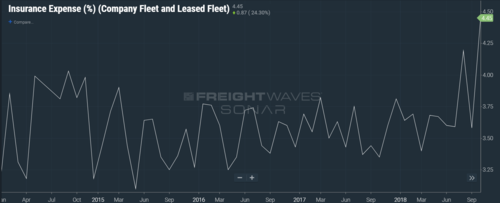

(CHART: DATA FROM TRUCKLOAD CARRIERS ASSOCIATION INSIDE FREIGHTWAVES’ SONAR)

Despite many truckload carriers reporting record revenues and strong operating ratios in the second and third quarters, TCA data housed inside FreightWaves’ SONAR shows an anomalous jump in insurance expenses, spiking as high as 4.45% of total revenue at the end of October 2018.

TCA’s insurance expense data is collected from a sample of asset-based carriers that participate in TCA Best Practice Groups. The data represents insurance expense as a percentage of total revenue at the operations.

At the end of October 2017, insurance expenses only took up 3.35% of total revenue, representing a 1.1% climb year-over-year. In August 2018, insurance expenses topped 4% of total revenue for the first time since September 2014.

Reliance Partners President Chad Eichelberger said auto liability market losses are a persistent issue for many companies in the truck insurance space. This, combined with fact that several major insurance companies have left the space in recent years, has contributed to rising insurance premiums.

“We are hearing that more insurance companies are at or near their premium capacity. This means that in general, insurers can afford to be more selective or get additional premium per truck that is needed to offset what has been an unfavorable overall auto liability market,” Eichelberger said. “I believe the rate of increase in the auto liability line has definitely been more pronounced since July of this year. The increases have not necessarily been proportionate in all regions of the country either. We have seen rate increases in areas like Texas outpace others elsewhere.”

He said insurance companies are also interested in getting additional premium exposure in other lines as a means if shielding against possible losses on the auto liability line.

Eichelberger noted that these rising premiums can prove especially challenging for new venture companies. While there are plenty of insurance companies willing to provide coverage, the cost can pose as a stumbling block for those without a proven track record of safety to rely on.

When it comes to more established companies in the space, not all companies are seeing premium increases. In fact, some companies with exemplary records are seeing their premiums decrease, despite wider trends.

“We have plenty of trucking companies that have seen insurance premiums decrease and or stay flat,” Eichelberger said. “Outside of historical losses and loss frequency, insurance underwriters are looking at areas such as CAB scores, driver turnover, radius of operation, safety program, financial stability, years in business, growth and equipment.”

Eichelberger acknowledged that some of the factors underwriters take into account are out of the trucking company’s control, but he was optimistic that improving the factors within the company’s control would still yield positive results.

“Attention to detail and running a great operation will make your trucking company more attractive to insurance underwriters,” he said.