Hot Takes

Over the past few weeks we’ve seen the biggest glow up that the FreightTech industry has had in a long time.

Last week alone we saw three major players in the FreightTech world get the opportunity to take their companies to the next level. The first round of FreightTech startups has graduated to the big leagues, leaving a trail of others hoping to follow in their footsteps.

These hopefuls waiting in the wings are bringing more to the party than their predecessors.

For example, Emerge, founded in 2017, is aiming to be the universal platform for RFPs. Any carrier on the platform can see the lanes a shipper has out to bid. With future plans to have a scorecard for any carrier on the application visible to any shipper.

Successfully building relationships and integrating shipper networks on a large scale has allowed for shippers to feel comfortable to expose their networks to a large number of providers.

With all this funding being thrown at startups, it begs the question: How do existing companies grow without an influx of capital?

Some companies will look at marketing, sales, internal processes — anything they think can be a quick win to boost revenue. What most don’t realize or want to realize is that a lack of updated technology is a major factor holding them back.

Most companies have a legacy system(s) they’ve sunk years of development hours, thousands, if not tens of thousands of dollars, and built processes around.

By continuing to make code changes and fixing the same system it is increasing the technical debt, so that you are making the “easy” fixes for now but increasing your long term problems.

For example, I had a similar issue with data importing:

“This system is supposed to be ‘no touch EDI’ yet we have to ‘touch’ every shipment to make corrections with how loads are marked complete or billed.”

Only to be met with: “That’s just not an option here. We’d have to change the entire importing process and how the system read information.”

This results in at least 3 employees wasting roughly 4 hours a day on a task that could have and should have been automated.

If we have learned anything with the introduction of freight technology, automation is king. It allows people to do more in their working hours and not waste time and energy on something that is not making any money.

Some of the biggest success stories I’ve heard lately are about how companies have invested in technology that works for their carriers’ sales representatives. By implementing technology that improves productivity and workflow, individuals have been able to book at least twice as many loads while not adding to their in-office time.

Who doesn’t love making twice as much money for the same amount of effort?

Maybe it’s time to take a hard, uncomfortable look at some systems and their processes to see if there is room for improvement.

Quick Hits

It’s electric: The future is here. Since the US has re-entered the Paris Climate Agreement, sustainability is now a topic on everyone’s minds. Some shippers have started the sustainability swap now.

Anheuser-Busch has switched at least 30% of their dedicated fleet out of St. Louis and Houston over to 100% renewable natural gas. The end goal being to reduce the emissions in their supply chain 25% by 2025.

Amazon has already started utilizing electric delivery trucks for their home prime delivery services in Los Angeles this year. Their end goal is to be net-zero emissions by 2040.

This will likely become more commonplace as shippers and carriers alike are becoming more involved in the EPA SmartWay program. Which helps companies identify more emissions efficient freight carriers, supports global energy security and carbon offsets, and reduces freight transportation related emissions but accelerates the use of advanced fuel-saving technologies.

With the availability of electric trucks becoming more commonplace, now is the time to understand what shippers’ main driving factors are.

Is it still just “i want the lowest price with the fastest carrier”, or has it morphed into meeting some of their other company metrics regarding their emissions in their supply chain.

When the market switches, it’s important for the individual broker to know a little bit more about the trucks themselves. If your customers start having emissions requirements that becomes another requirement on the load.

It’s like when you ask for a flatbed. Do you need a Conestoga, low boy, step deck, etc.

Let the barometer for this change be the building of the nation’s electric charging infrastructure to serve as how quickly electric trucks will enter the market.

Currently the maximum distance a semi truck can go is 250 miles before requiring a charge. That won’t get you very far, but if there are charging stations every 100-200 miles then suddenly having electric trucks on the road becomes a more viable option.

Ultimately, start working with your shippers now, make sure you can be involved as possible in what their sustainability goals are for their company so you make sure you’re able to provide for them.

Market Check

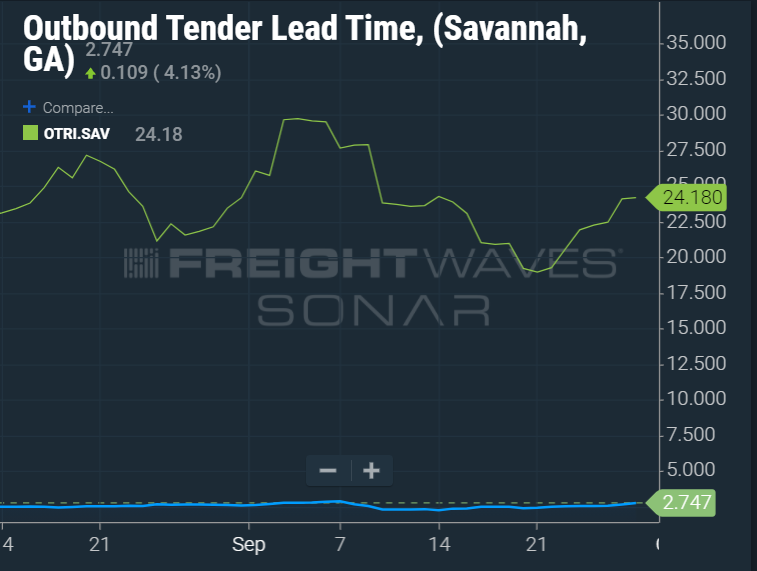

Leaving on a midnight train to Georgia? You’ll have to schedule that a few days in advance. Georgia right now has almost a three-day lead time, specifically in the Savannah market.

Outbound tender rejections are high, meaning capacity is tight. This is nothing new for Georgia but what is interesting is that there was a 5% increase in outbound tender rejections from last week in just the Savannah market.

Now we do have to remember it is harvest season. It’s something to keep in mind when sending trucks into the area. Capacity will be tighter there than most other places.

Who’s with Who

ArcBest has acquired MoLo for $235 million. In a move that will single-handedly propel both companies forward to new heights, ArcBest, with the new acquisition of MoLo, will make it a top-15 truck broker in the country. MoLo will be able to offer its existing customer base a broader range of service and in turn ArcBest can expand its brokerage side into a powerhouse. Read more here

The More You Know

Plus delivering autonomous systems in China after equipping Amazon trucks in US

Transport heads want solutions to ‘resolve’ supply chain issue

Want this in your Inbox? Subscribe here