Trucking is among the most fragmented industries on the planet. Growing up, I was told that there would be massive consolidation in the trucking industry following deregulation in 1980.

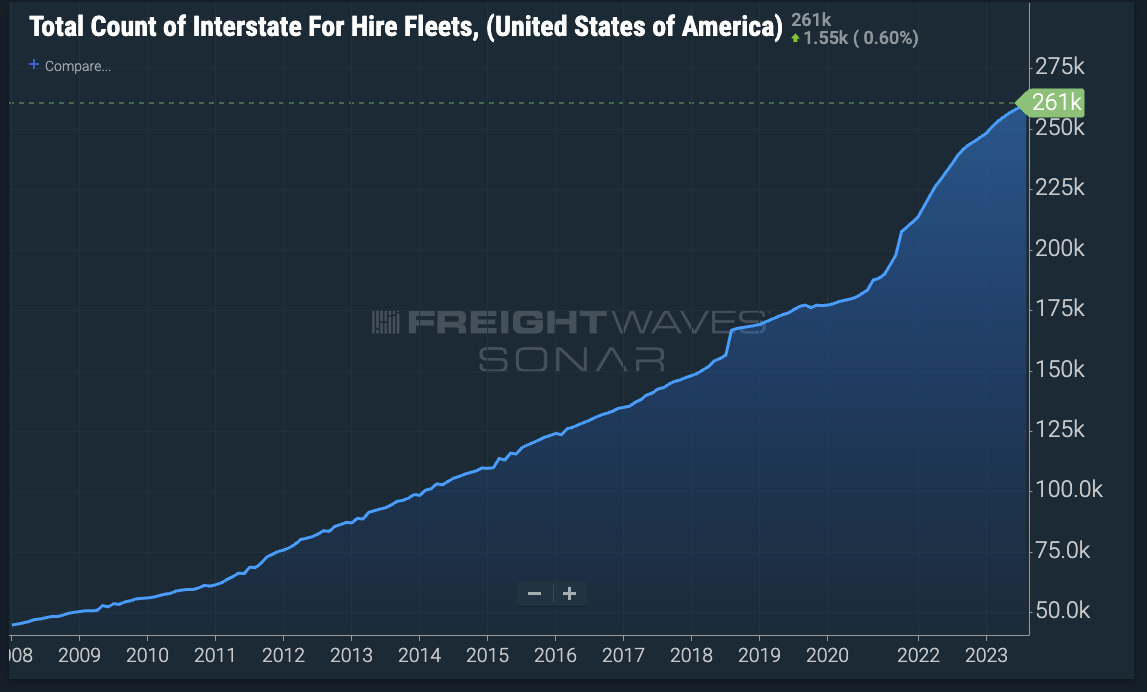

Instead, the opposite has happened. This chart shows the growth in the number of individual trucking fleets from 2008 to now.

There are a few reasons why — and some of them are unexpected.

The impact of deregulation on the trucking industry

Before deregulation, trucking rates were fixed and approved by the Interstate Commerce Commission (ICC). President Jimmy Carter deregulated the airline industry in 1978 and then the trucking and railroad industries, both in 1980.

As a result of deregulation, we saw significant consolidation in the airline and railroad industries. Meanwhile, there was an explosion in the number of trucking fleets, while many long-standing giants went bankrupt.

Under the ICC, starting a new trucking company was a bureaucratic nightmare. Expansion was so difficult that to grow, existing trucking companies had to seek ICC approval for the purchase of another trucking company in order to gain new routes. Prior to deregulation, trucking companies were only allowed to service certain route pairs and then only to haul certain types of goods.

It was only after deregulation that a trucking company could haul a load where it wanted to and for a price it set.

Trucking, along with most industries, used to be far more unionized. The Teamsters said in the mid-1970s that it had more than 2 million unionized truck drivers, many of whom were long-haul drivers.

Many of the trucking companies that filed for bankruptcy following deregulation were unionized — and the ones that replaced them were virtually never unionized. After deregulation, nonunionized long-haul truckload and less-than-truckload carriers were far more agile and able to compete successfully against unionized companies that had benefited from government regulation and fixed prices.

Because of their higher cost structure, the remaining union carriers were much less flexible and capable in the new environment. Therefore, over the next several years many unionized carriers filed for bankruptcy. New, nonunionized trucking companies took larger and larger shares of the market and were often high-growth businesses with attractive economics.

The recent bankruptcy of Yellow Corp. is an example of a unionized LTL carrier with pre-deregulation roots and long-term financial problems.

The impact of deregulation on the railroad industry

Railroads were also in a mess when they were deregulated, thanks in part to stringent ICC requirements and increased competition from long-haul trucking firms.

Following industry deregulation, the railroad industry went through a series of consolidations — decreasing to seven major Class I railroads. (That number is now six, after Canadian Pacific acquired Kansas City Southern in late 2021.)

The Class I railroads initiated widespread efficiencies and technological innovations after the ICC yoke was lifted. However, their overall carloads have greatly declined in recent years, thanks in part to new management strategies that prioritize profits over revenue growth. Shippers say rail service has overall declined in the past decade as a result.

Thanks to trucking deregulation, rail is no longer significantly cheaper than moving freight by truck. However, loads moved by truck are far less likely to be delayed by days — let alone weeks — than those moved by rail.

Those are additional tailwinds for the trucking industry, especially small carriers that provide ultra-low rates.

Containerized shipping changes the world

The humble steel box made global trade far simpler, cheaper and faster. That meant more stuff Americans could consume — and more freight volume for truckers to carry.

The earliest forms of intermodal began in the late 1940s and were driven by the Eastern railroads. In what was then known as “piggybacking,” truck trailers were lashed to railroad flatcars and moved by rail. But the practice did not become today’s integrated system for decades. Old rail corridors in the East — with low bridges, narrow tunnels and not enough double tracking — stunted this early version of intermodal, as did the railroads’ uncertainty over its long-term profitability.

In the early 1950s, Malcom McLean led the containerization revolution, which he had seen used successfully by the U.S. armed forces during World War II. He first used converted tankers to haul truck trailers to ports along the Eastern Seaboard and Gulf of Mexico. He and his staff then developed containers that were improvements to those used during the war and he built the first container ships.

Until the 1950s, most goods transported via water were shipped loose or packaged in small containers — known as break-bulk shipping. The steel shipping container reduced costs and the speed of loading, unloading and transportation. It revolutionized global trade. Due to McLean’s innovations, intermodal shipping became the preferred method of ocean transport by the mid- to late 1960s.

China’s rise had an outsized impact on the American trucking industry

After 15 years of negotiations, China was admitted into the World Trade Organization in late 2001. That led to a veritable explosion of Chinese-manufactured goods being imported into the U.S.

As a WTO member, China began to enjoy open access to U.S. markets. It also enjoyed a number of unfair advantages that it leveraged to sell goods to U.S. retailers and consumers. These advantages included very cheap labor and few human rights or environmental restrictions to slow it down.

China also had raw materials to fuel its industrialization and was able to drive industrialization through state policy.

The Chinese government’s policies of currency manipulation, cheap capital and massive infrastructure programs drove the nation’s rapid development. China’s WTO membership also had the unintended consequence of decimating the surge in North America Free Trade Agreement cross-border commerce.

This increase of imported goods — along with the boom of online shopping — meant more freight for trucking companies of all sizes to haul. Personal consumption expenditure of durable goods has more than doubled in the last two decades, according to federal data.

The growth of intermodal transportation in the US

As noted above, intermodal was a small share of the railroads’ long-haul freight in the 1950s and 1960s. However, two things happened that increased the use of intermodal rail transportation significantly. Beginning in the early 1970s, oil prices surged due to political instability and then later from the scaling of China’s industrialization.

As China’s manufacturing of industrial and consumer goods grew — combined with its WTO charter to export those goods — seaborne containers filled with cheaper goods poured into U.S. West Coast ports via ever-larger container ships. Big box retailers took advantage of the circumstances, importing many of their goods from China, significantly benefiting U.S. consumers through low prices.

After being off-loaded from ships on the West Coast, containers are put onto rail chassis and moved across the country, then trucked to warehouses and distribution centers. This intermodal system that developed is far more efficient and less expensive than other forms of transport.

Ever-increasing imports favored the increased use of intermodal rail. Moreover, intermodal carriage became (and is) a key revenue source for the railroads. The integrated system of intermodal transportation moves millions of intermodal containers annually.

Why intermodal works

The economics of intermodal rail scale as the distances the containerized cargo travels increases. Freight moved by ship travels slower than over land, so importers often prefer to bring freight to the nation’s West Coast ports — even if it is eventually bound for the population centers of the Midwest and East Coast.

U.S. population density can be thought of as two separate islands — the West Coast and east of Interstate 35. The Rocky Mountains and desert are beautiful but lack population density (the exceptions include Las Vegas, Denver, Salt Lake City, Phoenix, Albuquerque, New Mexico, and El Paso, Texas).

As the deluge of containers grew, large long-haul truckload carriers began to struggle with the volume and small margins. They simply couldn’t compete with intermodal rail. Therefore, circumstances favor moving imported containers eastward via rail intermodal. The distances to transport cargo from West Coast ports to the Midwest and East are long and therefore cost savings via intermodal rail add up.

Railroads are inefficient in many ways; however, they carry freight at a lower cost per mile than trucks. Intermodal rail is far more fuel efficient, consuming 25% to 33% the amount of fuel a truck does.

Truckload carriers pass their incremental fuel costs onto shippers through fuel surcharges, which are often based at $1.20 per gallon for diesel. Any incremental diesel cost at retail above $1.20 is paid by the shipper. Railroads also have fuel surcharges, but they are often half as much as truck fuel surcharges. Therefore, as fuel spikes, shippers move more freight via rail.

The rapid growth of containerized shipping, Chinese exports and rising fuel costs helped create the conditions for a much more extensive use of intermodal rail transportation. Since then, improved trackage, an increase in double tracking and higher tunnels/overpasses have led to double-stacking of intermodal containers in much of the nation.

The nation’s intermodal system works well because each mode — container ship, railroad and truck — efficiently and effectively does what it does best.

Brokerages ascend

Something else took place beginning in the 2010s that once again changed the trucking industry. Trucking brokerage, which had been a small cottage industry before 2010, exploded.

Before then, trucking brokerage was a last resort for shippers and carriers. For the most part, brokerages were only given the “junk” freight that was left in the market.

In 2000, trucking brokerages represented less than 6% of all truckload freight, according to Statista. By 2018, that hit 19%. FreightWaves estimates that brokerages accounted for as much as 30% of truckload freight during the COVID peak.

Brokerages began to invest in technology and sales teams in the 2000s, often providing better customer service and on-time delivery than the “mega” enterprise carriers. More and more shippers began to trust freight brokerages and named them as primary providers. Critically, shippers started to tender their higher paying, driver-friendly freight to brokers.

Today, many brokers often work with the smallest carriers, which means these carriers can now access high-paying, high-quality freight without needing a sales team or the technology that is mandated by the most discerning shippers.

Small trucking fleets will continue to dominate

With deregulation and the changing freight landscape of the past 50 years, many of the barriers to entry have evaporated. These and other factors have created significant growth for both small carriers and freight brokerages. Moreover, this process will continue.

The chart below shows the number of trucks per industry cohort: The white line is the total number of tractors among fleets of one to six trucks; the purple line is the total number of tractors among fleets of seven to 11 trucks; the yellow line is the total number of tractors among fleets of 12 to 19 trucks; the blue line is the total number of tractors among fleets of 20 to 100 trucks; the green line is the total number of tractors among fleets of 101 to 999 trucks; and the orange line is the total number of tractors among fleets of 1,000 trucks and more.

Based on research, discussions with fleet owners and brokerages of all sizes, industry news and events, FreightWaves predicts that the future of truckload carriers is not increased industry consolidation.

The future will be focused on small carriers that will continue to work closely with brokers to dominate the market.

The future of trucking is small.

All charts in the article are available on the FreightWaves SONAR high-frequency data platform. To set up a demo, check out SONAR.FreightWaves.com

Eric Carter

Looking the big trucking companies screw up! There lot of way they could had just about all the freight! But somebody got greedy and trying to hired more unnecessary people! You see why didn’t YELLOW TRY to get into an agreement with the RAILROAD? Now train can transport across country lot cheaper! But it CAN’T DELIVER FROM RAIL YARD! A smart business man would had been sure to build a terminal near the YARDS! Somebody got to transport it to the store or warehouse!! One they unloaded the trailer off the train . Where it going??? That to me, would been a smart idea keeping the company going strong! Driver could pull tractor into yard and hook up!

Victor

People need to remember how easy it is to open up your own fleet. Record numbers of them opened during the freight boom of the COVID era. And they just as rapidly go away to be replaced by new fleets (1 truck or 100 trucks, a fleet is a fleet). O/O will always be around and will always carry a dominate percentage of the freight we move. Some is on independent trucks. Some is on trucks leased to fleets. O/O are the safety valve for fleets, though. When they have too much to move in a certain area and not enough in house equipment, they’ll look to the O/O segment to carry the extra load (Pardon the pun). Consolidation? No. Changes? Yes. It is cyclical. Always has been, always will be.

Sean Stewart

I think that a lot of people need to look at the facts more carefully. First. I have been looking at various shipping modes for over 40 years. And as such I can say that although trucking is more efficient than rail in terms of getting to more places, it is not always cheaper. In fact today more trucking companies are piggybacking their loads on trains than 30 or more years ago. Regardless of the price of fuel at the pump $1.00 per gallon or $5.00 per gallon rail can haul more cargo for less cost.

Diana Slyter

Are you getting your numbers from the “postcard” STB fleet registrations? If so, a lot of those small fleets are no longer active and some never even hit the road. For example, I know of a guy who was for a hefty fee filing new carrier registrations to unsuspecting immigrants who had no idea what else they had to do to become truckers.

KAL

I wonder if the chart on Total Count of Tractors from Fleets has the ability to see how many of the fleets that are 1-6 trucks have their own authority but are actually leased on or running for larger carriers. It seems odd that once you hit 7 trucks in your fleet the numbers drop from 752k to roughly 190k fleets.

Brenda Zwyghuizen

HI Craig (my mom’s maiden name is Fuller). ☺

When talking about Yellow, you only referenced union costs as main/only reason for going under. There were multiple other reasons including miss-handling millions, multi-layered executive staff salaries and billions spent on electric and driverless truck research with no successful results.

People reading this without in-depth understanding will put another negative check to unions. Pay, benefits and time-off negotiated for drivers shows value at so many economic levels and attract quality drivers. There are also negatives, inability to be fluid with slow-drawn-out negotiations. I am not pro or negative unions – I do feel they are a valuable part of our economy and the ONLY reason in the 40’s & 50’s that the middle class grew in significant ways (along with the g.i. bill). In my small town – Steelcase & other companies paid employees as much as unions or more…JUST to keep the unions out. Bonus.

Just my 2 cents and I hope you have a nice day.

Stephen Webster

I am seeing a lot of small fleets of less than 20 company employees and total count of 40 or less trucks shutdown in past 8 months

I am told many more are behind on truck payments and ready to shutdown along with owner or lease ops with current insurance costs and low freight rates. A lot of these drivers and lease ops will not go back to a larger trucking company unless paid at least $28 hr on payroll with medical care in ont . Many have sent their families back to the county they came from because of higher housing costs in Ontario. Several have went back to Holland and 🇩🇪 already

Tyler Billeg

Rather than count of fleets, total count of unit share would be much more appropriate. While we see a larger number of “mom and pop” fleets, they continue to make up less of the capacity. Further, a chart showing the increase of freight next to the increase of “mom and pop” fleets over the same time period would likely suggest those numbers are closely aligned.

The future will likely see much more rapid consolidation than we are seeing now with the increase of truck prices, autonomous trucks, AB5 type laws, etc.