On FedEx Corp.’s mid-December analyst call, Frederick W. Smith, FedEx’s founder, chairman and CEO, was asked by Scott Group, an analyst at Wolfe Research, to comment on the prospects for profit margin improvement in the quarters ahead. Smith, making a cameo appearance to answer questions specifically for him, said “there is a massive margin improvement opportunity” at the company.

He then directed his second-in-command, President and COO Raj Subramaniam, to fill in the blanks.

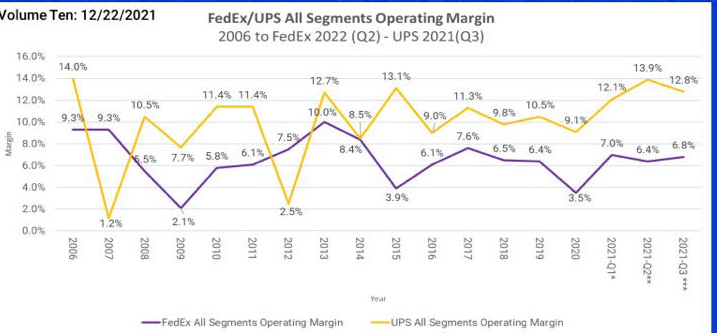

Those seven words were Smith’s way of throwing down the gauntlet to the company he established more than a half-century ago. After 15 years of erratic operating margin performance when it often lagged rival UPS Inc. (see chart), and coming off its lowest margins at its FedEx Ground parcel-delivery unit in years, FedEx (NYSE: FDX) has vowed the second half of its 2022 fiscal year, which began Dec. 1, will mark the start of a long and powerful upward move in profitability.

It is a vow that stakeholders expect it to fulfill.

Two actions underscore FedEx’s confidence that it can regain its mojo. It unexpectedly announced last month that it would host an analyst meeting this June, an event that wouldn’t be held unless the company had favorable news to share.

In addition, FedEx’s board authorized a proposal to repurchase $5 billion in shares. Included in that was approval to buy back $1.5 billion of shares on an accelerated timetable.

“It’s messaging, which is what every company does,” said Dean Maciuba, who was a FedEx executive for 25 years and is now managing partner, U.S., of consultancy Crossroads Parcel Consultants. “But why would they even announce it, especially with margins being where they are, if they didn’t believe things were improving?”

If the company falls short, it won’t be due to the macro climate. The strongest seller’s market in 25 years for parcel services shows no signs of abating, and FedEx will take no shipper prisoners.

Brie Carere, executive vice president and chief marketing and communications officer, said on the call that FedEx’s 5.9% general rate increase for calendar year 2022 is sticking better than the company originally thought. In addition, FedEx is making “structural changes” to all of its contracts and has renewed about half of its contracts that were up for re-negotiation, according to Carere.

Carere also said the small to midsize customer base, coveted by FedEx and UPS (NYSE: UPS) because of its price inelasticity, was FedEx’s fastest-growing segment in its fiscal second quarter.

The priority in the turnaround story appears to be the ability to sustain higher staffing levels at FedEx Ground. By mid-December, the unit had added 60,000 more employees than it had in September. Labor shortages at FedEx Ground have cost the unit hundreds of millions of dollars in added costs and service disruptions during the past two quarters, making a hash of the unit’s margins.

On the analyst call, the company said FedEx Ground’s profitability should improve in coming quarters as additional workers become available to support its network. Analysts said it’s critical to the entire company that such a scenario plays out.

“We believe improving labor availability is the key lever to a transition to improving (FedEx) Ground margin” in the second half of the fiscal year, said Thomas Wadewitz, analyst at UBS. Wadewitz lowered his 12-month price target to $343 a share from $369 a share, but still well above current price levels.

Another potential catalyst for improvement is a $1 pick-up fee to be imposed on every shipment moving under the company’s new “Ground Economy” service. The service, aimed at shippers of low-value, lightweight parcels whose deliveries aren’t time-critical, was branded as “SmartPost” when FedEx tendered packages to the U.S. Postal Service for final deliveries to residences. Today, FedEx handles virtually all of that business in-house.

Satish Jindel, president of consultancy ShipMatrix Inc., said the $1 fee translates into a double-digit increase over current prices. FedEx should not lose market share as a result of the increase because capacity remains tight and UPS, looking to protect its own margins, is more selective about the business it pursues, according to Jindel. The wild card, Jindel said, is the Postal Service, where Postmaster General Louis DeJoy is aggressively expanding the parcel business to offset secular declines in first-class and marketing mail.

The third leg in the stool is coming from overseas.

In April, FedEx plans to complete the integration of its European air network with that of TNT Express, which was acquired in 2016 for $4.8 billion. With that, the physical integration of the two companies will be complete, five years and hundreds of millions of dollars in costs after it began. FedEx has moved almost all of the integrated network to its existing hub at Paris’ Charles deGaulle Airport, leaving the old TNT Express hub in Liege, Belgium, to function as a secondary facility serving lanes on the continent.

The integration gives FedEx full air and ground coverage throughout Europe, both within and between countries. The completed network also will serve as a feeder for intercontinental air service to and from Europe.The jewel in the crown is TNT Express’ vast European ground-delivery operation. FedEx had a very small European road presence before the acquisition.

FedEx believes the extensive road network will create new opportunities in the form of profitable e-commerce traffic. Maciuba said, however, that the company faces formidable competition from market leader DHL and UPS, and must be careful in its pricing.

Also, the prolonged integration process – combined with the disastrous 2017 NotPetya hack that crippled TNT’s computer systems and caused massive shipment dislocations – resulted in customers fleeing to DHL and UPS. Many of those costumes never returned.

The biggest potential opportunity of all hasn’t happened yet.

Since its inception, FedEx’s three business units, Express, Ground and Freight (its LTL unit), have operated separately. Jindel, who has been involved with the company in various aspects for more than a quarter of a century, has long advocated for the integration of the Express and Ground units, saying it would boost profits by many hundreds of millions of dollars due to the operating synergies.

Until recently, his arguments have fallen on deaf ears. But things may be changing. Subramaniam, dubbed by some as the “Crown Prince” because of his heir-apparent status to the 77-year-old Smith, is advancing the message that the units are now operating collaboratively instead of independently.

On the analyst call, Subramaniam referred to “expanded collaboration” across the units that will “drive cost benefits, lower delivery and line-haul cost, and better utilization of existing assets.”

He noted that FedEx Freight’s trucks traveled four million miles during 2021 on behalf of FedEx Ground. In addition, FedEx Freight during the year provided FedEx Ground with badly needed intermodal containers, which had been dispatched nearly 50,000 times by mid-December.

“We will continue to look comprehensively at all assets in our network, including stations, hubs and equipment, to put the right package in the right network at the best service for our customers,” Subramaniam said.

The FREIGHTWAVES TOP 500 For-Hire Carriers list includes FedEx (No. 1) and UPS (No. 2)