A year ago, an armada of ships came to Europe’s aid, bringing U.S.-produced liquefied natural gas to replace Russian pipeline gas supplies lost in the wake of the war. The outlook for the coming winter was dire despite the surge of American LNG cargoes — then it grew even worse.

A fire and explosion took Texas’ Freeport LNG facility offline last June, removing a major U.S. export source. The price of natural gas in Europe hit $100 per million British thermal units (MMBtu) in late August, the equivalent of $600-per-barrel oil.

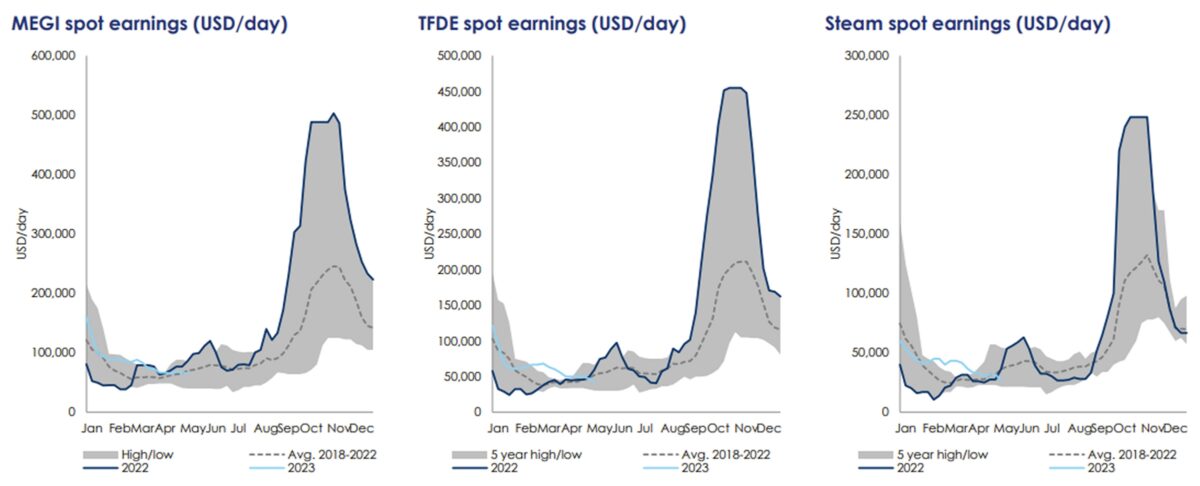

Then someone blew up the Nord Stream pipelines in September, severing Europe’s largest remaining supply of Russian gas. By November, LNG carriers were earning spot rates of $400,000-$500,000 per day — more than any other commercial cargo vessels had in history.

Fast-forward to today. Europe’s natural gas situation is vastly improved, despite receiving far less Russian gas than in 2022.

Luck has played a big role. Europe enjoyed one of its warmest-ever winters, slashing gas demand. Competition for LNG cargoes from China was heavily curbed by China’s draconian COVID policy.

Natural gas inventories were further buoyed by European demand destruction from high pricing and conservation, and throughout it all, U.S. LNG cargoes kept on coming. They still are.

European inventories above 5-year average

Brent crude traded at $77 per barrel on Wednesday. The price of natural gas in Europe is down to around $10-$11 per MMBtu, the equivalent of around $60 per barrel of oil, said Oystein Kalleklev, CEO of shipowner Flex LNG (NYSE: FLNG), during a conference call Tuesday.

The Wall Street Journal recently reported that natural gas has not been this cheap in Europe since July 2021, seven months prior to Russia’s invasion of Ukraine.

Anatol Feygin, chief commercial officer of Cheniere Energy (NYSE: LNG), America’s largest LNG export facility operator, said on a conference call earlier this month: “With storage levels above the five-year average this year, Europe is positioned well as it looks to replenish supplies of the 2023-2024 winter.”

Shipping redirects post-invasion commodity flows

Europe’s surprisingly high natural gas inventories offer yet another example of how shipping has allowed commodities to take new routes and buyers to avoid war-induced shortages (with shipowners profiting in the process).

The pattern is the same across the commodity spectrum. LNG carriers have allowed Europe to replace Russian pipeline gas with LNG from the U.S. Crude and product tankers have brought new supplies to the EU, replacing Russian crude and diesel, and brought Russian crude and diesel to new destinations.

Dry bulk ships have kept the world’s agricultural markets supplied despite wartime constraints on Ukrainian corn and wheat. Liquefied petroleum gas carriers have allowed Europe to replace Russian pipeline supplies of ammonia fertilizer.

‘Europe is really gobbling up spot cargoes’

America has even more LNG export capacity this year with the Freeport facility back online since February. “We expect the U.S. to become the biggest exporter of LNG in 2023,” said Kalleklev, citing U.S. government estimates of 14% year-on-year growth.

“On the import side, we see the same trend we saw last year. Europe is really gobbling up spot cargoes in order to replace the lost volumes from Russian pipeline gas,” Kalleklev said.

Not only does the U.S. have more export capacity in 2023 versus 2022, Europe has more import capacity.

Feygin noted that five floating storage and regasification units (FSRUs) have been positioned in the Netherlands, Germany and Finland over recent months, adding over 13 million tons per year in regasification capacity in the first quarter alone.

It takes years to build a land-based regasification terminal. FSRUs, which are either purpose-built or converted from old LNG carriers, are mobile and can be bought online quickly.

Roughly two-thirds of U.S. LNG exports went to Europe in 2022. In prior years, only a third had gone to Europe. “U.S. flows to Europe continued to remain strong in Q1 2023,” said Feygin.

“In fact, approximately 80% of cargoes produced by our two sites were delivered to Europe in the first quarter. The pricing was more attractive in Europe than it was to Asia. It’s as simple as that. We obviously don’t control the vast majority of the volume that we produce and our customers took advantage of the destination flexibility.”

Increased Asian competition for cargoes

What happens next for LNG shipping rates depends on how much Asian buyers compete for cargoes now heading to Europe as stockpiles are built up before winter. What happens in China, in particular, will be key.

Shipping demand is measured in ton-miles (volume multiplied by distance). The more U.S. cargoes head to Asia as opposed to Europe, the longer the average voyage distance and the higher the LNG shipping demand.

“The big question this year is how strong will import demand be from Asia? How fierce will the competition be?” said Kalleklev. He noted that Chinese LNG import demand growth was flat in January and February but rose 17% year on year in March and April combined. “It’s a bit early, but there is some positive sentiment toward Chinese imports, especially when [commodity] prices are at these levels. We see this in the routing of our ships. We see more ships going to Asia.”

‘Tide could be turning’ for spot rates

Spot rates for tri-fuel diesel engine (TFDE) LNG carriers now average $42,700 per day, around one-tenth of record highs in November, according to Clarksons Securities.

However, Clarksons Securities analyst Frode Mørkedal noted that “the forward freight market indicates that the tide could be turning.” Derivatives are priced at $68,000 per day for June, $76,000 per day for July, $102,000 per day for August and $209,000 per day for the fourth quarter.

That said, the vast majority of seaborne LNG is transported by ships under long-term charters, not voyage charters. Spot rates are less important to LNG shipping than in any other shipping segment, and long-term LNG carrier charter rates have remained strong. One-year TFDE charters are now at $140,000 per day and three-year charters at $120,000 per day, according to Mørkedal.

The LNG shipping business is overwhelmingly about locking in long-term charters and reaping sustainable returns, not gambling on spot rates and buying assets low and selling them high — as is the case in tanker and dry bulk shipping.

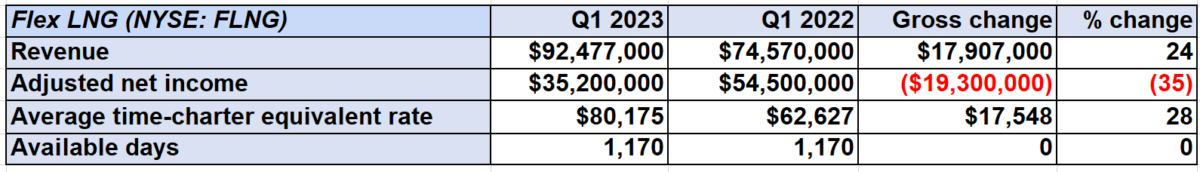

Flex LNG, which reported Q1 2023 results Tuesday, is a case in point: It doesn’t have any ships coming off charter until 2027 (assuming charter extensions are exercised). As Kalleklev put it, his company’s 11% dividend yield over the past year is “safe” and “a much better yield than you’re getting on a government bond.”

Click for more articles by Greg Miller

Related articles:

- What will happen if Russia blocks Black Sea grain ships?

- One year later: How Ukraine-Russia war reshaped ocean shipping

- China-Russia vs. US-EU: How global shipping is slowly splitting in two

- European tanker owners make a fortune off Russian oil trade

- What do crazy $500,000-per-day rates say about shipping demand?

- Biden-EU energy pact: LNG shipping game changer or wartime hype?