WASHINGTON — A dockworker strike along the U.S. East and Gulf coasts could endanger Kamala Harris’ presidential bid, say retail and transportation leaders.

The International Longshoremen’s Association (ILA) affirmed last week that it plans to strike if its contract demands are not met, and the West Coast ports, represented by the International Longshore and Warehouse Union, has pledged solidarity.

That’s why the Biden administration will likely be working behind the scenes – if it isn’t already – to ensure such a scenario doesn’t occur, according to a Washington insider whose members have the most to lose.

“I think someone in the administration – like [Labor Secretary] Julie Su or [Transportation Secretary] Pete Buttigieg is going to do something soon behind the scenes, maybe tell [the ILA] to tone down” the rhetoric, Michael Hanson, senior EVP of public affairs for the Retail Industry Leaders Association, told FreightWaves on Wednesday.

“I can’t gauge exactly what the union will do, but Harris does not want that kind of an economic headache before the election.”

RILA’s members, which include retail giants The Home Depot (NYSE: HD), Walgreens (NASDAQ: WBA), Best Buy (NYSE: BBY) and Target (NYSE: TGT), have already been shifting cargo to West Coast ports in anticipation of a strike, which could occur at the end of the month if an agreement with port terminal employers is not reached by then. “I don’t know exactly who and what percentage, but they’re moving it,” Hanson said.

FreightWaves’ SONAR charts show evidence of shippers looking to avoid getting caught in a work stoppage, with West Coast ports taking an increasing share of the import volume of the past several months as some retailers have opted to bring products in earlier and “frontload” the fall holiday shipping season.

Bad optics

While a strike may not directly harm consumers – i.e., voters – in the short term, negative media coverage alone could validate perceptions of a faltering economy and the ability of the Biden administration to deal with it, which would be projected onto the vice president.

“Any actual strike would be a national news event,” Loren Smith, a transportation policy analyst and founder of Skyline Policy Risk Group, told FreightWaves in an interview.

“And if a strike were to hit the seven-day mark, it turns into a very significant event, because a week-long port shutdown takes months for cargo backlogs to catch up. It would be a shock to the markets and unsettling for a lot of places along the supply chain. But it would also materially contribute to the narrative that the economy is shaky.”

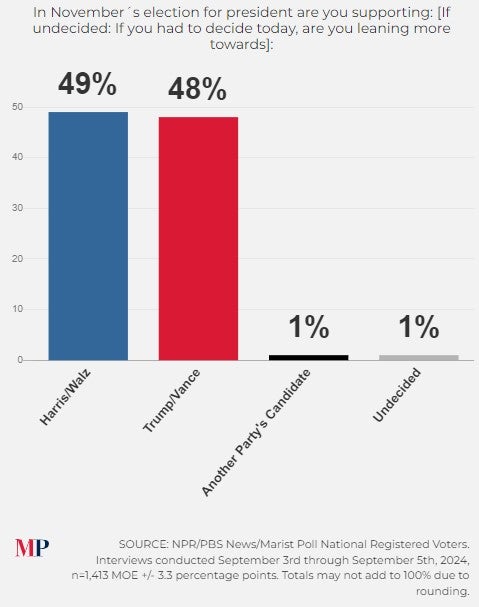

Recent polls have shown that Harris’ rival for the White House, former President Donald Trump, beats her on the economy, edging out Harris 52% to 48%. It’s a worrisome sign for Harris, because the economy is often considered the top issue in voters’ minds as they enter the voting booth.

“It’s clear that the Democrats don’t think the economy is their strongest card, so a big economic story coming out that cuts against the stability of the economy would be very risky for Harris,” Smith said.

He agrees with Hanson that behind the scenes the Biden administration “is in conversations with unions and business leaders all in favor of calming things down, to either get a deal done before the end of the month and take the credit for it, use their influence to get the two sides to agree to a truce or an extension that carries through to next year after the blast zone of the election has been cleared.”

Avoiding Taft-Hartley

What the administration – and by extension, Harris – wants to avoid is waiting until it’s too late and using provisions of the Taft-Hartley Act to declare a national emergency and force the union back to the bargaining table.

The ILA has indicated it opposes a government-mandated cooling off period, which is what Taft-Hartley would bring to the dispute. Such a move could undercut ILA’s leverage in negotiations with the marine terminals and risk alienating general union support before the election.

“I don’t see the Biden administration implementing Taft-Hartley,” Ron Leibman, a transportation supply chain expert at the law firm McCarter & English, told FreightWaves in an interview.

“I have to be very clear, this is not a political statement. I am not a political person. We are in an election where union votes count, and I don’t think anyone on any side would want to take any action that could be viewed as anti-union. Now, if everything gets shut down and they have no choice, I think the Biden Administration will help with mediations.”

Pressure mounting

John Brennan III, chief counsel at the Federal Transit Administration under former President Trump, knows firsthand the pressure to keep controversy away from the national spotlight in an election year.

“The order came down earlier in [2020] to keep a lid on everything as much as we could, to try to avoid new issues, bad news of any kind or controversies, and leave the candidates free to do what they needed to do not detract from their election campaign,” Brennan told FreightWaves.

“You want to plan out your TV ads, deal with the topics you’re strong in and have nothing interfere with that. And if you’re Kamala, you don’t want to deal with some tricky labor issue.”

With candidates in a dead heat less than eight weeks before the election, the pressure on Biden and Harris to avoid a strike is mounting.

“Let’s not forget,” Brennan said, “Trump might look to take advantage of a strike by tying it to inflation and causing consumer prices to continue to rise. How it plays out I don’t know, but I don’t want a port strike on my election bingo card if I’m a Democrat.”