The US trade deficit in goods narrowed for the second consecutive month as a decline in imports outweighed a drop in exports to the rest of the world

The Census Bureau reported that the US economy’s goods deficit narrowed modestly in April to -$68.2 billion dollars on a seasonally adjusted basis, from a revised -$68.6 billion in the previous month. This marks the second straight improvement in the global trade picture after six consecutive months of widening deficits.

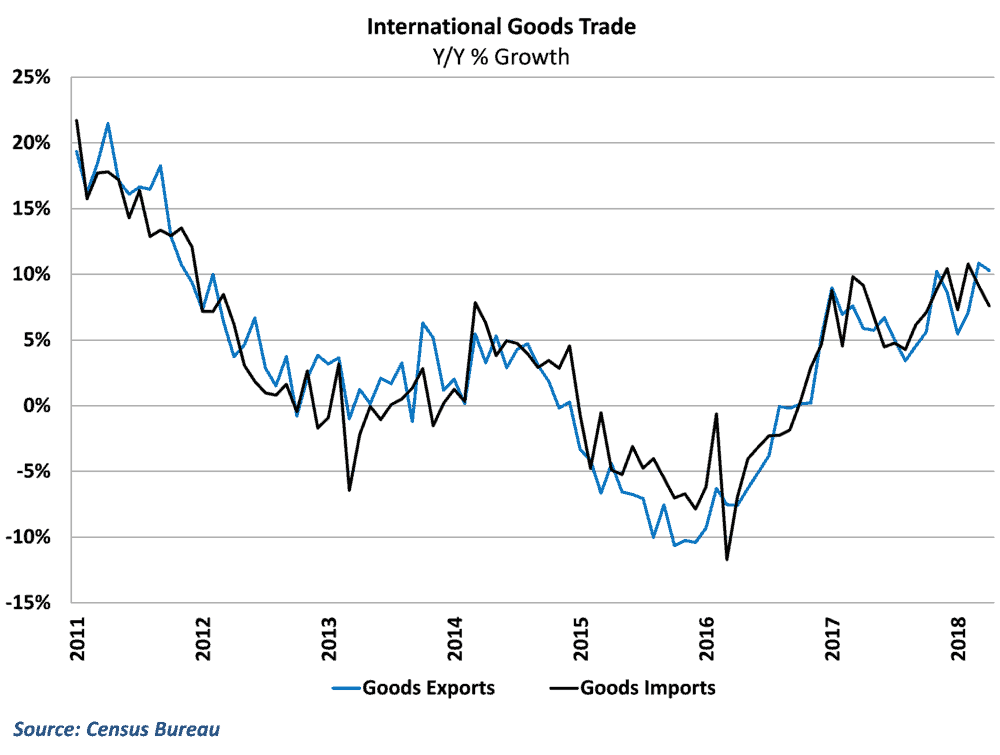

However, the improvement in the headline trade deficit was driven by a fall in the overall value of goods traded in and out of the country. Goods imports fell by over $1 billion in April following last month’s large decline, dropping year-over-year growth to 7.6%. Exports of goods also declined during the month, falling $400 million from March’s levels.

As was the case last month, the declining total value of trade is not good news for transportation markets. Ocean and air freight carriers such as Maersk rely heavily on the international movement of goods to help drive volume performance, and can see diminished results even if the overall trade picture for the economy improves. In addition, a considerable amount of domestic demand for trucking and rail involves movements to and from ports and across borders for international trade.

With that said, international trade activity is still generally strong despite the recent declines. Both exports and imports of goods are considerably higher than they were at this point last year, and freight demand from the ports is still strong from a year-over-year perspective even if it has cooled some from recent highs.

Behind the numbers

The total trade numbers ended up being a disappointment, but trade is still improving. Revisions to last month’s data showed a bit of a brighter picture than originally reported, and trade is still on an upward trend, even if there are fits and starts along the way.

Going forward, the state of international trade for the US economy remains unsettled, as the government faces some major policy decisions that could significantly impact the outlook. The administration remains embroiled in an on-again/off-again trade conflict with China, with tariffs on US exports and imports being threatened by both sides. In addition, President Trump’s administration plans to deliver a revamped version of the North American Free Trade Agreement (NAFTA) in upcoming months. The negotiating parties are reportedly still far apart in terms of demands, and concerns have emerged over whether the US can get to an agreement before governments in Mexico and Canada begin to change over.

These policy shifts have introduced a great deal of uncertainty into the global trade environment. Survey data suggests that the lack of policy clarity is beginning to disrupt business operations for US manufacturers, and have caused some erratic price swings in certain imported and exported commodities such as steel and aluminum. The actual policy changes have been fairly minor up to this point, but the threat of something major has cast an intimidating shadow over the trade picture.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.