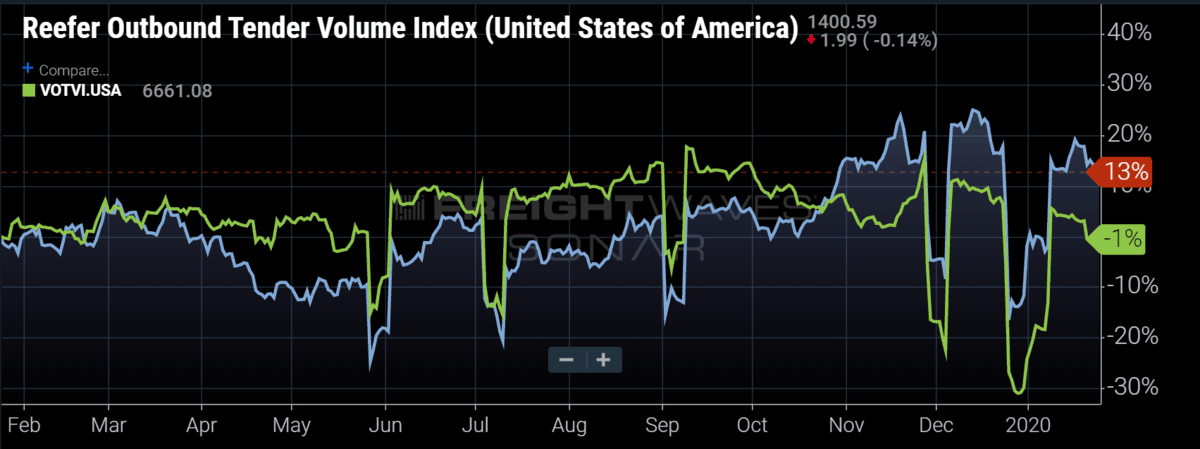

Chart of the Week: Reefer Outbound Tender Volume Index, Van Outbound Tender Volume Index – USA SONAR: ROTVI.USA, VOTVI.USA

According to FreightWaves Reefer Outbound Tender Volume Index (ROTVI), which measures contracted reefer freight volumes in Canada and the United States, reefer trailer demand is outperforming one-year ago by 13%, while their dry van counterparts are down a percent. According to the index, reefer — or more accurately called temperature-controlled — requested trailer volumes have exceeded previous year levels over the past two and a half months. What should we take away from this?

Reefer demand makes up roughly 12-20% of contracted freight market volume and is very seasonal. Reefer loads consist of more than just perishable goods like fruits and vegetables, but these are the types of items that create some of the biggest changes in market capacity. The infamous California “produce season” can drain capacity from all corners of the U.S. between April and June, which leads to increasing spot market activity and subsequently rates. Carriers will abandon contracted accounts to pursue more profitable freight moving across the country.

This is one of many reasons reefer capacity is a much more volatile commodity than the dry van counterpart. Some of the other factors are:

- Lower supply of carriers

- One directional freight, making it difficult to balance the network

- Some freight requires specialization. i.e. cannot haul produce on hazmat trailers

On that last note, certain chemicals and products like paint and adhesives need to have consistent temperature or protection from freezing to maintain the quality of the product. These are the types of products that drive a lot of the winter demand for reefer trailers. Knowing this, it is a good sign for the coming months to see reefer demand increasing early in the year as these items have a connection to the industrial side of the economy, one of the weakest sectors over the past year.

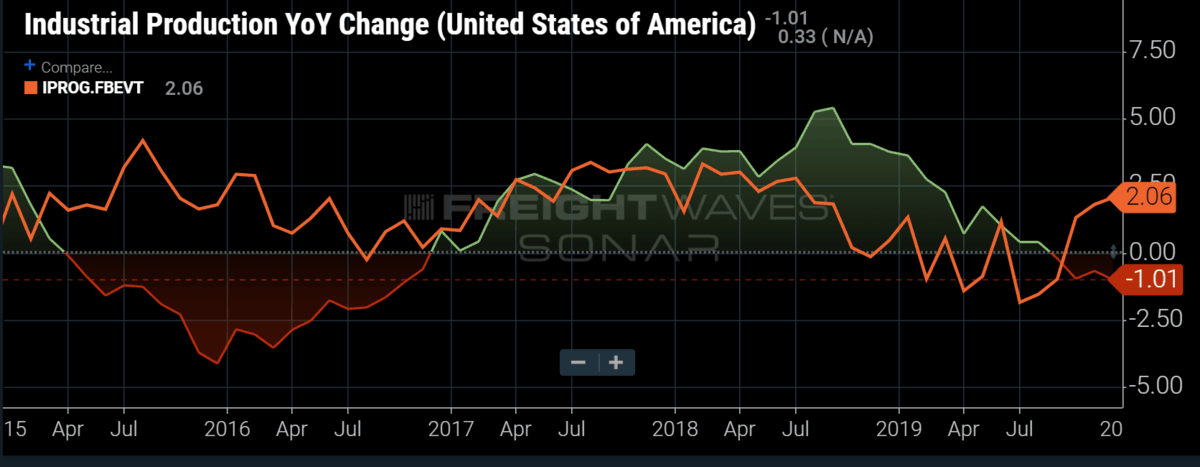

The industrial sector is responsible for a lot of the health of the transportation sector. Manufacturing and capital goods production drove a lot of the economic recovery in 2017-18. Industrial growth has been negative since September. The good news is that this figure appears to be lagging in its representation of its impact on transportation, meaning the market may be recovering before we can measure it. Freight volumes were in steady decline in October of 2018 while industrial growth was showing robust 4% y/y increase.

There is evidence that the industrial side may not be driving growth in reefer demand, at least on the manufacturing side. There has been significant growth in food production in recent months. There is a large interest in the development of the e-grocery segment, leading to increased investment in food and beverage warehouses over the past year. It is hard to tell which commodities are driving the recent increase in demand, but either way, reefer carriers have reason to be optimistic in the coming months.

The same supply side constrictions that inhibit dry van growth are exaggerated for reefer carriers. Reefer trailers are 3-5 times more expensive than dry van trailers, making it harder for people to enter the space without significant investment. If demand increases further with limited supply, the sector will be exposed to increasing rate volatility — something that is already more prevalent in comparison to dry van movements.

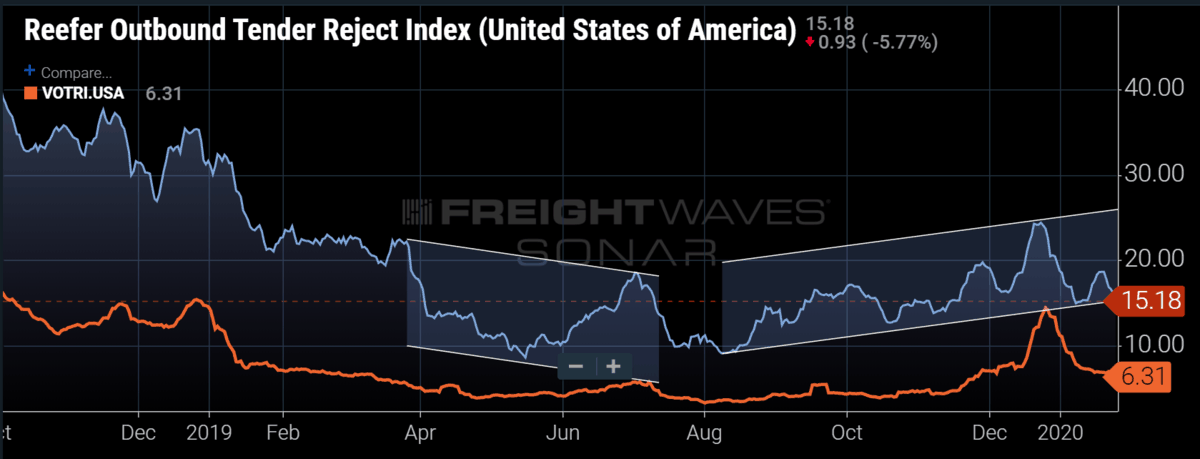

Looking at the Reefer Outbound Tender Rejection Index (ROTRI), tender rejection rates, or the rate at which carriers reject their loads tendered by their customers and signal movements in spot rates, are already higher on average and subject to much more volatility than the van side. Last year, the ROTRI fluctuated from 23% in February to 8.6% in May and back above 24% in December.

The current trajectory of the ROTRI is different from the back half of 2018 in the way rejection rates have been trending higher since August. Increasing demand appears to be a contributing factor. The supply side limitations along with surging demand may make this spring more volatile for this segment than 2019.

Shippers who relaxed last year may be in for a rude awakening in the spring if produce shipments hit with any volume. The reefer carrier may be in a better position than van this year, even though there are many predicting a recovery for both.

About the Chart of the Week

The FreightWaves Chart of the Week is a chart selection from SONAR that provides an interesting data point to describe the state of the freight markets. A chart is chosen from thousands of potential charts on SONAR to help participants visualize the freight market in real-time. Each week a Market Expert will post a chart, along with commentary live on the front-page. After that, the Chart of the Week will be archived on FreightWaves.com for future reference.

SONAR aggregates data from hundreds of sources, presenting the data in charts and maps and providing commentary on what freight market experts want to know about the industry in real time.

The FreightWaves data science and product teams are releasing new data sets each week and enhancing the client experience.

To request a SONAR demo click here.