Hurricanes and FEMA freight

Hurricane season can frequently — and unexpectedly — change the trucking dynamic. Part of this involves the positioning of equipment in anticipation for hauling FEMA freight. With the approach of Hurricane Ian, the yearly tradition of disaster relief supplies began anew. But understanding the extent of the impact FEMA loads will have on truckload markets and spot rates will take time, as declines in outbound tender rejection rates and increases in spot market rates will be plainly observable after the storm passes.

For carriers and brokers hauling FEMA freight, an important point to consider is making sure one gets paid. Craig Fuller, CEO and founder of FreightWaves, said, “This is a big problem for trucking companies if they’ve not hauled FEMA disaster-relief loads before, and some of the brokers that are involved in the process can take advantage.” Fuller added, “They may not pay you detention, which is BS, because the federal government pays the broker detention. They will ask for documentation, but make sure that you get paid for detention because it’s your equipment and you’re the one that’s stuck.”

Part of this concern involves the archaic paperwork process both carriers and brokers go through when dealing with FEMA. Not only is it difficult and time consuming to get set up and approved to work with FEMA, but the detention on trailers and documentation required for invoicing can take additional time before those payments reach carriers.

Power-only growing in importance: UBS report

According to a recent report by the UBS Global Research and Evidence Lab, both freight brokerages and asset-based trucking companies are expanding their power-only offerings. For those unaware, power-only refers to using trailers from one carrier or fleet, being picked up by an independent driver or another carrier and delivered to a customer. Often these can require what is called a trailer interchange agreement.

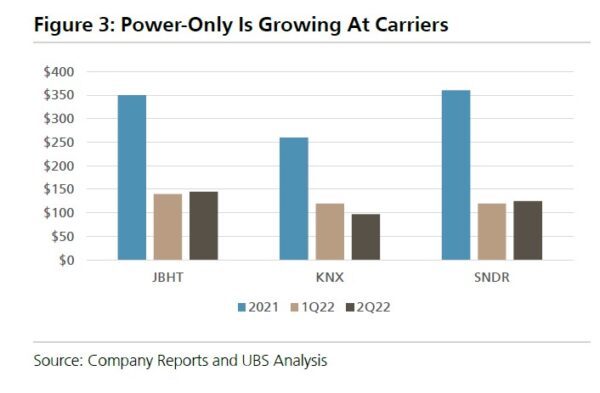

The UBS report said, “Not discussed much as a business concept even two years ago, power-only has grown to account for upwards of $350mm and $360mm of revenue at JBHT and SNDR in 2021, respectively, with trends from 2Q22 pointing towards +10% revenue growth in this business in 2022. WERN has noted that TTS (dedicated, one-way TL) has a total of 25,905 trailers for 8,400 trucks as of the end of 2Q22 (3.08 ratio of trailers to trucks) vs. 23,090 trailers for 7,645 trucks at the end of 2Q21 (3.02 ratio of trailers to trucks) — we believe the power-only business is growing at WERN as well.

For large asset-based carriers, creating an opportunity for moving and using spare equipment like trailers via power-only loads can be quite lucrative. The UBS report added, “We believe that power-only as a business can carry margins of ~20-22%, based on our analysis, and brings attractive characteristics to carriers.”

Market update: ACT Research shows August trailer order improvement

Recent data released by ACT Research shows improved net trailer orders as OEMs see some supply chain improvements. According to the report, “August net U.S. trailer orders of 17,777 units were 4.6% higher compared to last month, but more than 37.7% above the year-ago August level.”

Jennifer McNealy, director of CV market research and publications at ACT Research, said in the report, “While manufacturers continue to wrestle with rolling supply-chain disruptions, as well as challenges on the labor front, tangible improvements are being made.” She concluded, “OEMs are investigating longer-term supply solutions, including but not limited to increased parts inventories and automation to offset labor pains, in hopes of getting ahead of potential future disruptions. Demand remains strong, cancellations remain insignificant as fleets in queue plan to stay in line, and we’re beginning to hear about price stabilization accompanying the smoother flow of materials in the supply chain.”

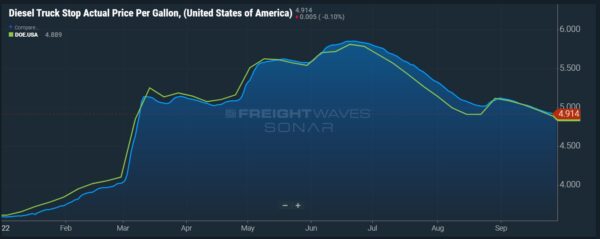

FreightWaves SONAR spotlight: DOE/EIA fuel price moves reach six-month lows as Hurricane Ian approaches.

Summary: The run-up to Hurricane Ian’s landfall this week has yet to be observed in the fuel data. On Monday, the weekly average retail price for diesel from the Department of Energy’s Energy Information Administration fell for the 13th time in the past 14 weeks, falling to $4.889 per gallon — a decline of 7.5 cents per gallon. This is the lowest level for the benchmark price used for most fuel surcharges since March 7.

Regarding Hurricane Ian’s impact on fuel markets, FreightWaves’ John Kingston wrote, “Markets will be watching Hurricane Ian and its impact on oil markets. Both BP and Chevron announced production shut-ins Monday at some of their Gulf of Mexico platforms in anticipation of Ian.”

Kingston added, “But the most widely expected track of the storm takes it along the west coast of Florida, making landfall somewhere between Naples and the Tampa Bay area. Offshore production in the Gulf of Mexico is farther west than where Ian is expected to make landfall. There are no refineries in Florida.”

The Routing Guide: Links from around the web

US trucking forced into low gear as shippers use breathing space to cut costs (The Loadstar)

Amazon Routinely Hired Dangerous Trucking Companies, With Deadly Consequences (The Wall Street Journal)

Trucking comes to the rescue during hurricanes (FreightWaves)

Are ELDs making the trucking industry safer? (FreightWaves)

FMCSA Seeks Input on CDL Third-Party Training, Testing Programs (Transport Topics)

Fleets can pivot to tackle chronic driver turnover (Fleet Owner)