Growth in the US economy slowed slightly in the third quarter of the year, but remains strong headed into the end of 2018 as consumers and inventory building carried the load.

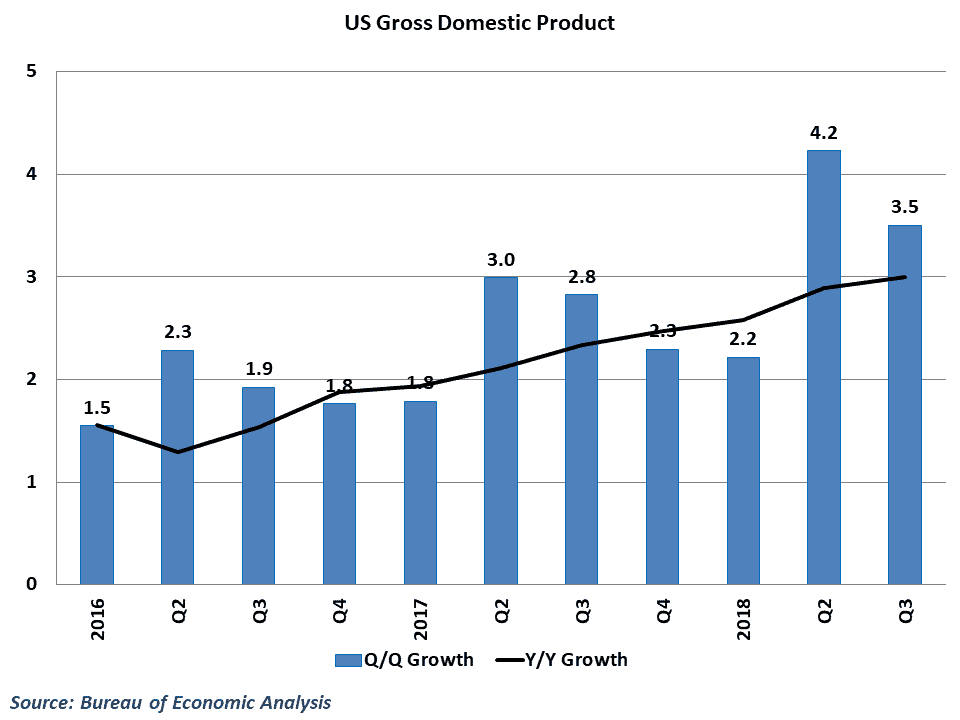

The Bureau of Economic Analysis reported that US gross domestic product rose at a 3.5% annualized pace in the 2nd quarter, down from 4.2% growth in the previous quarter. This beat out consensus estimates of a 3.3% and, combined with last quarters results, marks the strongest back to back quarters of growth in the economy since 2014 and pushes year-over-year growth to 3.0%.

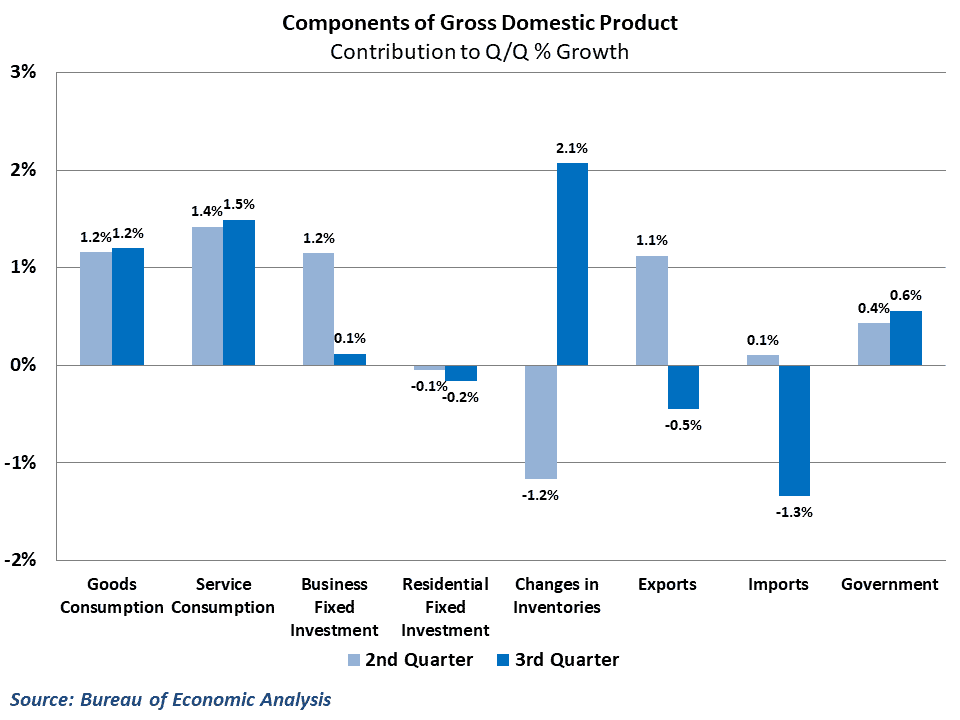

Consumer spending, which makes up approximately 70% of all expenditures in the economy, was again the driving force behind the impressive 3rd quarter performance. After a brief slowdown at the beginning of the year, consumers have spent generously throughout the year, boosted by tax cuts and solid income gains. This trend continued during the 3rd quarter, as growth in consumption contributed 2.7% towards overall GDP growth. Inventories also made an impressive showing, reversing the 2nd quarter decline and contributing over 2% to growth during the quarter.

Of course, much of this inventory build was driven by goods that are imported from the rest of the world instead of produced domestically. Imports jumped significantly during the 3rd quarter as many US businesses looked to bring in goods earlier than they otherwise might in an effort to avoid impending tariffs, particularly on goods coming from China. At the same time, exports tumbled as many agricultural exports that were pushed out early in the 2nd quarter saw a significant drop off. As a result, international trade reversed its big contribution to 2nd quarter growth by subtracting over 2% from growth during the 3rd quarter. Business fixed investment also experienced slower growth in the 3rd quarter, contributing the more moderate pace of growth overall.

Solid growth expected to round out the year

The GDP results over the past couple of quarters have been full of wild swings in the volatile trade and inventory components. A good deal of that is tariff-related adjustments that US and foreign businesses have made to try and reduce the impact of various trade disputes.

Behind all of the noise, however, is still an economy that is growing at a healthy pace. The economy is still benefitting from the effects of tax cuts and high consumer and business confidence, and activity should remain strong in upcoming months.

GDP and freight markets

In a broad sense, gross domestic product is the most often utilized measure of the state of an economy. GDP measures the value of all goods and services produced within an economy during a given period, and provides the broadest measure of economic activity.

Most of the activity in the US economy revolves around the production of services, however, which has looser ties to freight movements. Spending on things like health care, recreation, and financial services are a significant chunk of economic production, and headline GDP numbers may not accurately reflect the state of the freight market.

It is more useful, then, to focus on the areas of GDP that do tie to the goods side of the economy. Consumption of goods, business investment in equipment and structures, residential investment, and trade in goods all serve as key drivers for freight demand in the economy

Taken through this lens, the GDP result also look strong. Except for the softening in business and residential investment and the weakness in exports, the drivers of freight demand looked healthy during the 3rd quarter. Even the surge in imports, which by itself subtracted 1.3% from GDP, is a positive from a freight perspective because a good deal of freight movement is bringing things in from the ports.

Behind the numbers

This morning’s report was largely expected given the temporary fluctuations that occurred in the 2nd quarter, and also positive despite the slight slowdown in the headline growth figure. The strength in consumer spending was a big of a surprise on the upside and would normally paint a bright picture for the holiday season. However, the recent plunge in stock markets raises some real concerns about how consumer confidence and spending will hold up going forward should the slide in stocks worsen.

The weakening in business investment is also a bit of a concern going forward. Business fixed investment had contributed a significant amount to growth in the previous three quarters, and to see that fall off removes one of the key supports for overall growth. Consider that much of the spending on investment has been done in the oil and mining industry. With prices stabilizing around $70 per barrel, it’s not clear that there will be this continued surge in spending to expand oil production.

Overall though, the economy still looks generally healthy. Growth may not reach the 3+% range that the economy experienced in the middle of the year, but should still remain solid to round out the year.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.