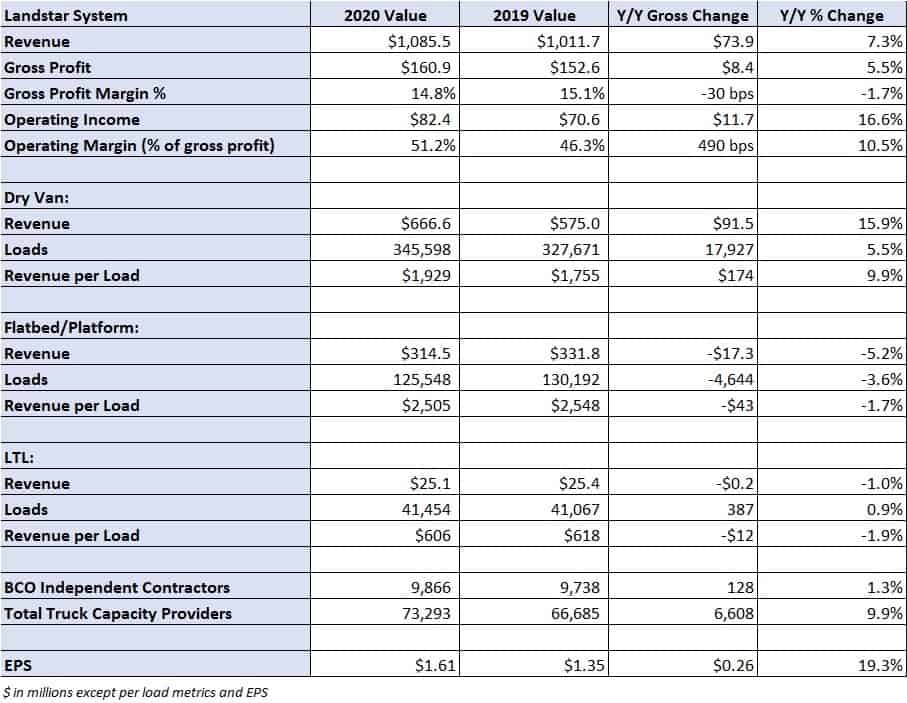

Truck broker Landstar System Inc. (NASDAQ: LSTR) experienced quite the turnaround during the third quarter, reporting earnings per share (EPS) of $1.61, 19 cents higher than the consensus estimate and 26 cents higher year-over-year.

The Jacksonville, Florida-based company’s original guidance called for loads and revenue per load to decline in the mid-single-digit range year-over-year, but by the close of July they were only off 1% and 2%, respectively. By the first week of August, both metrics had turned positive compared to 2019.

“Landstar entered the third quarter of 2020 facing one of the most unpredictable and challenging freight environments in the Company’s history,” President and CEO Jim Gattoni stated in the Wednesday afternoon press release.

Landstar raised earnings expectations in early September, calling for low-single-digit increases in truck volumes and revenue per load with corresponding EPS of $1.40 to $1.46, well ahead of its original guidance of $1.11 to $1.17. The $1.61 result was the company’s second-highest third-quarter earnings result in its history, only behind the 2018 period.

During the quarter, dry van loads increased 6% with revenue per load climbing 10%. Flatbed loads were off 4% with revenue per load dipping 2%.

“The number of loads and revenue per load on loads hauled via truck for fiscal September 2020 continued to improve from August 2020 on a sequential basis beyond our expectations, particularly with respect to the demand for services provided by van equipment, and exceeded fiscal September 2019 amounts by 7% and 10%, respectively,” Gattoni continued.

So far in October, truck loads are up in the high-single-digit range year-over-year and Landstar is guiding for similar increases for the entire fourth quarter. Truck revenue per load is expected to increase in the low double-digit percentage range year-over-year as pricing is expected “to remain strong and relatively stable through the 2020 fourth quarter given current demand and assuming little change in the level of truck capacity available in the marketplace,” said Gattoni.

Fourth-quarter revenue is expected to be in the range of $1.15 billion to $1.2 billion, compared to the current consensus estimate of $1.09 billion with adjusted EPS of $1.61 to $1.71 versus analysts’ current forecast of $1.51. The EPS range excludes 29 cents per share of a one-time expense related to the restructuring of its independent sales agents’ compensation plans.

Landstar reported a sequential rise in truck capacity in its network. Business capacity owners (BCOs) increased more than 2% with total capacity providers climbing 15% from the second quarter.

Landstar will hold a conference call to discuss these results on Thursday at 8 a.m. EDT.