Logistics warehouse operator Prologis beat second-quarter estimates Wednesday, reporting core funds from operations (FFO) of $1.34 per share, which was 1 cent ahead of the consensus expectation. The company said demand is improving in what it categorized as an “uncertain macroeconomic environment.”

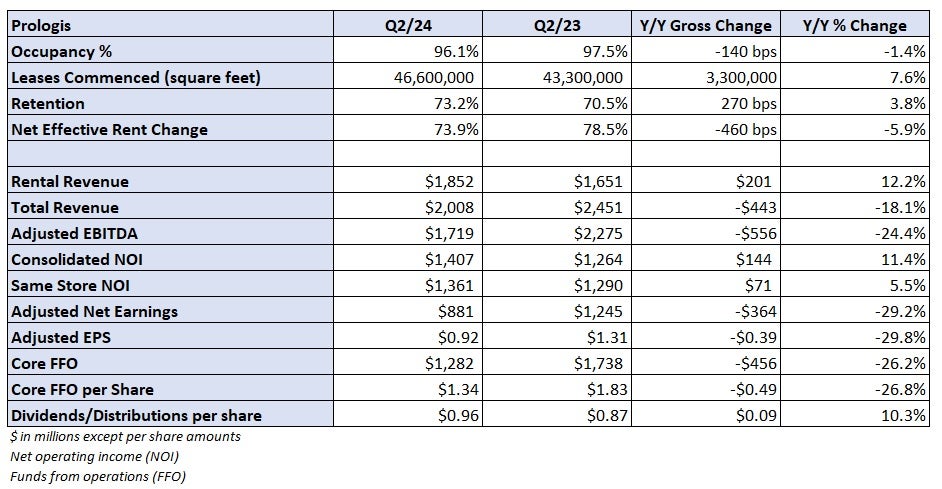

Rental revenue increased 12% year over year to $1.85 billion while consolidated revenue fell 18% year over year to $2 billion. The decline in consolidated revenue was attributable to an 80% drop in strategic capital revenue, which the company generates from asset and property management services at its co-investment ventures.

Prologis (NYSE: PLD) commenced leases covering 46.6 million square feet in the quarter, which was an 8% y/y increase.

“We continue to outperform the industry, driven by our team and the quality of our assets,” said Hamid Moghadam, Prologis co-founder and CEO, in a news release.

Occupancy across the portfolio was 96.1%, which was 140 basis points lower y/y and 70 bps worse than the first quarter. The company reiterated its guidance for full-year average occupancy to range between 95.75% and 96.75%.

Net effective rent change (over the entire lease term) was 73.9% in the quarter, 460 bps lower y/y.

“While customer demand remains subdued, it is improving, and we expect that trend to continue as the construction pipeline shrinks,” said Moghadam. “Meanwhile, our premier global portfolio will continue to benefit from its embedded NOI potential, and opportunities in data centers and energy give us tremendous confidence in future growth.”

The company raised the bottom end of its full-year 2024 FFO guidance by 2 cents to a range of $5.39 to $5.47. The consensus estimate was $5.42 at the time of the print.

Prologis will host a call at noon EDT on Wednesday to discuss second-quarter results.