Old Dominion Freight Line saw continued demand weakness during the third quarter but signaled October could be the last of the big year-over-year declines for this cycle.

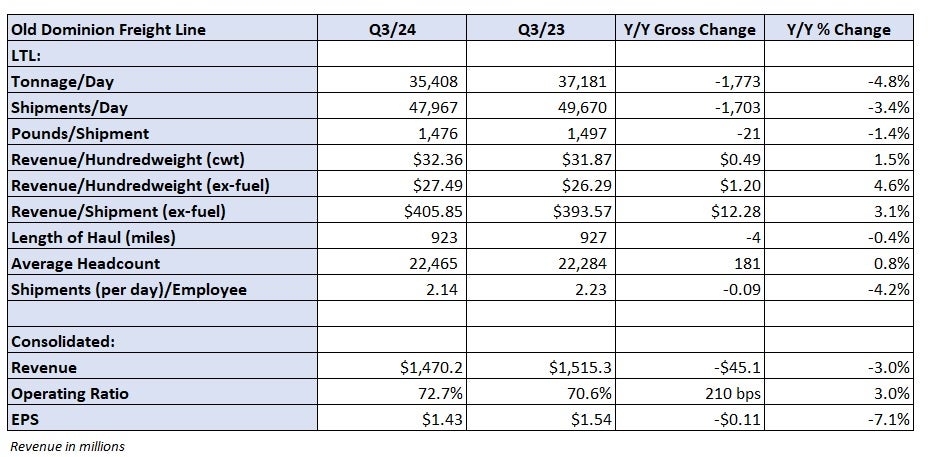

The less-than-truckload carrier reported $1.47 billion in revenue, a 3% y/y decline. Earnings per share of $1.43 were 1 cent ahead of the consensus estimate but 11 cents worse than the 2023 third quarter.

The company said y/y declines in operating metrics have accelerated so far in October. Revenue per day will likely be down 11.2% to 11.8% y/y for the full month. Tonnage per day is expected to be down 9.2% to 9.8% y/y, implying a 2% y/y decline in revenue per hundredweight, or yield. (Diesel prices are off 20% y/y, presenting a headwind to yields.)

The y/y comp for October will likely be the toughest for Old Dominion (NASDAQ: ODFL). Last October, a cyberattack at competitor Estes produced a short-lived volume uptick for the rest of the industry, which presents a headwind to this year’s comp.

“This feels like we’re finally getting to what we hope is a floor,” said Old Dominion CFO Adam Satterfield on a Wednesday call with analysts. “We’re encouraged about how things are trending. It’s good to see the sequential performance thus far in October.”

He said the sequential changes in October are getting closer to historical month-over-month change rates after two-and-a-half years of underperformance. Through the first three weeks of October, tonnage is off 3.5% sequentially versus the normal change rate of down 3.1%. He said this was the first time the company has started a quarter “relatively close” to normal seasonality.

Old Dominion has also seen a slight sequential increase in weight per shipment, which is often “a sign of hope with respect to the economy.”

“It feels like we’ve been running against the wind for a long time now, and we’re ready to see things start to turn around and give us a little bit of help from an economic standpoint,” Satterfield said.

Tonnage per day in the third quarter was down 4.8% y/y as daily shipments fell 3.4% and weight per shipment was off 1.4% to 1,476 pounds, near a historical low. The year-ago quarter was the first to benefit from Yellow Corp.’s (OTC: YELLQ) shutdown, making this year’s comps more formidable.

Across its book of business, Old Dominion continues to see weak demand from industrial-related customers (approximately 55% to 60% of revenue). However, retail-oriented customers and 3PLs are experiencing some growth.

Yield was up 1.5% y/y in the third quarter, 4.6% higher when excluding fuel surcharges. The yield increases are partly due to the lower shipment weights, but the company said it is continuing to capture increases on contractual bid renewals.

For the fourth quarter, management painted a picture where revenue could be off as much as 10% y/y. However, with normal seasonality, it will likely be off only 6% y/y to $1.4 billion as tonnage falls 6.5% to 7% and yield is slightly negative (up 3.8% to 4.2% y/y excluding fuel).

Old Dominion reported a 72.7% operating ratio (operating expenses expressed as a percentage of revenue) for the third quarter, which was 210 basis points worse y/y. The result was 80 bps worse than the second quarter, which was about 30 bps worse than management’s guidance.

A 1.7% increase in cost per shipment outpaced a 0.1% increase in revenue per shipment. The company said it would continue to try to price freight 100 to 150 bps above costs but noted that its core cost per shipment is running approximately 100 bps higher than normal. Widespread cost inflation and a decision to carry 30% incremental network capacity ahead of an eventual market turn have been headwinds.

Salaries, wages and benefits (as a percentage of revenue) were 250 bps higher y/y as head count grew 1% y/y and employee benefit costs stepped higher. Shipments per employee fell 4.2% y/y.

The company expects to see 300 to 350 bps of OR deterioration from the third to the fourth quarter, 100 bps worse than the normal change rate, implying a 76% OR (420 bps worse y/y).

“We’re not out of the woods yet,” Satterfield said but noted there are “some reasons to be optimistic based on what our trends have looked like thus far in October.” He reminded analysts that Old Dominion has a long track record of capturing share when the market inflects positively.

The company generated $447 million in cash flows from operations in the quarter ($1.3 billion for the first three quarters of 2024).

Full-year capex guidance of $750 million was reiterated. Investments include $350 million for real estate projects, $325 million for tractors and trailers, and $75 million for IT.

Shares of ODFL were down 6.3% at 2:25 p.m. EDT on Wednesday compared to the S&P 500, which was off 1.4%.