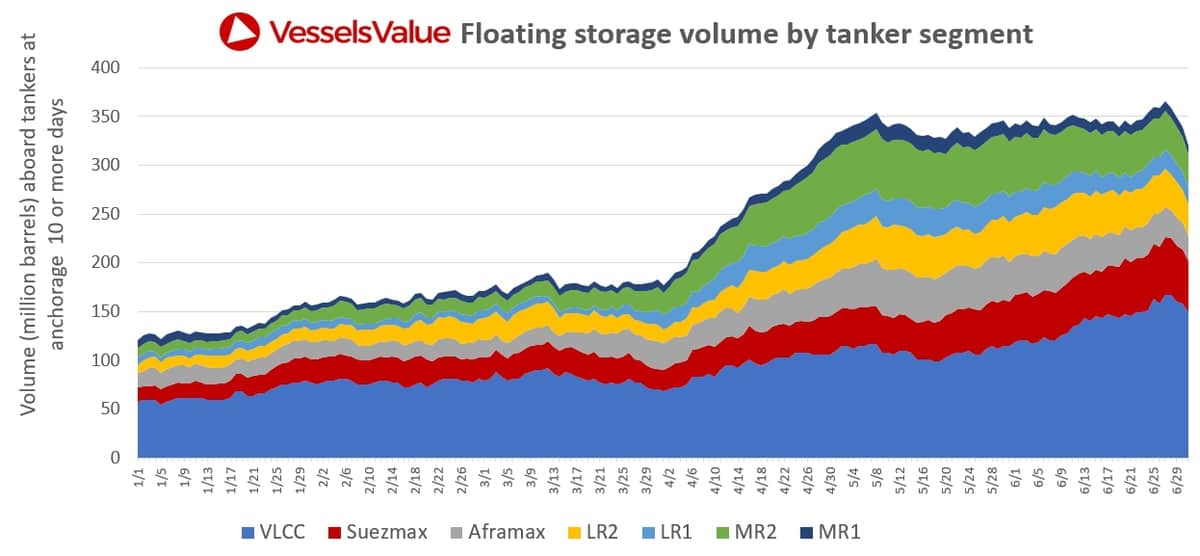

VesselsValue is a U.K.-based company specializing in asset valuations and ship-movement data and analysis. It provided FreightWaves with its information on the number of laden tankers in an anchorage zone for 10 or more days.

The numbers show a peak reached in early May, followed by a steady decline, and a sharp drop-off in late June.

But the actual market effect is skewed by ship size. A very large crude carrier (VLCC) can carry over 2 million barrels of crude oil. An MR1 product tanker carries around a sixth of that volume.

Weighting the numbers by the ships’ carrying capacity tells a different story. The estimated volume aboard tankers idle 10 or more days didn’t peak until June 27 — just two weeks ago.

The pattern is very different for product tankers than crude tankers. Idled product volumes started to decline in mid-May. But crude tied up on tankers kept rising and offset the product declines until idled crude volumes also turned negative on June 27.

The China congestion factor

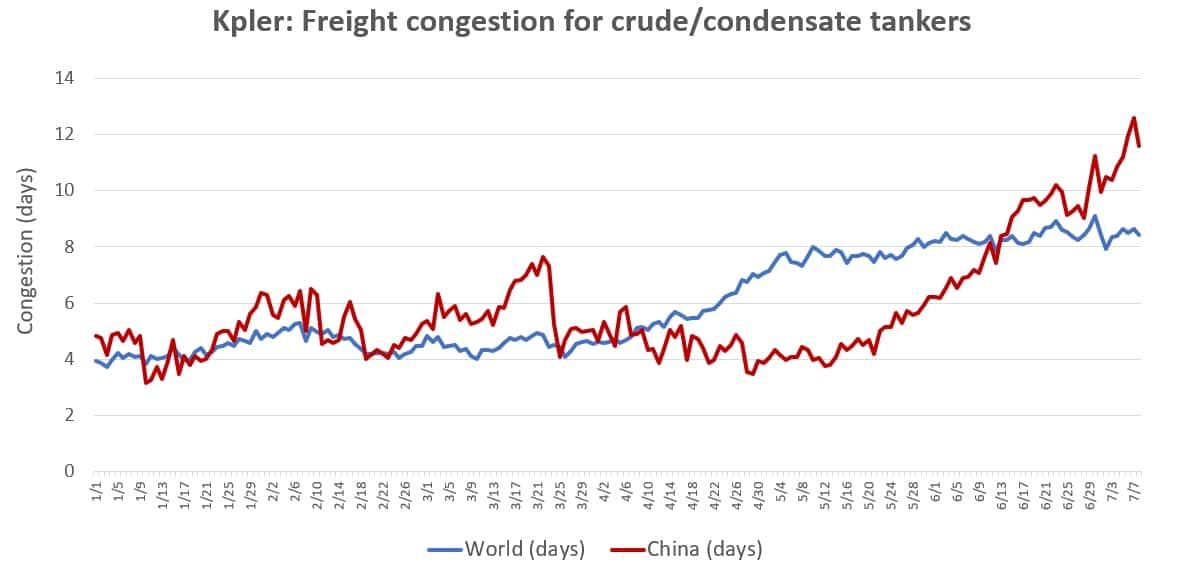

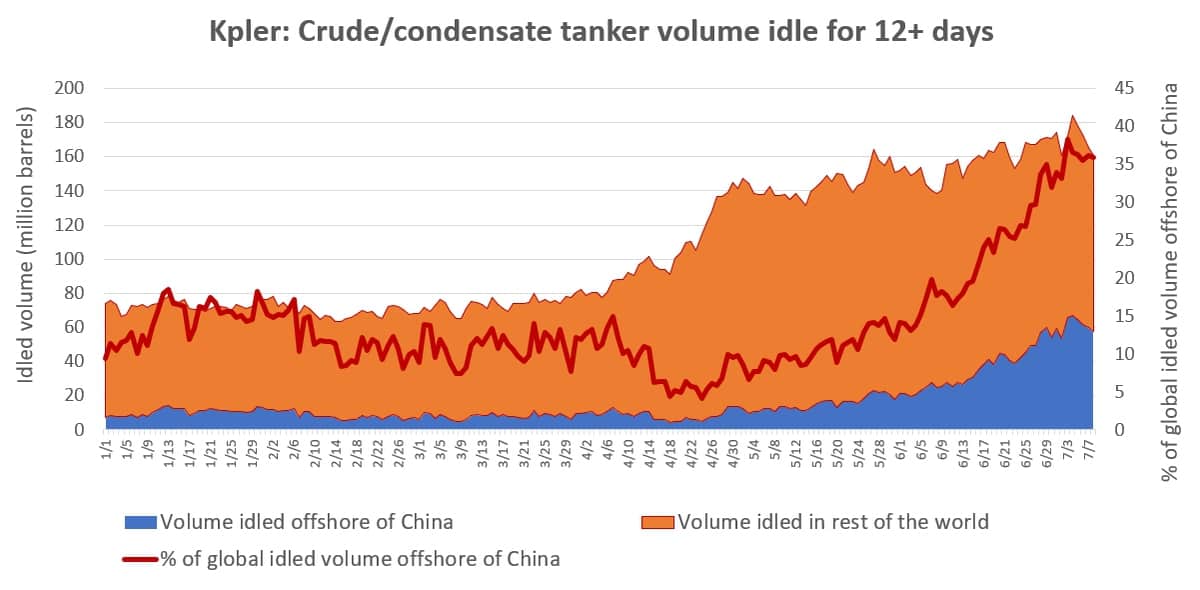

Kpler is a global data provider well known for its oil-storage information, including its “volume on water” product. This indicator shows how much oil is at sea, regardless of whether it is on a normal voyage or at anchorage due to floating storage or congestion. Kpler unveiled a new dedicated freight platform with additional datasets in June.

Kpler provided FreightWaves with its volume-on-water data as well as its floating storage and port congestion data.

Volumes on water for crude/condensates and clean products have followed the same pattern. In both cases, the trend line began to climb steeply through April and peaked in early May. Volumes have come down since then but remain above where they were in the first quarter.

The primary reason the volume on water is down from its highs is OPEC+ production cuts. The IEA cited Kpler tanker tracking data showing that Saudi Arabia cut seaborne crude exports by 2.9 million barrels per day in May versus April.

The reason volume on water hasn’t fallen further is congestion and floating storage that has yet to be unloaded.

Kpler data on port congestion for crude and condensate tankers shows that the wait time in China has tripled from four days in mid-May to around 12 days this month. Delays in China are now around 50% higher than the global average.

Kpler also tracks the number of tankers idled for 12 or more days by geographic region. Its data shows that delays in China normally account for around 10% of the global tally. But the share has been escalating since mid-May. China now accounts for more than a third of all global idled tanker volumes.

Effects on supply-demand balance

Spot rates for VLCCs were up again on Friday. According to Clarksons Platou Securities, they averaged $36,500 per day, double rates at this time last year.

Rates are well off their stratospheric peaks because OPEC+ exports are down and floating storage is not building. Floating storage is being unloaded, but most of that volume is still at sea. Delays in bringing that oil ashore, and extreme congestion in China, mean that the tanker supply-demand balance remains tighter than some market watchers had expected. Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON TANKERS: How retail investors on Robinhood could be skewing tanker stock performance: see story here. The COVID global relapse hedge theory of tanker pricing: see story here. For a look at the near-term headwinds facing the sector, see story here.