Recruiting and keeping qualified workers remains the top challenge for supply chain executives, according to the industry’s annual report card on industry attitudes released Thursday at the ProMat 2023 material handling, logistics and supply chain conference in Chicago.

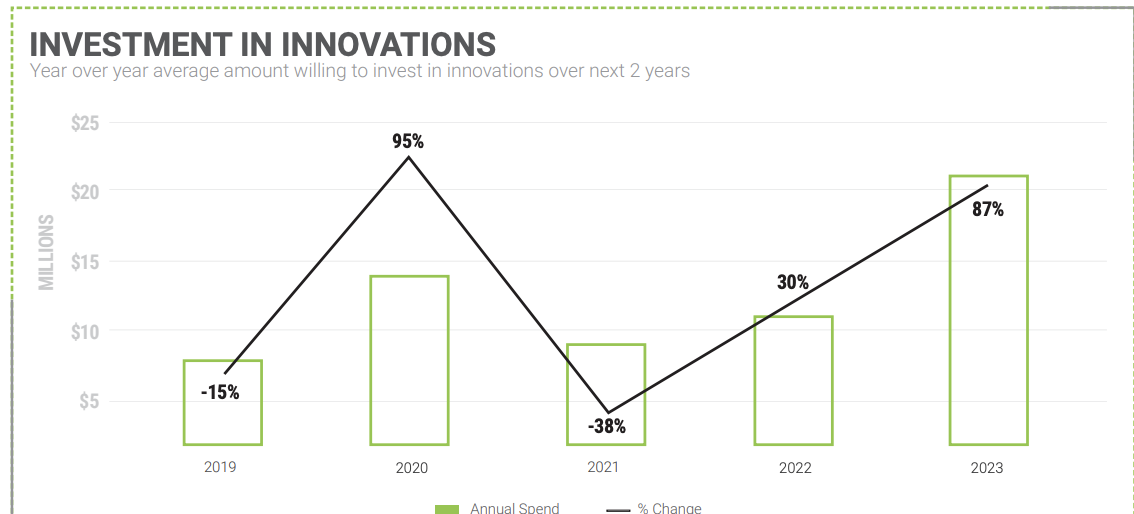

The report, published by the trade group MHI and consultancy Deloitte, found that 74% of 2,000 respondents, virtually all supply chain leaders, plan to boost their technology investments in 2023 over the past year. About 90% of those companies will spend 24% more than in the prior year, while 36% will spend 19% more, according to the report. The survey was conducted at the end of 2022.

Much of that investment is geared toward creating high-productivity roles that will appeal to people entering the field or transferring from another field, the report said.

The highest level of IT adoption over the next five years will be in the area of inventory and network optimization (see chart below). There, 87% of respondents expect to dramatically ramp up spending over the next five years. That was followed by investments in cloud computing and storage, sensors and automatic identification, and advanced analytics, the report said.

According to the report, the demand to adopt 11 different technological categories will rise significantly during the next five years.

About 57% of respondents said that hiring and retaining qualified workers was the biggest supply chain challenge. That was followed by the talent shortage at 56%. This year, however, supply chain disruptions, stockouts and increasing customer demands — all legacies from the pandemic — followed close behind, according to the report.

Companies are investing in new technologies to improve efficiency and to reduce the need for repetitive manual labor. These investments “create the kind of advanced technology environment that results in more rewarding supply chain jobs that appeal to today’s top talent,” according to the report, titled “The Responsible Supply Chain.”

In the meantime, 41% of respondents are reskilling or upskilling labor to support emerging technologies, according to the survey. About 34% said they were recruiting for skill sets for future needs, and 27% are building a culture of innovation that allows them to succeed regardless of the challenges at hand.

In a world in which disruptions will be the norm, most companies are planning to either partner with vendors or build and pilot their own technologies, according to the survey.

In years past, companies could get away with collaborating with a small set of supply chain partners. However, the supply shocks of the past three years have demonstrated the need to widen collaborative efforts and expand data-sharing capabilities, the report said.

Nearly half of the 2023 respondents said they are faced with increasing pressure from multiple stakeholders to become more environmentally conscious. However, only 23% have made compliance with reducing scope 3 emissions a top focus of their efforts. Scope 3 emissions are the result of activities from assets not owned or controlled by the reporting organization but that the organization indirectly affects in its value chain.

About 40% said that electrification was the top focus for sustainability. That was followed by natural resource management, water usage and transition to renewable energy.

By 2027, autonomous, connected and intelligent supply chains will be the norm, according to 87% of the respondents. Only 5% said the industry is there today.

In 10 years, digital supply chains will be the norm, with seamless end-to-end networks delivering transparency at all levels of planning and execution, according to the report.

“This means a future where companies have invested in digital transformation will see increased speed, connectivity and transparency” and will be “certain to benefit from data that is accurate, shareable, secure and actionable,” the report predicted.

.