The views expressed here are solely those of the author and do not necessarily represent the views of FreightWaves or its affiliates.

Time presents new evidence. Let’s review some of the revealed strengths of the 2020 version of Hunter Harrison’s 2005 notebook “How We Work and Why: Running a Precision Railroad.”

The book is a continuing best-seller. Want a copy? The retail price – if you can find one – on Amazon is over $400. That’s for a book of less than 200 pages and it is an easy read.

And guess what. It does not have any real secret recipes or formulas inside. It’s a book of principles. Five easy to remember “do it” tenets. In his own forward, he told his “students”:

It’s no big secret, really.

First, commit to precision railroading, and the five guiding principles of Service, Cost Control, Asset Utilization, Safety and Passionate People, so that we all share the same fundemental objectives and don’t work at cross-purposes.

Second? Well, there is no second. That’s it.

The five principles, in case you did not memorize them are:

- Service

- Cost Control

- Asset Utilization

- Safety

- Passionate People

Now the service part is important. Because without customers, Harrison admitted there is no railroad business.

Service has a simple definition, according to Hunter: “Service means doing what we say we’ll do.”

What could possibly be better than a copy of Hunter’s little red book?

A better value is likely the hand-written notes and the PowerPoint slides (Harvard Business Graphics) that Harrison used in his classroom lectures.

Or perhaps the takeaway study notes that his students now running CSX and other railroads must have written out and kept in their private locked desk drawers.

Those would be worth much more as a practical primer.

In my previous commentaries on precision scheduled railroading (PSR), I have taken great pains to list the contrary sides of the PSR model – since in operation it is neither precise like a Swiss watch or rigorously scheduled by location or by train. So far, it appears to be more of a marketing term.

You may have read my previous FreightWaves commentary that discusses PSR from my experience and that of Penn State professor Peter Swan: “CSX beta test trip plans scorecard introduced” – you can visualize the strengths and weaknesses of CSX’s emerging version of PSR. I believe that CSX has improved since then.

In some ways the PSR operations have evolved to something like a conveyor belt movement of trains. Train differentiation and performance speeds become normalized and less differentiated. The benefit is that the overall flow of all assets across the railroads’ tracks and railyards becomes smoother.

Taking a fresh look, here are some changes to note. These are changes that the railroads deliver to a customer against the fundamental PSR principles.

- Customers cars get delivered as promised now more closely to the day and time expected as CSX increasingly is focused on the car’s trip performance.

- All departments and people focus on the car delivery promise.

- Internally, CSX is getting better at making their service performance predictable.

- The how is by focusing on cost control and safely – while executing the movement plan across their now stable mostly entirely optimized network.

That’s my interpretation, seconded by a few other experts. The regulators? They have not independently decided, have they?

Here now is a second look as of the spring of 2020 at how an outsider’s review sees samples of PSR execution from Canadian National, CSX and Norfolk Southern (in no particular order).

Let’s start with the recent (2017-20) PSR conversion successes. Here is what seems to be happening.

- They are indeed minimizing railcar classification times.

- They have reduced the number of places that require classification.

- Railcars are now crossing the network in a more balanced rhythm.

But has this resulted in significantly better delivery service for shippers? No one is answering that question.

Here is the Canadian National report card showing the improvement of Trip Plan Compliance in the year 2004 compared to 1999. Yes, a success story from 77% to 85% compliance.

However, is the Canadian National trip compliance for carload freight now in the 96% range in 2020? We can’t find that report card. We can’t tell what the continuous quality improvement rate has been – unless Canadian National reports it.

Since the autumn of 2019 CSX is reporting some of its trip compliance rates, as is Union Pacific.

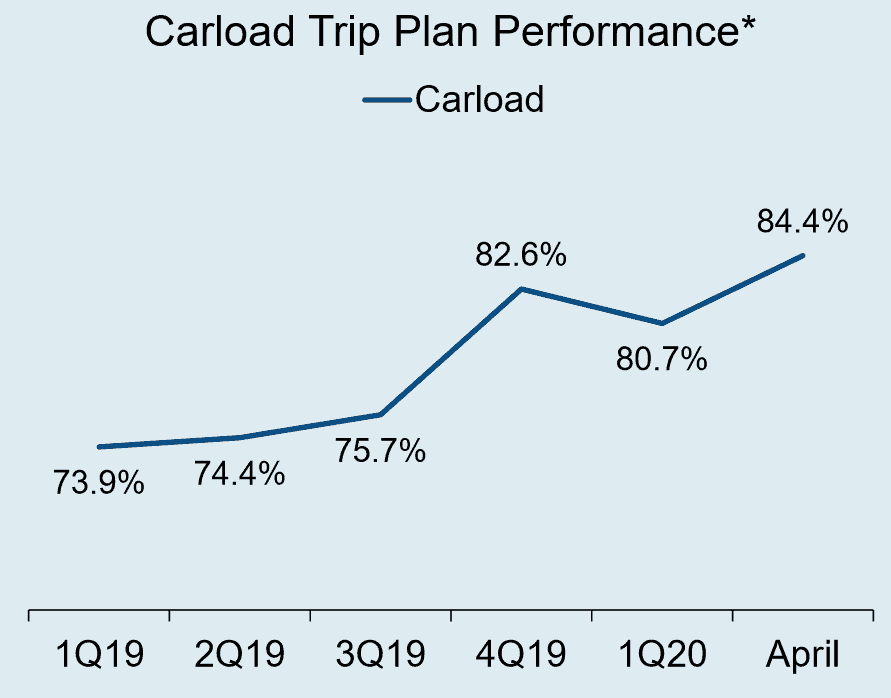

Here are the just posted April 2020 CSX performance numbers in graph format for carload traffic.

The actual computation logic and the progression pace are not always reported and there may indeed be a critical difference as to the procedure used by each carrier. No independent agency such as the Surface Transportation Board gives an interpretation as to the validity or actual translation of the achieved scores.

In contrast, understanding the financial report card is clear under accounting terms and translatable to investors, analysts and media.

Regardless of exact content, the CSX numbers show customer service improvement. As does a similar graph from Union Pacific’s first quarter report.

Here is a closer look at PSR changes and possible direct customer benefits. First, PSR flat switching changes as some hump yards close.

- Cars often can be switched in half the time of using a hump classification when volumes per day are < 1,500.

- Cars in a flat yard can often be placed into more destination “train slots” than when using a fixed number of yard classification tracks.

- This provides for “deeper” into the railroad network blocking.

- Deeper network railcar blocking helps avoid other intermediate yards.

- Each “avoided” yard can save between 8- and 24-hours yard delay time

PSR railroads are also now increasingly using block swapping to improve railcar movement performance.

- The use of block swapping out along the main line tracks also avoids intermediate yard use – each yarding adding dwell time hours.

- Block swapping can eliminate some railroad interchange yard delays between two carriers.

Yard dwell time reduction has been significant across most of the reporting PSR railroads. It is true that yard dwell improvements can be more important at creating network fluidity and network reliability than can the increase in average system train speeds.

The final Hunter Harrison improvement to the rail networks that appears to be paying off into 2020 involves the use of more general mixed merchandise trains and fewer special purpose trains like intermodal or automotive.

Here are the performance deliverables promised by more mixed train operations.

- The overall railroad system of track and assets are better balanced

- Reduces failures because of crew or locomotive shortages

- Reduces train schedule failures because of simple things like a lack of safety end of train warning/brake assist devices

- Unit or special trains are only used when it is a closed loop special service with high performance fast loading/unloading of trains

- Lower car dwell times can make crew availability more reliable

The above PSR actions seen now in 2020 could result in increased car delivery performance that the customer can see at the receiving dock.

To make it count as a direct customer benefit, somehow the report card must be transparent to each such customer so that it can be translated into lower railcar use costs and lower forward inventory carrying costs. That’s what digital age marketing allows.

The final judgement is dependent upon the reliability of the railroads’ performance records and an open transparent railcar by railcar event transmission in near real-time to the customers’ transportation management or inventory management systems.

Transportation management systems are used by logisticians for shippers and receivers. Many trucking companies use such data integration direct feeds. Most railroads do not do that yet. Why not?

Are those transparency or near real-time feeds to those systems happening? The railroads have to allow it to happen by changing their data exchange procedures.

If you run a PSR railroad, why not reveal more about the direct customer- received benefits you are calculating?

These important customer benefits were not reported in most cases this in the first quarter earnings releases or analyst calls. Will they be reported in the second quarter reports?

Acknowledgements

- Technical review of 2019-2020 PSR techniques from notes by Donald Graab, General Manager of Triangle Brothers & Associates, LLC; REF20 in March.

- Selected notes from my copy of the PSR red book; “Why Traditional Railroading Doesn’t Work and Precision Does.”