Less-than-truckload carrier Saia appears to be holding the volume influx it received following the shutdown of Yellow.

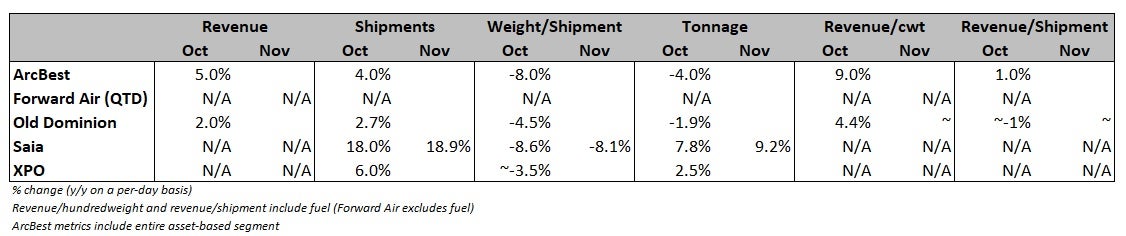

The company reported a 9.2% year-over-year (y/y) increase in tonnage per day during November, which followed a 7.8% increase in October. The acceleration was in part due to softer comparisons to last year. Saia recorded y/y tonnage declines of 3% and 7.1%, respectively, in October and November of 2022.

Saia’s (NASDAQ: SAIA) 2023 fourth-quarter tonnage increases were driven by high-teens growth in daily shipments, which were partially offset by weight per shipment declines of more than 8%.

October had some impact from a cyberattack at Estes, however, some of the carriers that saw a bump in volumes due to the event said that the freight had flowed back to Estes by the end of the month.

Saia’s current growth rates imply tonnage will be down by roughly 5% in the fourth quarter, which is a little bit better than normal seasonality.

“While the acceleration in volume is partly comp related (and we expect another acceleration in December due to even easier comps), today’s announcement does support the view that SAIA is holding on to the majority of its market share gains despite its focus on price and profitability,” Deutsche Bank (NYSE: DB) analyst Amit Mehrotra told clients in a Monday morning note.

Saia’s tonnage was down 13.2% y/y last December. Less-than-truckload demand turned negative at the end of the 2022 summer with the y/y declines accelerating to close the year.

“We also didn’t see anything surprising in weight per shipment trends from October to November vs. what we would normally expect (down 0.6% sequentially), which further supports the view that SAIA is holding on to its market share gains,” Mehrotra continued. “December volumes will also be important, given the company’s GRI [general rate increase] takes effect today (December 4).”

Yellow’s exit has prompted some carriers to implement annual GRIs ahead of schedule. Saia’s recent announcement of a 7.5% increase was 100 basis points higher than its prior GRI and the implementation came two months earlier.

Saia saw the biggest sequential increase in shipments among publicly traded carriers during the third quarter, the first reporting period following Yellow’s collapse. Saia responded by adding more than 1,000 employees to its existing head count of roughly 12,000. It has also been adding terminals and equipment in certain markets to accommodate the share wins.

During the third quarter, Saia’s tonnage per day was up 6.7% y/y as shipments increased 12.2% and weight per shipment was down 5%. The company doesn’t disclose yield metrics in its intraquarter updates but revenue per hundredweight excluding fuel surcharges was 8.4% higher y/y in the third quarter.

The broader industrial complex, which generates roughly two-thirds of the freight moved through LTL networks, remains in decline. The Manufacturing Purchasing Managers’ Index remained unchanged at 46.7 during November and below the neutral threshold of 50 for a 13th straight month. The new orders component of the index did improve 2.8 points to 48.3.

Soft demand throughout the industrial sector has been a primary headwind for LTL shipment weights.

More FreightWaves articles by Todd Maiden

- Auction for Yellow’s terminals ‘remains ongoing’

- Lineage Logistics reported to be pursuing $30B-plus IPO

- Forward Air, Omni pointing fingers over EBITDA forecasts

Brandie

The person that says “no one wants to hire YRC drivers because they were union” is either just parroting what he’s heard or is using his own feelings on unions to make assumptions. I worked for YRC which then became Yellow. I saw in the Facebook groups of former employees helping each other to find jobs with other contact center employees, drivers, and terminal employees. The majority of them have jobs. I got a new job at another LTL company.

Stop spreading this misinformation. Yellow employees have dealt with enough, they don’t need you spreading lies about them.

Craig

Tony, Central Freight has been closed for a year now. Central Transport is still running, tho they are the armpit of the LTL business.

No one wants to hire former YRC drivers, as they were union. No one non union, invites that mentality into their tent. They just shut YRC down ! But the YRC drivers were the oldest YRC people hanging on with their seniority, dragging it down. Along with brand new people that had been run off by other carriers.

SAIA took the YRC freight at a huge discount to their already published pricing with the same customers. Stupid. Thats why their tonnage will go up, …..but their yield will be crap, and their OR then goes up. Thats why they are taking such a huge GRI now. They have to. When they do, and their service, claims, and cust svc kicks in, those customers will bail. Bet on it. It was all about price.

ABF is a good company, but not even close to the best. (And they wont ever be, with having the teamster union control their company)

Tony

I’m surprised, central freight hasn’t gone under, but I do believe it will be the next Trucking Company to fall. I Hear nothing but bad news about the company, then again, it depends upon terminal, and ask for linehaul drivers having to work the docs doesn’t sound good doesn’t sound like they’re gonna have stable company, unless they are hiring migrants, and still using paper logs, as for the trucks I think seniority plays here for a new truck if you’ve been there for a while. But haven’t heard any news coming from Central transport, they are keeping quiet. I am wondering if they’re getting a piece of YRC freight? This company is keeping very quiet without something as always.

Wendy

Francis Gallagher you said it all a lot of the Terminal Managers working at Saia were once New Penn/YRC employees why not hire the drivers???

Steven

Saia has hired some YRC employees . As for the weights and billing problems I can’t defend that. Saia’s health insurance is some of the best in the industry , sure ABF has a teamsters pension, will it be there in future? I don’t know. We at least have a 401k match.

Francis w Gallagher

When are you going to write a article on how they won’t hire the Yellow employees.

Moe

Interesting- We cut them after starting to ship with them in March – Nov. we shipped 625k and their billing is the worst in the industry, we weigh and measure every shipment with dimensioners, plus we have documents with what is on every single pallet and the weight of the product, but they are so bullheaded they won’t listen to us, so today I wrote them a termination letter, I could go on and on, the interesting thing is they are the only carrier we have these issues with, so it’s clearly a SAIA issue.

Daniel Lund

What about ABF they have gotten freight that Yellow hauled. ABF is the best LTL freight company in the business with the best health insurance the best retirement the best of everything. Again Talk to a retired Saia and a retired ABF employee find out who is living the best.