Oil prices plummeted Wednesday before making a late-day comeback, with the possible spread of the coronavirus cited as the force behind the downturn.

Traders have looked over their data, searched their memories and are remembering that in 2003, when the SARS virus was impacting much of China and Hong Kong, international air travel fell sharply. Jet fuel demand fell with it.

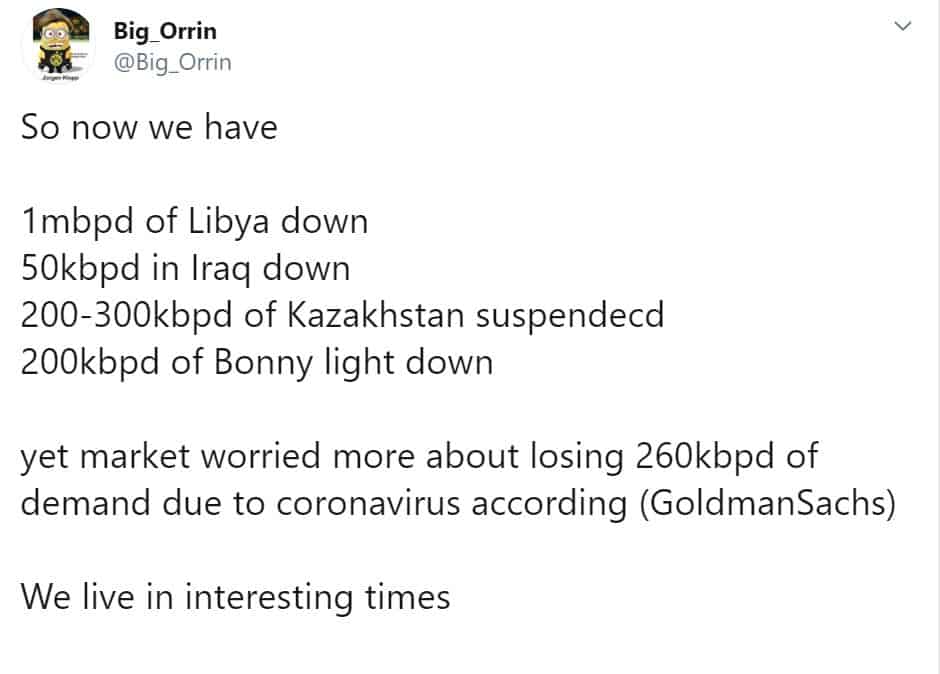

Goldman Sachs gave a push downward to markets Wednesday when it said in a report the coronavirus and accompanying jet fuel decline could result in a 260,000-barrel-per-day drop in global oil demand. Percentage-wise, that is a fraction of the roughly 100 million barrels per day that the world consumes.

But in a market that is already looking at models showing supply exceeding demand in 2020, it is not insignificant. According to news reports of the Goldman Sachs forecast, a drop in demand of that magnitude, mostly coming from a drop in jet fuel demand, would reduce the price of Brent crude by $2.90 per barrel. Brent is the global crude benchmark.

Jet fuel, like diesel, is a distillate. A collapse in one would be expected to spill over into the other.

But even though it is jet fuel that is being fingered as the most likely product to take a hit if the coronavirus problem becomes something of an epidemic, the diesel market was somewhat stronger than most other oil benchmarks Wednesday, both in the commodity markets and physical markets.

On Tuesday, ultra low sulfur diesel (ULSD) dropped 1.61% to a settlement of $1.8292 per gallon. That was roughly a full percentage point larger decline than what was posted by the WTI and Brent crude benchmarks.

And on Wednesday, ULSD fell by about the same percentage: 1.59%, to $1.8002 per gallon. But that was less than WTI crude, which dropped 2.66%, and Brent, which declined 2.14%. RBOB gasoline dropped 3.48%.

In physical markets, diesel market spreads tightened. For example, the price of a pipeline quantity of ULSD in the Gulf Coast relative to the CME benchmark narrowed slightly, according to data provided by S&P Global Platts. It was negative 8.75 cents a gallon Wednesday; on Tuesday, it was negative 8.75 cents. A physical barge of ULSD in New York Harbor was 1 cent less than the ULSD CME price on Wednesday after being 2 cents less a day earlier.

The settlement prices were mostly on the high end of the day’s range, which swung wildly but were mostly trending upward as the day’s trading ended. The ULSD settlement of $1.8002 was about in the middle of a 6-cent range, large for a one-day session. Brent was $63.21 per barrel, toward the low end of a $62.95-$64.59 range, and WTI settled near the bottom of its $56.54-$58.38 range.

Andrew Lebow, president of Commodity Research Group and a longtime observer of petroleum markets, said the relative strength of diesel Wednesday compared to crude is a normal reaction given how much it has fallen relative to Brent and WTI in recent weeks. “Refined fuels have just been destroyed,” he said. “Margins are horrendous and eroding.” Markets will often take a break in that sort of trend after several days of moving in one direction, Lebow said.

The simple crack between front month Brent and ULSD on CME has fallen to about $12.40 a barrel. On the final day of 2019, it was more than $19. There are 42 gallons in a barrel.

As noted earlier, a drop in demand as a result of the coronavirus would fall on a market generally seen as oversupplied in 2020. That view got affirmation this week when Fatih Birol, executive director of the International Energy Agency, said during a forum at the Davos meeting in Switzerland that he expected a 1 million-barrel-per-day surplus in world oil markets this year.

But even as the coronavirus news and the Birol statement would work to push down prices, oil supplies are being affected by a cutoff of most Libyan supplies and a new problem with Nigerian supplies that developed Wednesday. And yet, the trend has been downward.

When traders holding long positions see that, Lebow said, it can persuade them it’s time to get out of the market. “You’re long and you’re looking at what’s going on and you wonder, what is it going to take to make this market go up?” Lebow said.

Diesel markets may get another downward push overnight and into Thursday on the back of the weekly report from the American Petroleum Institute. That report, released late Wednesday, showed U.S. distillate inventories building 3.5 million barrels. The S&P Global Platts forecast was for a build of 1.6 million barrels.