C.H. Robinson (NASDAQ: CHRW), a leading third-party logistics provider and the largest freight brokerage in North America, reported third-quarter financial results after markets closed on Oct. 29.

Robinson’s business was finally hit hard by the industrial recession in the United States, slowing global trade and a contracting eurozone.

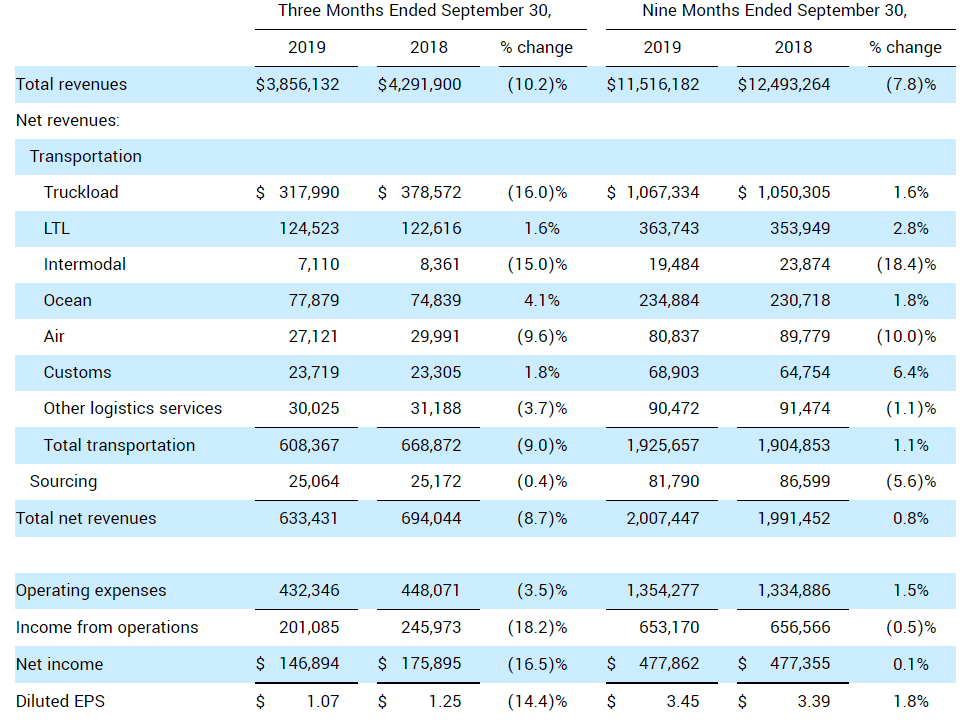

Total revenues were down 10.2% year-over-year to $3.9 billion; net revenues fell 8.7% from the prior year, to $633.4 million. Diluted earnings per share decreased 14.4% to $1.07, missing Wall Street’s expectations of $1.14.

Last quarter, Robinson managed to grow earnings by 8% and beat the Street by a penny, but the truckload cycle has started to shift against the 3PL. Spot rates — a freight brokerage’s cost to buy trucking capacity — have bottomed, while contract rates, which represent about 70% of C.H. Robinson’s revenue, are still being revised downward.

“The third quarter provided challenges in both our North American Surface Transportation and Global Forwarding segments,” Chief Executive Officer Bob Biesterfeld said in a statement. “Our net revenues, operating income and EPS results finished below our long-term expectations. We anticipated an aggressive industry pricing environment coming into the second half of this year driven by excess capacity and softening demand and knew we faced difficult comparisons versus our strong double-digit net revenue growth in the second half of last year. Our results were negatively impacted by truckload margin compression in North America.”

Still, Robinson’s North American Surface Transportation (NAST) division, the truckload brokerage, widened its gross margins slightly to 15.4% from 15.34% a year ago. The issue is that the brokerage’s top line revenue was down 12.4% to $2.82 billion and net revenue dropped 13.2%. NAST suffered from decremental margins, as its income from operations — a rough measure of the business unit’s internal profitability — fell even faster, by 21.3% on a year-over-year basis.

Global Forwarding was less sensitive to the downturn in ocean and air pricing and air volumes. Total revenues fell 6.5% year-over-year to $597 million, but net revenues were up 1.3% and income from operations climbed 3.5%. Ocean revenues in particular climbed on margin expansion, Robinson said in its earnings release (overall Global Forwarding gross margins were 22.7% for the quarter compared to 20.9% a year ago).

In Robinson’s “All Other and Corporate” segment, Robinson Fresh’s net revenues contracted slightly by 0.1% year-over-year to $23.6 million; Managed Services grew net revenues by 7.4% to $21.5 million; and other Surface Transportation grew net revenues by 13.6% to $15.9 million.

Biesterfeld gave pessimistic guidance for freight markets going forward.

“Looking ahead, we expect that North American routing guides will continue to reset at lower prices in response to the falling cost environment and decline in spot market freight opportunities,” Biesterfeld said. “While industry data suggests capacity continues to exit the North America truckload market, we believe capacity will exceed available shipments for the next few quarters. Despite the current freight environment, our long-term goals remain unchanged. We remain focused on taking market share, automating core processes while delivering industry-leading quality service to our customers and carriers, and improving operating leverage in our businesses.”

Jed

That’s ok. Ch Robinson has been ripping off there customers for years. Over charging and underpaying the people doing the work and spending the most amount of money to move the freight. Ch Robinson is getting what the deserve. There will be more to come for Ch Robinson. The nightmare isn’t over yet.

Nick

It hit them because people are tired of hauling their cheap a$$ freight. Take your $.75 mile load and shove it. Hopefully they go under.

Joe

I would love to see a dirt bag company like CH Robinson go under. I dont feel bad for them losing millions, they should lose there shirts for fucking over the independent and owner operators for years by paying extremely low cents per mile. Many times I denied there 85 cent a mile loads. Any company that dont own trucks and make money from the hard working truckers in my eyes are scum. Rot in hell CH Robinson.

Grace Sharkey

Does anyone have insight on what their “other Surface Transportation” revenue is defined as? Thank you!

Shawn

Thank you Mr. Trump that was a real smart move to fuck up the country the way you did !!!

MrBigR504

Ohhh no, he’s “The Deal Maker”! Tried to tell these fools out here, don’t fall the the okee doke!

Ulises Hernandez

With what we carriers are being paid to move Freight across the United States we will all end up bankrupt! How is it possible that the Brokers are going to renegotiate lower rates for the shippers when there will be no carriers left to haul their Freight? A lot of the large carriers that we all know don’t want to haul drive-ins anymore and are firing drivers and closing terminals. Who will ch Robinson have to move their Freight if we’re all gone. Don’t get me wrong CH Robinson has been good to me and my company but we will not be around anymore if the rates don’t go up. Only the Strong Will Survive! But this also means carriers and shippers! You guys are putting the nooses around our necks.

Noble1

.

Not to come across as a pessimist , however, from my perspective you haven’t seen anything yet . Wait till the next shoe drops . It shouldn’t be long .

And by the way , A better way of putting it would be : “Only the shrewd & knowledgeable will survive” . I’m referring to understanding peaks & troughs & mal-investments at peaks (wink)

History is a mighty good teacher .

In my humble opinion ………..

.

Noble1

Quote:

Cash flow from operations decreased 24.1 percent to $167.3 million

“Cash Flow Generation and Capital Distribution

Cash from operations totaled $167.3 million, down 24.1 percent versus the prior year, primarily due to decreased earnings versus the year-ago period.

In the third quarter, $135.9 million was returned to shareholders, with $68.9 million in cash dividends and $67.0 million in share repurchases. This represents a decrease of 9.9 percent over the prior year.

Capital expenditures totaled $19.4 million in the quarter. We now expect 2019 capital expenditures to be between $65 and $75 million, with the majority dedicated to technology. “

Dave

Wow. I can only imagine just how bad it is then for the so called new digital brokers who were already losing money even last year before this so called freight recession.

If Robinson is seeing a 10% revenue fall and lower margins then I imagine that Uber Freight, Convoy, Transfix, Loadsmart and all the rest I read about are seeing heavy blood in the streets and burning through their cash piles faster than ever.

Does anyone here know?

JP Hampstead

I imagine that’s right—anyone trying to grow revenue in this market would have to bid very aggressively indeed.

Still, it’s harder to get insight into private companies. UBER reports Nov. 4., but unclear how much light will be shed on Freight, which is buried in “Other Bets” along with their scooter and bike sharing businesses.

Miguel Yolo

I believe it was Freightwaves that did an extensive piece on Convoy couple months ago…I remember the company touting impressive revenue growth in the article but declined to shed any light on profitability or even a timeline to profitability which tells me they have no idea when they will be profitable.

If things were really great as they sound wouldn’t they tout the profitability or at least a projected schedule when they’re expected to hit? Look past the smoke and mirrors and focus on the fundamentals. Nothing has changed over the past several thousand years…name of the game is to make money not lose it. Same goes for Uber and any other digital broker who find themselves hiring more people to support a business they tried to replace entirely through technology.