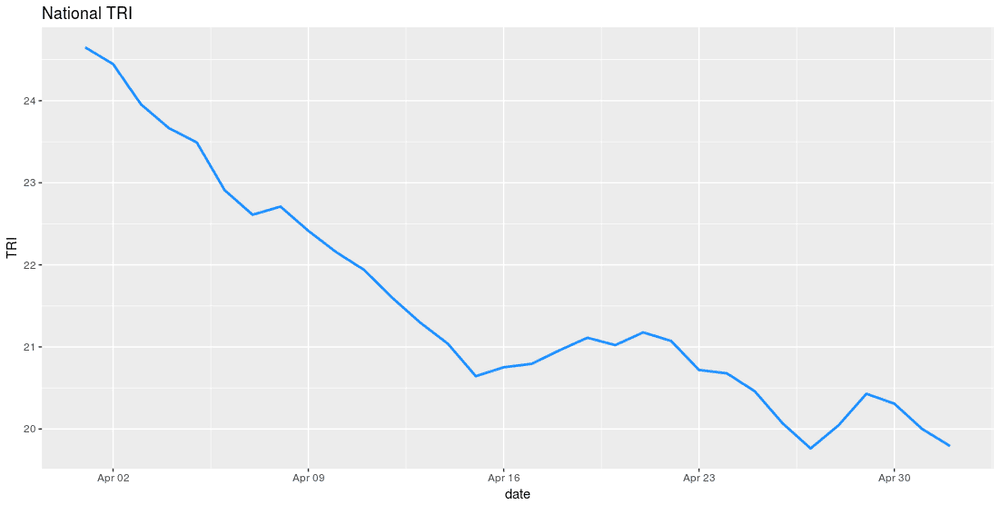

For the past month the national Tender Rejection Index (TRI) has been showing signs of stabilizing as carriers are remaining in their contracted rates versus putting capacity on the spot market. Along those same lines DAT has been reporting declining rates in the spot market over the past 3 weeks. After reaching a high of $2.24 per mile on the dry van market average rates dropped and are now sitting at $2.16 per mile. Amid a slew of earnings calls many CEOs of trucking companies alluded to a slower start to April than anticipated. The TRI is showing that trend continues.

Most recently C.H. Robinson announced their quarterly earnings that came in lower than expected. Analysts at Cowen broke down what contributed to this disappointing result as they comment, “The last time CHRW’s TL (truckload) volume mix was 50% spot/50% contract was in mid-2015, the start of what would become a roughly 12-18 month industrial recession.” They make a note that CHRW’s mix is not quite 50/50 but 55% contract and 45% spot. They also say they do not expect an industrial recession but they “do expect the truck market to come off its highs in the coming months.”

Considering the TRI should be a leader in predicting spot market volatility by a period of a few weeks there is little reason to believe the spot rates will see anything but continuing flatness to slow decline in the near term.

The reasons for the reduced TRI have origins in 2017 as weather events and government regulations had significant impacts to capacity, driver hours, and shipping volumes. All these issues occurred over a relatively short period of time creating the need for carriers to increase rates and capitalize on the supply and demand imbalance. Carriers found themselves in unfamiliar territory with shippers willing to dig a little deeper to secure power.

The contracted rate increases from those volatile times are the main factor in downward pressure on spot market rates. But another factor of the spot market decline is there has not been a major capacity event this spring.

The winter saw a series of major winter storms roll through the Northeast. We saw the storms impact in the Philadelphia area this March as 4 nor’easters, heavy snow and wind producing systems indigenous to the northeastern U.S., hammered the northeast shutting down many trucks unfortunate enough to be operating in the area. Carriers rejected loads going into the market at a rapid pace in attempts to keep their networks from being impacted without just compensation.

The spring season tends to see increases in shipping volumes but what the TRI is telling us is there are no significant spikes in volumes across the country. The produce season that disrupted so many networks last May and June has yet to have the same impact. It would be fallacy to expect a mirror image of last year considering many shippers do not want to experience the same unpleasant rush of 2017. You should expect them to have planned to avoid the same unpleasantness.

Carriers and shippers appear to have figured the market out for now, but there is no planning for the unexpected as 2017 taught us. Readers of FreightWaves can keep piece of mind knowing they will be ahead of the curve when the unexpected shows its head again.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.