Railroads are fundamentally directly involved in heavy manufacturing, resource commodities, energy and industrial production.

Not so much e-commerce — at least not as direct movers and organizers.

With that in mind, let’s examine how the railroad merchandise carload traffic pattern looks more than halfway through the third quarter of 2020.

Here is the bad news: 2020 could very well end up for the railroads as the worst overall freight volume loss year-over-year in the past 15 years. That goes back to the last significant drop in rail freight during the 2007-08 period associated with the Great Recession.

We will isolate only some of the data to better view meaningful patterns. Translation: We will leave out a lot of what I call “data noise.”

Here is how this review is organized — we start with 2020 compared to overall changes in full-year 2019:

— And changes so far into 2020 versus 2019.

— Slices of 2020 compared to the previous year.

— Changes across the first three quarters of 2020.

— Then changes during the third quarter year-to-date (YTD).

— Versus the changes of the past trailing four-week average period.

We are going to ignore the change in the last week report. Why? Too many possible distortions from a one-week change — particularly if it involved a holiday period different than the same timeline a year ago.

Using data from multiple sources and consultancy railroad “watchers,” these next tables sort the commodities moved by the U.S. railroads.

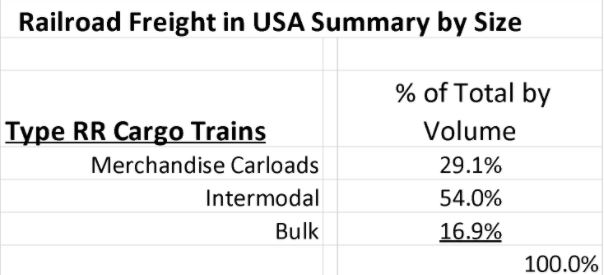

This first simple table segments the market by three groups:

The heavy freight bulk movements are of course the bulk traffic like coal or grain. That is about 17% of total railroad U.S. freight volume.

The overall merchandise carload trains move about 29% of all unit volume cars.

Notice the intermodal, which about three decades ago might have accounted for only 15% to 25% of all rail-moved train types – but today amounts to over half of the average big railroad company traffic – when seen visually as units behind locomotives.

Remember that these are averages. A few railroads might have closer to 60% of what we could label as intermodal.

How is 60% possible? Because technically moving finished automobiles and light trucks on train cars is a form of intermodalsim. So is moving commodities that might easily be transferred into truck at an intermediate point called a transloading terminal.

It is all about the actual physical definitions.

Yet, the railroad language refers to intermodal as only semi-trailers on flat cars (TOFC) — or as containers on flat cars — or stacked two high in so-called “well cars.”

Here is a slightly different segmentation of the size of these three distinct cargo markets:

Note that semi-trailers riding on flat railroad cars five decades ago were about 95% of the intermodal market. Today trailers are less than 5% of the total railroad traffic … or about 10% of the total intermodal units.

Translation: Intermodal semi-trailers are slowly being abandoned as a market.

Table 3 is a bit more complex view of merchandise train freight.

Six merchandise categories are defined by row, and one catchall category covers about 40-plus named goods: “all other.”

The “other” covers things like canned food products and refrigerated foods — or perhaps manufactured washers and dryers, as examples.

Here, as an economist, are takeaway points — starting with 2019 versus the year before 2018:

2019 ended up the year with 2.4% less total merchandise traffic than was moved during 2018.

Therefore, we see that a recessionary rail merchandise trend possibility was underway well before the pandemic arrived in February/March.

An exception was rail-moved petrol; that was up about 12% versus 2018.

Stone and gravel used for all types of construction was down 8% — not a good economic sign heading into 2020.

Chemicals was down just under 1% — better but not great.

Total merchandise was down about 2% in round numbers.

Not a single commodity within the merchandise area with growth except for the petrol group (lots of crude oil) with about a one-quarter swing from a 12%-plus range the year before to now down about 13%.

Our purpose here is to look strategically at the broad economic picture — and not just the current midyear 2020 period.

Next, let’s examine what has been the year 2020 low point. That would be the second quarter.

Here are statistics that stand out:

— Traffic like finished autos and light trucks down a whopping 65%.

— Stone and gravel down 20%.

— The total rail carload merchandise group was down about 22%.

— Chemicals down about 13%.

But there were two rail merchandise categories that did not fall as much. One was the “mixed other category.” It includes foods and medium durable manufactured goods: down only about 9%.

The other was forest products, down about 10%.

Third-quarter improvement

Now we are deep into the third quarter. How is rail merchandise doing? A recovery is underway.

Chemicals are now down only about 5% year-over-year. All other merchandise carload is down only about 7%. Motor vehicles traffic is down just about 1.5%.

Yet there were some third-quarter struggling year-over-year sectors:

— Stone and gravel were down about 24% — a bit more than in the second quarter.

— Metals — still lagging — being down 29%.

— All merchandise as a group still down about 11%.

— Chemicals still down 5%.

If we collapse Table 3 a bit, Table 4 shows us the new pattern into the third quarter.

Importantly, as an old railroad economist, this table makes it easy to see the recent four-week trending data against the third quarter to date — and against the disastrous second quarter.

Wow! Significant improvement — but no V-shaped economic recovery except perhaps for a few rail carload commodities like motor vehicles.

Motor vehicles these recent weeks were down year-over-year during the same four-week pattern only by some 2%. I’ll admit to a V pattern there.

Chemicals were still down but somewhat consistent in the quarter at about 5%.

The all “other carload merchandise” sector was down only about 5%

Yes, across the carload merchandise market segment, a recovery is underway, but still lagging for:

— Stone and gravel (-22%).

— Metals (-14%).

— Petrol products (-about 14%).

One last observation is this: From the following graph we can interpret that there has been an overall trending at best described as stagnation of carload growth over the past two years heading into 2020.

This three-year graph pattern reminds us that there was something structurally challenging rail carload growth before the pandemic hit our economy in March.

Was this part of a pattern reflecting a loss of competitive position?

Or just pains associated with struggles while trying to implement so-called precision scheduled railroading? What do you think? Do not just take this old railroader’s opinion. I might be too contrarian.

Commentary: Railway insight from New England

Commentary: Intermodal missed signals? Fumbling so close to the growth goal line?

Commentary: Is outlook for Mexico’s rail freight still relevant?